Luminar (LAZR) to Report Q1 Earnings: What's in the Cards?

Luminar Technologies, Inc. LAZR is scheduled to release first-quarter 2024 results on May 7, after the closing bell. The Zacks Consensus Estimate for the to-be-reported quarter’s loss per share and revenues is pegged at 22 cents and $22.09 million, respectively. The consensus mark for LAZR’s first-quarter loss per share has narrowed by a penny in the past 30 days.

Its bottom-line estimates imply growth of 8.33% from the year-ago reported figure. The Zacks Consensus Estimate for its quarterly revenues suggests a year-over-year rise of 52.26%.

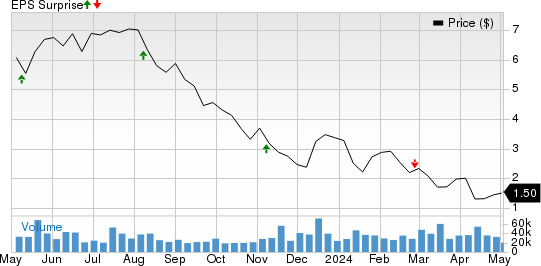

In the last reported quarter, this LiDAR manufacturer incurred a net loss per share of 32 cents, wider than the Zacks Consensus Estimate of a loss of 30 cents. In the trailing four quarters, LAZR surpassed the Zacks Consensus Estimate thrice and missed once, delivering an average earnings surprise of 4.86%.

Luminar Technologies, Inc. Price and EPS Surprise

Luminar Technologies, Inc. price-eps-surprise | Luminar Technologies, Inc. Quote

Things to Note

Luminar’s automaker partners are actively marketing its technology and the functionalities enabled as a core pillar of their brands and products. Active marketing has provided Luminar with ample growth opportunities in the global market. The LiDAR maker has made necessary investments in its technology, manufacturing and infrastructure and expects to start reaping the benefits of the economic tailwinds from this investment in 2024.

Growth opportunities in the global market and economic benefits from past investments are likely to have bolstered Luminar’s performance.

However, for full-year 2023, the company missed its own guidance of generating $75 million in revenues. It generated $69.8 million in revenues in 2023 due to lower-than-expected adjacent market sensor sales and Lidar Sensor Intelligence revenues and slower revenue recognition for a development contract. Some of these headwinds are expected to have persisted in the first quarter.

Also, in the last reported quarter, LAZR’s operating expenses rose to $127 million from the year-ago quarter’s figure of $124 million. The upward trend in operating expenses is likely to have continued in the to-be-reported quarter. Rising expenses might have weighed on the company’s margin. Lower expected revenues and shrinking margins are expected to have hurt the performance of Luminar.

What the Zacks Model Says

Our proven Zacks model does not conclusively predict an earnings beat for Luminar this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is not the case here.

Earnings ESP: Luminar has an Earnings ESP of -39.33%. This is because the Most Accurate Estimate is pegged at a loss of 31 cents, wider than the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: LAZR currently carries a Zacks Rank #2.

Earnings Whispers for Other Auto Stocks

Lucid Group, Inc. LCID has an Earnings ESP of -8.00% and a Zacks Rank #3 at present. It is scheduled to post first-quarter earnings on May 6. The Zacks Consensus Estimate is pegged at a loss of 25 cents per share. You can see the complete list of today’s Zacks #1 Rank stocks here.

LCID missed estimates in each of the trailing four quarters, the average negative surprise being 7.96%.

Rivian Automotive, Inc. RIVN has an Earnings ESP of -1.77% and a Zacks Rank #3 at present. The company is slated to post first-quarter 2024 earnings on May 7. The Zacks Consensus Estimate is pegged at a loss of $1.13 per share.

RIVN surpassed earnings estimates in each of the trailing four quarters, the average surprise being 13.82%.

Nikola Corporation NKLA has an Earnings ESP of 0.00% and a Zacks Rank #3 at present. The company is scheduled to post first-quarter 2024 earnings on May 7. The Zacks Consensus Estimate is pegged at a loss of 9 cents per share.

NKLA surpassed earnings estimates in three of the trailing four quarters and missed once, the average negative surprise being 11.24%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nikola Corporation (NKLA) : Free Stock Analysis Report

Luminar Technologies, Inc. (LAZR) : Free Stock Analysis Report

Lucid Group, Inc. (LCID) : Free Stock Analysis Report

Rivian Automotive, Inc. (RIVN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance