LPL Financial (LPLA) Q2 Earnings Beat, Revenues Increase Y/Y

LPL Financial’s LPLA second-quarter 2021 adjusted earnings of $1.85 per share easily surpassed the Zacks Consensus Estimate of $1.63. The bottom line reflects a rise of 30% from the prior-year quarter.

Results in the quarter benefited from an improvement in revenues, partly offset by higher expenses. Further, the company’s balance sheet position remained strong.

After taking into consideration the amortization of intangible assets and acquisition costs, net income was $119.1 million or $1.46 per share compared with $101.7 million or $1.27 per share in the year-ago quarter.

Revenues Improve, Expenses Rise

Total net revenues were $1.90 billion, up 39% year over year. An increase in all components of revenues, except for other revenues, drove the rise.

Total operating expenses increased 42% to $1.71 billion. All expense components increased, except for occupancy and equipment costs.

At the end of the reported quarter, LPL Financial’s total brokerage and advisory assets were $1,112.3 billion, jumping 46% year over year.

Total net new assets were $106 billion at the end of the quarter, up from $13 billion of new assets recorded at the end of the prior-year quarter. Total client cash balances grew 7% year over year to $48.4 billion.

Balance Sheet Position Strong

As of Jun 30, 2021, the company had total assets of $7.22 billion, up 9% from the Mar 31, 2021-level. As of the same date, cash and cash equivalents totaled $906.7 million, up 8% sequentially.

Total stockholders’ equity was $1.55 billion as of Jun 30, 2021, up from $1.43 billion recorded at the end of the prior quarter.

Our View

LPL Financial’s recruiting efforts and solid advisor productivity will likely continue aiding advisory revenues. Strategic buyouts, including the acquisition of Waddell & Reed's wealth management business, will support financials. However, persistently mounting expenses are expected to hurt the company’s bottom line to an extent in the near term.

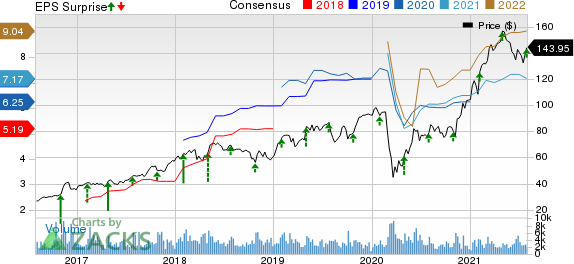

LPL Financial Holdings Inc. Price, Consensus and EPS Surprise

LPL Financial Holdings Inc. price-consensus-eps-surprise-chart | LPL Financial Holdings Inc. Quote

Currently, LPL Financial carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Brokerage Firms

Charles Schwab’s SCHW second-quarter 2021 adjusted earnings of 70 cents per share beat the Zacks Consensus Estimate by a penny. The bottom line grew 30% from the prior-year quarter.

Interactive Brokers Group’s IBKR second-quarter 2021 adjusted earnings per share of 82 cents lagged the Zacks Consensus Estimate of 83 cents. However, the bottom line reflects growth of 43.9% from the prior-year quarter.

Raymond James’ RJF third-quarter fiscal 2021 (ended Jun 30) adjusted earnings of $2.74 per share easily surpassed the Zacks Consensus Estimate of $2.32. The bottom line was up 77% from the prior-year quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Charles Schwab Corporation (SCHW) : Free Stock Analysis Report

Interactive Brokers Group, Inc. (IBKR) : Free Stock Analysis Report

Raymond James Financial, Inc. (RJF) : Free Stock Analysis Report

LPL Financial Holdings Inc. (LPLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance