Malibu Boats Inc (MBUU) Faces Significant Challenges in Q3 Fiscal 2024, Misses Analyst Forecasts

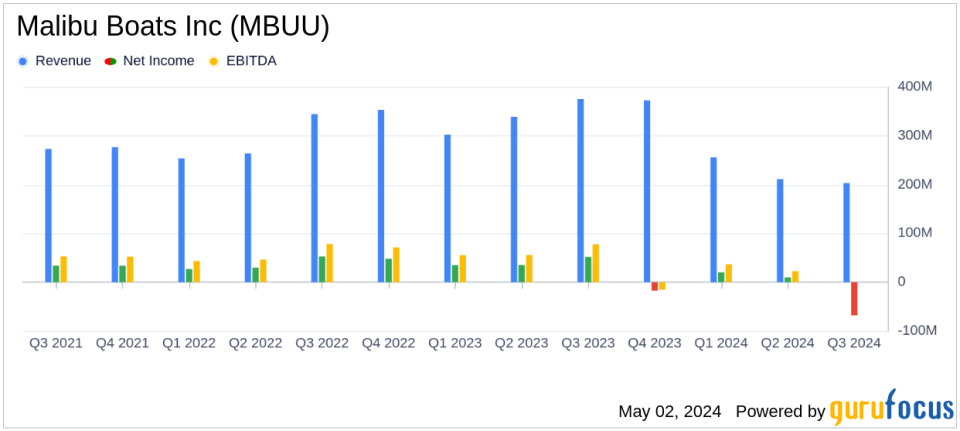

Revenue: Reported at $203.4 million, a decrease of 45.8% year-over-year, falling short of estimates of $206.51 million.

Net Loss: Reported a net loss of $67.8 million, a significant decline from net income of $53.5 million in the previous year, and below the estimated net loss of $9.40 million.

Earnings Per Share (EPS): Reported a net loss of $3.28 per share, a sharp decrease from the prior year, significantly below the estimated EPS of $0.48.

Gross Margin: Decreased to 19.8% from 26.3% year-over-year, indicating reduced profitability.

Adjusted EBITDA: Decreased by 69.2% to $24.4 million, with the margin also falling to 12.0% from 21.1% in the previous year.

Impairment Charges: Incurred $88.4 million in impairment charges for the Maverick Boat Group reporting unit, impacting net income.

Market Outlook: Expects continued softening in retail demand for the remainder of fiscal year 2024, with a forecasted net sales decline of 40-41% year-over-year.

On May 2, 2024, Malibu Boats Inc (NASDAQ:MBUU) released its 8-K filing, detailing a challenging third quarter for fiscal year 2024. The company, a leading designer and manufacturer of performance sport and recreational boats, reported a significant decline in both revenue and net income, falling short of analyst expectations.

Financial Performance Overview

For the quarter ended March 31, 2024, Malibu Boats announced net sales of $203.4 million, a sharp decrease of 45.8% from $375.1 million in the same period last year. This figure notably missed the analyst estimate of $206.51 million. The company also reported a net loss of $67.8 million, a significant downturn compared to a net income of $53.4 million in the prior year. This loss includes substantial impairment charges of $88.4 million related to the Maverick Boat Group. Adjusted EBITDA also fell by 69.2% to $24.4 million.

The earnings per share (EPS) turned to a loss of $3.28, starkly contrasting with the expected EPS of $0.48. This drastic change is primarily attributed to decreased unit volumes and increased costs, exacerbated by a challenging retail environment and elevated inventory levels.

Segment Performance and Market Challenges

Malibu Boats experienced declines across all its segments. The Malibu segment itself saw a 65.1% drop in net sales, driven by lower wholesale shipments and increased dealer flooring program costs. Similarly, the Saltwater Fishing and Cobalt segments reported significant sales declines due to reduced retail activity and higher costs.

CEO Jack Springer highlighted the softened demand in the tow boat and value boat markets but noted some resilience in the Cobalt and Pursuit segments. Despite these challenges, Springer remains optimistic about the company's long-term strategy and its three pillars of success: product, production, and distribution.

Financial Health and Strategic Adjustments

Malibu Boats' balance sheet reflects the impact of the current market conditions. Total assets decreased to $797.6 million from $925.9 million as of June 30, 2023. The company's efforts to manage elevated inventory levels and adjust production to align with market demand are crucial steps towards stabilizing its financial position.

Looking ahead, Malibu Boats expects the retail demand to continue softening throughout fiscal 2024, projecting a net sales decline of 40-41% year-over-year and an Adjusted EBITDA margin between 10.1% and 10.5%.

Investor and Market Implications

The significant downturn in Malibu Boats' performance this quarter poses concerns for investors, especially given the stark deviation from expected financial metrics. The challenges highlighted by the company underscore the volatile nature of the recreational boating market, particularly under current economic pressures such as rising interest rates and inflation.

As the company navigates these turbulent waters, its focus on strategic adjustments and long-term stability will be critical. Investors and stakeholders will likely keep a close watch on Malibu's ability to rebound and adapt to the evolving market conditions.

For more detailed financial analysis and future updates on Malibu Boats Inc, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Malibu Boats Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance