Lyft beats Uber in one key area for business riders, survey finds

Although Uber still dominates the market for business travelers, a new survey shows those riders are more satisfied with Lyft (LYFT).

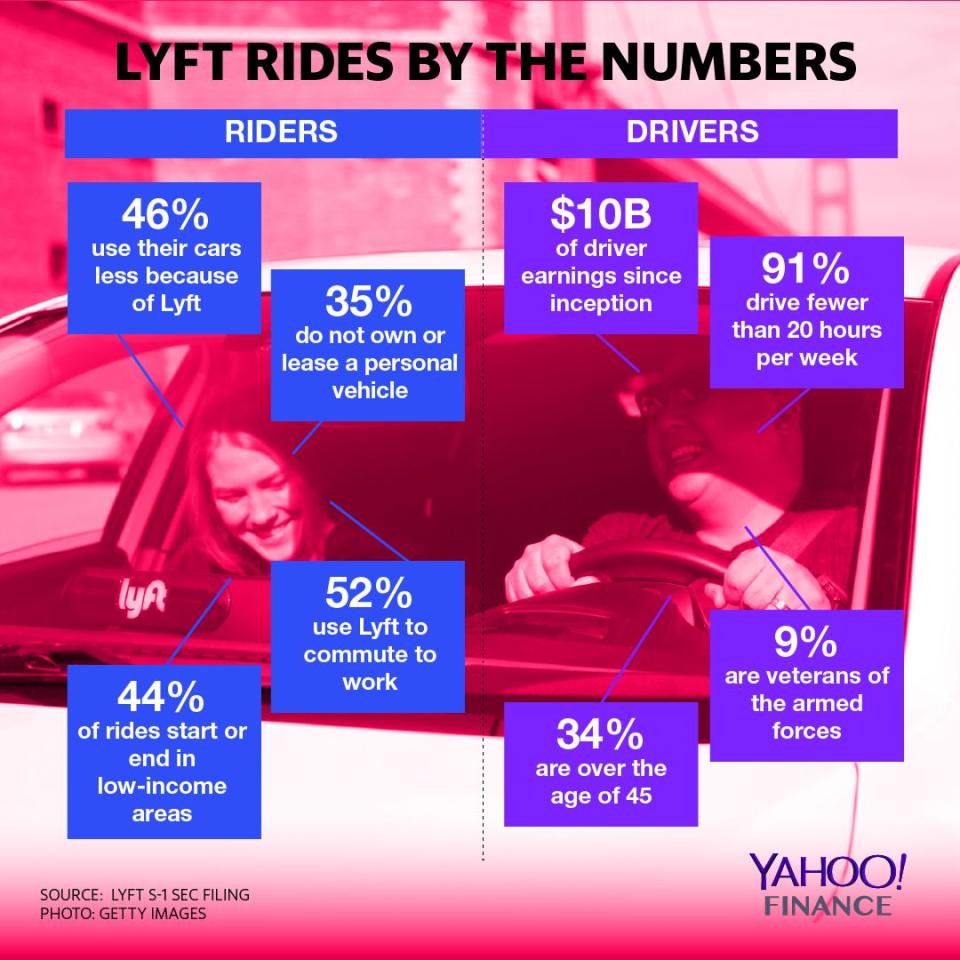

According to The Certify Q1 2019 SpendSmart Report, business riders were more satisfied using Lyft than they were using Uber. During the first-quarter of 2019, Lyft earned an average rating of 4.9 versus Uber’s 4.6 and taxis’ 4.0. Lyft also grew in market share and average cost-per-ride from first-quarter 2018 to first-quarter 2019.

“Quarter after quarter, Lyft and Uber have grown at the expense of taxis,” Certify CEO Bob Neveu tells Yahoo Finance. “Everyone can identify with that. It’s more convenient. It costs less. It’s higher quality.”

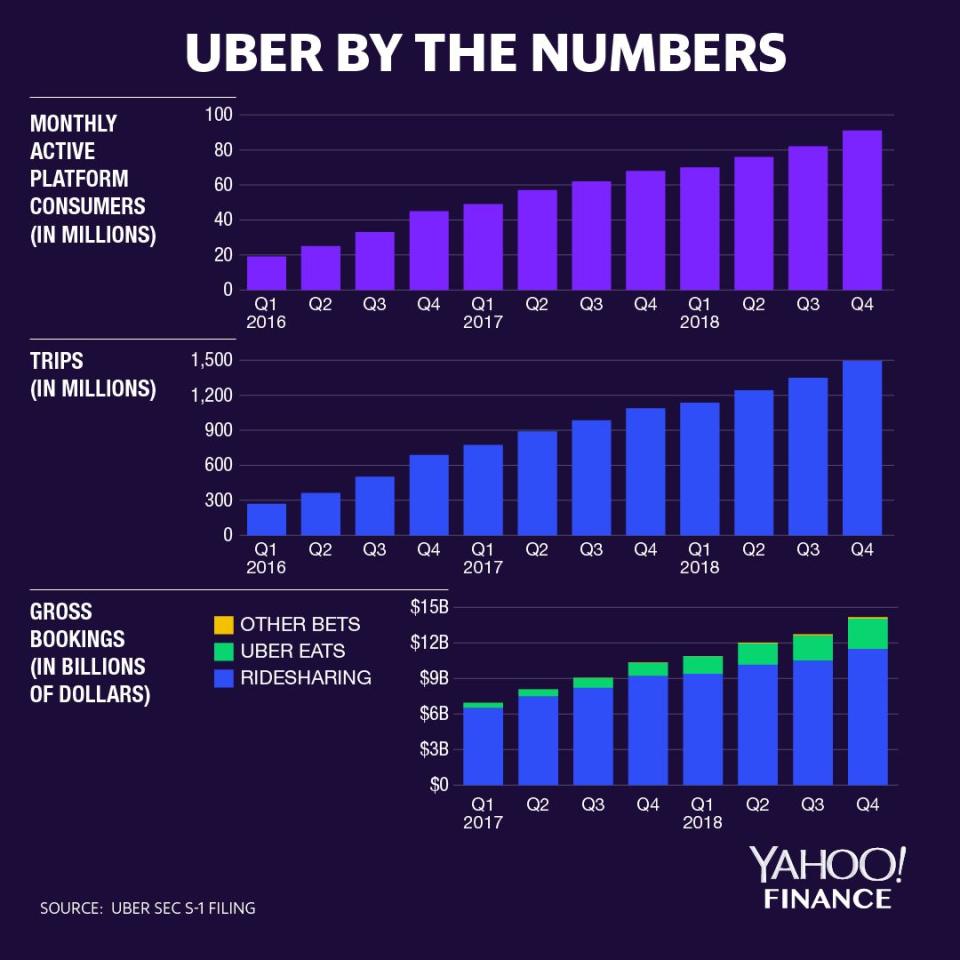

Uber, which is expected to go public in May, dominated the combined ride-hailing and taxi market among business users with almost 72.7% in the first quarter of 2019. However, Lyft grew from 17.7% during first-quarter 2018 to nearly 21.6% of the market in first-quarter 2019.

Lyft is also now the sixth-most expensed vendor — up from #11 in 2018 — behind Uber, Starbucks (SBUX), Amazon (AMZN), American Airlines (AAL) and Delta (DAL).

“Lyft makes traveling – whether it’s in a new city or part of the daily commute – easier for employees and seamless for businesses,” Gyre Renwick, Lyft vice president of Lyft Business, said in a statement. “Our partners share our vision of making better transportation a priority, and we continue to see excitement from both riders and businesses alike who use Lyft on a regular basis.”

Meanwhile, the average Lyft fare rose 28% during the same period to $25.32 in first quarter 2019, slightly more than the average Uber ride, which cost $25.19 during the same period. Both Lyft and Uber rides were at least $8.30 cheaper than a comparable taxi ride.

For the purposes of its report, Certify analyzed over 10 million receipts and expenses during the first quarter of 2019 submitted from Certify users, primarily from businesses based in North America. Lyft, Uber and taxi’s ratings are derived from ratings, ranging from one to five, which Certify users can give inside the expense report system. (Neveu estimates between 35% to 40% of all Certify users rate vendors inside the system, including Uber, Lyft and taxis.)

Bullish analysts

Since Lyft’s long-awaited IPO in late March, the ride-hailing company’s stock has had a rough time of it, dropping from the stock’s high to date of $88.60 per share on March 29 to $57.82 per share when the markets closed on Wednesday afternoon. The stock drop may be partly due to concerns around Lyft’s path to profitability and Uber’s own IPO.

Both Lyft and Uber aren’t expected to become profitable until at least 2022, Morningstar analyst Ali Mogharabi told Yahoo Finance earlier this month.

It isn’t all bad news for Lyft when it comes to Wall Street. On Tuesday, UBS analysts Eric J. Sheridan, Benjamin Miller, and Alex Vegliante, initiated Lyft coverage with a “Buy” rating and a price target of $82 per share. The three analysts wrote in their note that Lyft had all the positive characteristics of a “multi-sided marketplace” required to attract more riders, through a growing mix of transportation options like monthly subscriptions and a carpooling feature, as well as drawing more drivers to Lyft’s network with its well-known brand and financial incentives.

“Long-term, we see a market with a long runway for secular growth, potentially more rational industry competitive dynamics as maturity approaches and broader positive impacts on society,” wrote Sheridan, Miller and Vegliante in the note.

One of the more surprising findings in Certify’s report? As popular as Uber and Lyft may be among their riders, in the media and among some investors, the traditional taxi remains a favored method of transportation — at least among some corporate riders in two major U.S. cities.

In New York City, for instance, taxi market share actually grew from 26.5% in first-quarter 2018 to 32% in first quarter 2019, taking some market share from Uber and Lyft during the period. In Chicago, taxi market share remained significant but declined 40% to 13.9% of the market during the same time frame.

Translation: Taxis may be down but not out.

More from JP:

Yahoo Finance

Yahoo Finance