Loan Growth, Fee Income to Buoy Huntington (HBAN) Q4 Earnings

Huntington Bancshares HBAN is slated to report fourth-quarter and 2021 results on Jan 31, before the opening bell. The company’s revenues and earnings are expected to have improved year over year.

In the last reported quarter, the bank reported a negative earnings surprise of 2.8%. Elevated expenses and the TCF Financial acquisition-related expenses affected the results. Declining capital ratios created another headwind. Nonetheless, fee income growth, particularly in wealth management, capital markets, and card and payments processing, drove the top line.

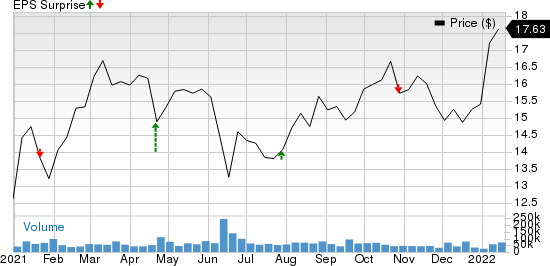

Huntington has a mixed earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in two and lagged in the other two of the trailing four quarters, the average beat being 10.5%.

Huntington Bancshares Incorporated Price and EPS Surprise

Huntington Bancshares Incorporated price-eps-surprise | Huntington Bancshares Incorporated Quote

The Zacks Consensus Estimate for fourth-quarter earnings of 37 cents indicates a 37% rise from the year-ago reported number. The consensus estimate for revenues of $1.69 billion suggests a year-over-year jump of 36.4%.

Key Factors at Play

Net Interest Income (NII) Growth: In the fourth quarter, the overall demand for commercial real estate loans was decent, while the commercial and industrial loan growth was impressive. This is likely to have aided the company’s fourth-quarter performance as the majority of its loan portfolio comprises total commercial loans (commercial and business lending as well as commercial real estate lending). On the consumer lending side, growth in residential real estate loans is expected to have been offset by home equity paydowns.

Management expects underlying loan balances (excluding Paycheck Protection Program) to modestly grow in the fourth quarter on a sequential basis.

The momentum in the commercial and consumer businesses is likely to have supported loan balances in the fourth quarter.

Moreover, management projects additional investment security purchases. This is likely to have driven an increase in earnings assets and NII. Notably, The Zacks Consensus Estimate for average interest-earning assets of $159.67 billion for the quarter implies a marginal improvement on a sequential basis.

The improvement in the lending scenario and higher loan balance from the TCF merger closed earlier this year are likely to have offered some support to Huntington’s NII despite the near-zero interest rate environment.

The consensus estimate for NII indicates a marginal rise to $1.17 billion from the prior quarter’s reported figure.

Per management, core net interest income is expected to sequentially grow in the fourth quarter.

High Non-Interest Revenues: Mortgage production is likely to have been relatively solid but not as robust as last year. Also, moderation in refinancing activity due to the rise in rates is expected to have weighed on HBAN’s mortgage banking income. A gradual slowdown in refinancing activities, prepayments and lower mortgage-servicing activities is expected to have hindered the mortgage banking business of HBAN.

Mortgage banking fee growth in the to-be-reported quarter is estimated to be $72 million, suggesting an 11.1% plunge on a sequential basis.

Fading stimulus aid is likely to have compelled consumers to rely on cards for expenses. Also, improvement in consumer confidence is likely to have boosted consumer spending and debit card use. This is expected to have supported the company’s card fees. The Zacks Consensus Estimate for cards and payment-processing revenues of $99 million suggests a 3.13% rise from the prior quarter’s reported figure.

The Zacks Consensus Estimate for capital market fees is pegged at $40 million, remaining flat with the prior quarter’s reported figure.

Overall, the consensus mark for non-interest income of $524 million indicates 2.1% sequential growth.

Expenses Escalate: Investments in digital, data and technology enhancements; product differentiation; front office expansions; and other initiatives to bolster its existing capabilities and infrastructure are likely to have led to higher expenses. While the company recognized $500 million of the $900-million TCF Financial merger-related expenses through the third quarter, the majority of the remaining expenses are expected to have been incurred in the fourth quarter. These are likely to have ramped up expenses, hindering earnings growth in the quarter under review.

Improved Asset Quality: Improved economic outlook and continued improvement in credit trends in the fourth quarter are expected to have driven additional reserve releases in the fourth quarter for HBAN. Such reserve releases are expected to have driven substantial bottom-line growth.

What Our Quantitative Model Reveals

Huntington has the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or higher — for increasing the odds of an earnings beat this time around.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for Huntington is +1.46%.

Zacks Rank: Huntington currently has a Zacks Rank of 3.

Other Stocks to Consider

A few other finance stocks, which you may want to consider as these also have the right combination of elements to post an earnings beat in their upcoming releases per our model, are Webster Financial WBS, BankUnited BKU and Prosperity Bancshares PB.

Webster Financial has an Earnings ESP of +0.16% and it flaunts a Zacks Rank #1 (Strong Buy) at present. WBS is slated to report its fourth-quarter and full-year results on Jan 20.

BankUnited is slated to report quarterly results on Jan 20. BKU currently has an Earnings ESP of +42.98% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Prosperity Bancshares is slated to report quarterly earnings on Jan 26. PB, which carries a Zacks Rank of 3 at present, has an Earnings ESP of +0.55%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Huntington Bancshares Incorporated (HBAN) : Free Stock Analysis Report

BankUnited, Inc. (BKU) : Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

Webster Financial Corporation (WBS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance