What Lies Ahead for Suncor Energy's (SU) Earnings in Q1?

Suncor Energy Inc. SU is set to release first-quarter 2020 earnings results on Tuesday May 5.

The Zacks Consensus Estimate for the to-be-reported quarter’s loss is 19 cents per share and for revenues is $8.5 billion. There has been no change in estimates for the bottom line over the past seven days.

Let’s delve into the factors that might have impacted the company’s performance in the March quarter.

Factors to Impact Q1 Results

Suncor Energy’s fourth-quarter 2019 operating earnings from the downstream unit decreased to C$558 million from the year-ago figure of C$762 million due to lower refining margins. Refining margin was C$34.8 a barrel compared with C$41.5 a year ago, a trend that most likely continued in the first quarter as well.

However, the company’s upstream unit witnessed operating earnings of C$508 million against a loss of C$269 million in the prior-year quarter. This ramped-up output was backed by robust production from East Coast Canada and the Oda project in Norway. The momentum is likely to have continued in the first quarter too.

Following the Petro-Canada acquisition, Suncor Energy became one of the largest owners of oil sands in the world. Further, the company’s newly-gained oil sands properties, which enrich its operating portfolio in northern Alberta, make it emerge as the leading producer in the region where its reserves come a close second to Saudi Arabia.

While significant activities at the above-mentioned principal projects are expected to have boosted Suncor Energy’s first-quarter upstream earnings, soft year-over-year refining margins might have affected its downstream results.

What Does Our Model Say?

Our proven Zacks model does not conclusively predict an earnings beat for Suncor Energy this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating estimates. But that’s not the case here.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Suncor Energy has an Earnings ESP of 0.00%.

Zacks Rank: Suncor Energy carries a Zacks Rank #3.

The above combination acts as a spoiler as it leaves surprise prediction inconclusive.

Highlights of Q4 Earnings & Surprise History

In the last reported quarter, Suncor Energy’s operating earnings per share of 39 cents lagged the Zacks Consensus Estimate of 50 cents, attributable to lower output contribution from Fort Hills and Syncrude operations.

However, the bottom line improved 40.74% from the prior-year figure of 27 cents per share. This upside in the year-over-year results is driven by a strong production in the East Coast Canada and Oda.

Moreover, quarterly operating revenues of $7,226.05 million fell short of the Zacks Consensus Estimate of $8,864 million. However, the top line increased 6.74% from $6,769 million in the year-ago quarter.

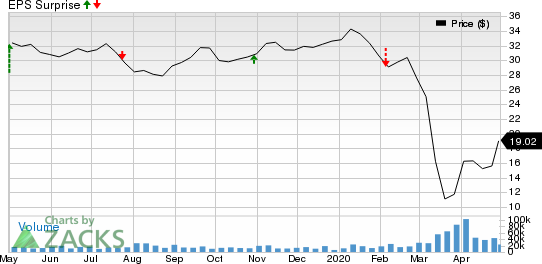

As far as the earnings surprise track is concerned, this Alberta-based company’s bottom line surpassed the Zacks Consensus Estimate in two of the trailing four quarters and missed the same on the remaining occasions. The average positive surprise is 3.88%. This is depicted in the graph below:

Suncor Energy Inc. Price and EPS Surprise

Suncor Energy Inc. price-eps-surprise | Suncor Energy Inc. Quote

Stocks to Consider

While an earnings outperformance looks uncertain for Suncor Energy, here are some firms worth considering from the energy space as our model shows that these have the right combination of elements to outpace estimates this reporting cycle:

Devon Energy Corporation DVN has an Earnings ESP of +3.80% and a Zacks Rank of 3. The firm is scheduled to release earnings on May 5.

Comstock Resources, Inc. CRK has an Earnings ESP of +2.63% and a Zacks Rank #2. The company is scheduled to release earnings on May 6. You can see the complete list of today’s Zacks #1 Rank stocks here.

Laredo Petroleum, Inc. LPI has an Earnings ESP of +2.50% and is Zacks #3 Ranked. The firm is scheduled to release earnings on May 6.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comstock Resources, Inc. (CRK) : Free Stock Analysis Report

Suncor Energy Inc. (SU) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Laredo Petroleum, Inc. (LPI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance