Investor Central

Investor CentralLionGold Corp Ltd - Will ASX-listed Bass Metals Ltd end up like Signature Metals Ltd?

People linked to LionGold have bought stakes in Bass Metals, even as LionGold and Bass Metals battle it out in court. What will happen if they vote out three directors at an Oct 4 EGM?

6/9/2013 – Legal battles are not always fought within the walls of a courtroom, as LionGold's latest move seems to prove.

On October 16 last year, ASX-listed Bass Metals Ltd initiated legal proceedings against LionGold in Australia, seeking A$20 mln in damages.

Bass Metals claims LionGold breached and repudiated an agreement dated July 5, 2012, for acquiring Bass Metals' wholly-owned gold-mining subsidiary, Hellyer Mill Operations Pty Ltd for A$13.5 mln in cash.

After LionGold backed out of the deal, Bass Metals successfully sold Hellyer Mill Operations Pty Ltd to Ivy Resources Pty Ltd for A$11 mln.

Despite the sale of Hellyer Mill Operations Pty Ltd to Ivy Resources Pty Ltd, Bass Metals says it has a significant claim against LionGold.

Which is why, Bass Metals is still pursuing the suit against LionGold, albeit for a reduced damages bill.

In its defence, LionGold applied to the Supreme Court of Western Australia seeking to set aside service of Bass' writ of summons.

The Supreme Court of Western Australia heard the case on March 26, 2013 and threw out LionGold's application in a decision published May 7, saying "the application represents perhaps the most pointless interlocutory dispute imaginable" (page 1).

It appears LionGold had argued that Bass Metals could not serve its writ on LionGold COO Mr Matthew Gill, because he is employed by LionGold subsidiary Castlemaine Goldfields, not by LionGold itself.

The Supreme Court noted (page 6) that "instead of resolving the issues between the parties the defendant [LionGold, ed] has chosen to take a point which at best could only delay the plaintiff's action".

In an announcement after the Supreme Court's verdict, Bass Metals vowed to pursue its claim against LionGold.

But Bass Metals' battle for compensation from LionGold is no longer just confined to the courtroom.

It has also spread to the boardroom.

Its largest shareholder, ASX-listed Metals Finance Limited, with a 9.61% stake, has called for a meeting of Bass Metals' shareholders with an aim to remove three directors, including the Chairman Mr Craig McGowan, the Managing Director Mr Michael Rosenstreich, and non-executive director Mr Barry Sullivan.

At the meeting, scheduled for 9am on October 4 in the West Perth suburb of Subiaco, Metals Finance Ltd proposes to appoint Mr Rick Anthon (a non-executive director of Metals Finance) and Mr Gavin Solomon (the Managing Director of Helmsec Global Capital Limited) as new directors of Bass Metals.

In its announcement, Metals Finance Limited said it called for a shareholders' meeting after consulting a 'number of other Bass shareholders'.

According to Bass Metals' shareholder registry on August 28, 2013, the top 10 shareholders' include Mr Edwin Sugiarto (4.86% stake), Mr Nelson Fernandez (4.83%), Mr Lee Chai Huat (4.68% stake) and Ms Bee Lay Neoh (2.31%).

Three of these names will be familiar to readers who have been following our coverage of SGX-listed Innopac Holdings Ltd's aborted acquisition of ASX-listed Merlin Diamonds Ltd.

Edwin Sugiarto, Nelson Fernandez and Lee Chai Huat bought significant stakes in Merlin Diamonds Ltd before and after SGX-listed Innopac Holdings Ltd announced a takeover for it.

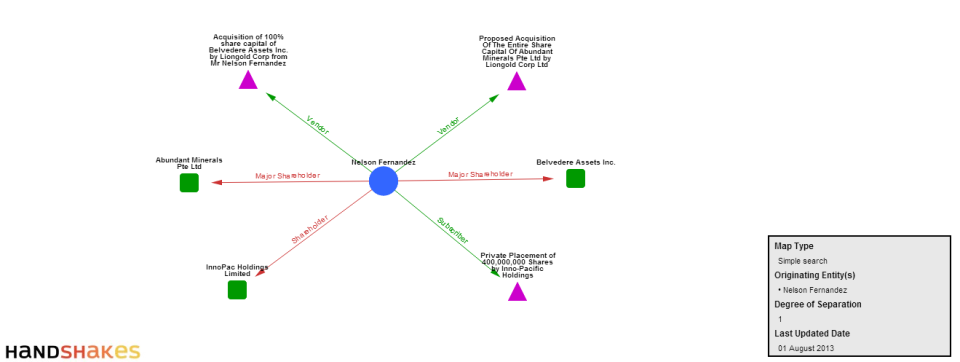

The following Handshakes map summarises LionGold Corp's past dealings with Nelson Fernandez:

Edwin Sugiarto and Lee Chai Huat have not had a direct business/shareholding relationship with LionGold.

But given the cross-shareholding of various companies in this network of SGX-listed companies, both Edwin Sugiarto and Lee Chai Huat, are interested in LionGold.

Nelson Fernandez, Edwin Sugiarto and Lee Chai Huat are shareholders of SGX-listed Innopac Holdings Ltd, and the following Handshakes' map shows the cross-shareholding of Innopac and LionGold:

Therefore, Nelson Fernandez, Edwin Sugiarto and Lee Chai Huat could reasonably be said to be close to LionGold.

We don't know much about Ms Bee Lay Neoh.

Incredibly, the shareholder registry gives her address as No 29 Jalan PJS 11/10, Subang Indah Bandar Sunway, Selangor, Singapore.

Selangor is a state of Malaysia, not Singapore.

Last month, Ms Bee Lay Neoh bought placement shares of SGX-listed Advance SCT Ltd.

According to Advance SCT Ltd's announcement (page 3), Ms Neoh is a businesswoman and a director of Tanda Suria Sdn Bhd.

Ms Neoh was introduced to Advance SCT Ltd by Mr Gan Tze Wee, who is a trading representative of DMG & Partners Securities Pte Ltd.

Investor Central. Asian insights for global investors. We ask the tough questions of Asian companies which global investors need answers to.

1. Why did these Singapore- and Malaysia- based individuals, with ties to LionGold, buy stakes in Bass Metals, even as LionGold is in a legal dispute with Bass Metals?

In a July 25, 2013 audiocast (comments from 4:11 to 4:55), Bass Metals highlighted the emergence of several new Malaysian investors on its ownership register.

Michael Rosenstreich, the managing director of Bass Metals, said he was aware of rumours circulating about them and their possible relationship with LionGold.

2. Has LionGold tried to reach an out-of-court settlement with Bass Metals?

Disappointed by an adverse verdict of the Supreme Court of Western Australia, it makes sense for LionGold to reach out to Bass Metals to settle the dispute.

But we don't know if LionGold ever made an attempt.

However, Bass Metals claims to have approached LionGold to discuss a settlement of the dispute.

(Total 12 questions)

While our purpose is to ask the questions which the man on the street would ask, and to help the everyday investor make informed investments, please note that:

Our articles and presentations ('our contents') are not investment advice nor should they be construed as investment advice or any recommendation of any kind; nor meant to cast allegations or insinuations of any kind against any individuals or entities. Before acting on the material in our contents, you should either seek independent advice tailored to your particular circumstances and intentions or rely on your own judgement.

Our articles and presentations express our observations, opinions and theoretical analysis based on the facts that we have gathered or have been provided to us. While we endeavour to ensure that our contents are accurate and are presented in good faith, we cannot and do not warrant the accuracy, adequacy or completeness of the material or that the material is suitable for its intended use; and we disclaim any such warranties express or implied that may be presumed by any party; neither do we take responsibility for the views of companies or other stakeholders or observers or sources quoted or hyperlinked in our contents. While every precaution has been taken in the preparation of our contents, we (and our principals) shall not be liable for any losses or damage or inconveniences due allegedly to errors or omissions in any facts or due allegedly to reliance on our contents in any way whatsoever; nor for any damage to any computer hardware, date information or materials allegedly caused by our contents.

All expressions of opinion and observations in our contents are subject to change without notice and we do not undertake a duty to update and supplement our contents or the information contained herein in the event we obtain any further or more complete information.

©2013 Investor Central® - a service of Hong Bao Media

Yahoo Finance

Yahoo Finance