Main Street (MAIN) Q3 Earnings Lag Estimates, Revenues Rise

Main Street Capital Corporation’s MAIN third-quarter 2019 net investment income of 62 cents per share lagged the Zacks Consensus Estimate by a penny. Also, the bottom line was down 1.6% from the year-ago figure.

The company’s third-quarter results benefited from higher total investment income. Also, increase in net asset value and growth in investment portfolio were tailwinds. However, rise in operating expenses was an undermining factor.

Distributional net operating income came in at $41.6 million compared with $40.2 million in the prior-year quarter.

Total Investment Income Up, Expenses Rise

Total investment income was $60.1 million, up 3% from the year-ago quarter. The upside was mainly driven by higher dividend income from investment portfolio equity investments. However, the top line lagged the Zacks Consensus Estimate of $61.4 million.

Total expenses jumped 4.3% year over year to $21.1 million. The increase was mainly due to higher interest expenses along with share-based compensation costs.

The fair value of Main Street’s total investment portfolio was $2.56 billion as of Sep 30, 2019.

Balance Sheet Position

As of Sep 30, 2019, Main Street’s net asset value was $24.20 per share compared with $24.09 on Dec 31, 2018.

As of Sep 30, 2019, the company had $52.3 million in cash and cash equivalents, $555 million of unused capacity under Credit Facility, with which it seeks to support investment and operating activities. Also, it had $35.2 million of remaining SBIC debenture capacity.

Our Take

Steady improvement in total investment income and strong origination volume are expected to support this Zacks Rank #3 (Hold) company’s bottom line. However, increase in operating expenses is a major concern.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

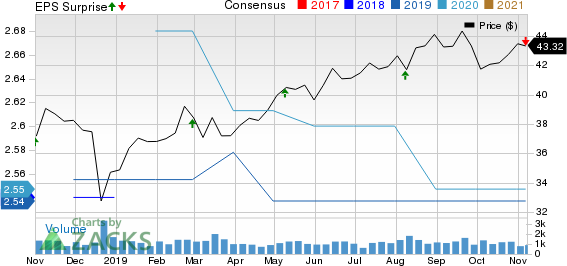

Main Street Capital Corporation Price, Consensus and EPS Surprise

Main Street Capital Corporation price-consensus-eps-surprise-chart | Main Street Capital Corporation Quote

Performance of Other Finance Stocks

Newtek Business Services Corp.’s NEWT third-quarter 2019 adjusted net investment income of 63 cents per share outpaced the Zacks Consensus Estimate of 57 cents. The bottom-line figure also jumped 26% year on year.

Prospect Capital Corporation’s PSEC first-quarter fiscal 2020 (ended Sep 30) net investment income of 19 cents per share came in line with the Zacks Consensus Estimate. The bottom-line figure decreased 17.4%, year over year.

LendingTree TREE delivered a positive earnings surprise of 34.7% in third-quarter 2019. Adjusted net income per share of $2.25 outpaced the Zacks Consensus Estimate of $1.67. Further, the figure came in higher than the prior-year quarter’s $1.92 per share.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

Prospect Capital Corporation (PSEC) : Free Stock Analysis Report

Newtek Business Services Corp. (NEWT) : Free Stock Analysis Report

Main Street Capital Corporation (MAIN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance