LendingTree (TREE) Gains 29.2% as Q1 Earnings Beat Estimates

LendingTree, Inc.’s TREE shares rallied 29.2% following the release of its higher-than-expected first-quarter 2024 results. Adjusted net income per share of 70 cents beat the Zacks Consensus Estimate of 46 cents. The reported figure compares favorably with 25 cents reported in the prior-year quarter.

The company’s results were aided by lower costs, while a decline in revenues was a spoilsport.

LendingTree reported net income of $1 million, down 92.6% from the year-ago quarter's level.

Revenues & Variable Marketing Margin Decline

Total revenues were down 16.3% year over year to $167.8 million. The downside stemmed from a decline in the Home and Consumer segments' revenues. Nonetheless, the reported figure surpassed the Zacks Consensus Estimate of $164 million.

The total cost of revenues was $8.5 million, down 37.9% from the prior-year quarter's level.

Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) totaled $21.6 million, up 49% year over year. The variable marketing margin was $69.4 million, down 8.8% year over year.

As of Mar 31, 2024, cash and cash equivalents were $230.7 million compared with $150.1 million as of Mar 31, 2023. Long-term debt was $631.3 million compared with $625.4 million as of Mar 31, 2023.

Outlook

For the second quarter of 2024, total revenues are estimated between $175 million and $190 million. Adjusted EBITDA and the variable marketing margin are anticipated between $22-$26 million and $70-$76 million, respectively.

For 2024, total revenues are projected between $690 million and $720 million. Adjusted EBITDA is projected in the $85-$95 million band. The variable marketing margin is expected in the range of $280-$300 million.

Conclusion

TREE’s market-leading position and flexible business model enable it to navigate through fluctuating macroeconomic situations. Its first-quarter results were mainly affected by a decline in the Home and Consumer segments' revenues. The company’s efforts to boost revenues by diversifying its non-mortgage product offerings will support top-line growth in the future.

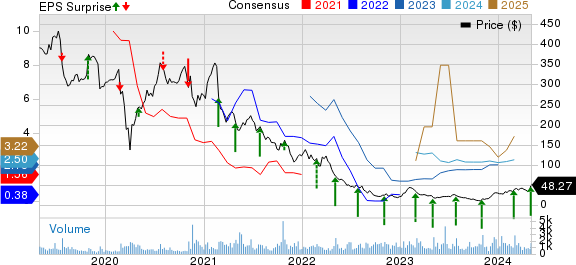

LendingTree, Inc. Price, Consensus and EPS Surprise

LendingTree, Inc. price-consensus-eps-surprise-chart | LendingTree, Inc. Quote

Currently, LendingTree sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Performance of Other Finance Stocks

Sallie Mae’s SLM, formally SLM Corporation, first-quarter 2024 earnings per share of $1.27 surpassed the Zacks Consensus Estimate of $1.09. The bottom line compared favorably with the prior-year quarter’s 47 cents.

SLM’s result shows lower provisions for credit losses, robust loan originations and higher non-interest income. However, a decline in the net interest income (NII) and a rise in non-interest expenses impeded the results.

Navient Corporation NAVI reported first-quarter 2024 adjusted earnings per share (excluding regulatory-related and restructuring expenses) of 63 cents, surpassing the Zacks Consensus Estimate of 58 cents. It reported 86 cents in the prior-year quarter.

NAVI’s results were driven by a rise in total other income and a fall in expenses. However, a decline in NII has affected the results.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SLM Corporation (SLM) : Free Stock Analysis Report

LendingTree, Inc. (TREE) : Free Stock Analysis Report

Navient Corporation (NAVI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance