Leggett & Platt (LEG) Guides Lower for 2022, Shares Down 9%

Leggett & Platt, Incorporated LEG shares plunged 8.6% on Oct 10 after the company lowered its expectations for 2022.

The company highlighted that the challenging global economic environment and consumer backdrop have been resulting in relatively weak demand in the U.S. bedding market. It has been cutting production in Rod and Wire businesses to reduce inventory, given the bedding demand environment and slowing market for steel.

Key Takeaways

Pandemic-related supply issues and channel-specific pressures have adversely impacted demand significantly for the Specialty Foam business. LEG has been witnessing lower demand for Specialty Foam, which along with operational inefficiencies, is creating hurdles.

Meanwhile, owing to geopolitical and macroeconomic disruptions in Europe, International Bedding has been experiencing lower demand. The home Furniture demand has softened significantly over the last few months, with slower consumer demand and excess inventory at retail.

The volume and cost recovery in Automotive has been improving in a slower-than-expected trend as supply chain and geopolitical impacts bring continued volatility.

Overall, owning to the above-mentioned headwinds, LEG now expects sales in the range of $5.1–$5.2 billion versus $5.2-$5.4 billion expected earlier. Earnings are now expected to be between $2.30 and 2.45 per share, down from a prior expectation of $2.65-$2.80. The company now expects an EBIT margin of 9.5-10% (versus the prior expectation of 10.5-10.7%). Cash from operations is expected to be between $400 and $450 million (versus the prior guidance of $550–$600 million).

Acquisitions

The company has been navigating these challenges by aligning costs, production levels, and inventory with demand. It has been evaluating near-term opportunities with customers, focusing on new product developments and expanding its existing businesses through acquisitions.

Leggett & Platt acquired a leading global manufacturer of hydraulic cylinders for heavy construction machinery in late August 2022. The acquired unit has manufacturing facilities in Eschwege, Germany and Ningbo, China and a distribution facility in Halifax, PA, with combined 2021 sales of approximately $65 million. Also, LEG acquired a converter of construction fabrics for the furniture and bedding industries in Shannon, MS, during the same month. On Oct 3, Leggett & Platt acquired a distributor of geo components located in Ottawa, Canada. Each of these Textile businesses has annual sales under $10 million.

Share Price

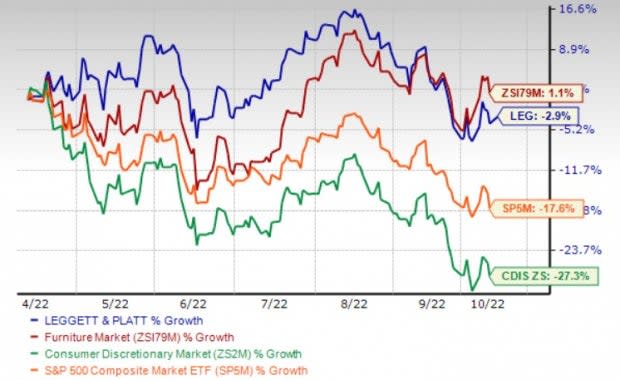

Image Source: Zacks Investment Research

Leggett & Platt shares have lagged the Zacks Furniture industry but outperformed the Zacks Consumer Discretionary sector and S&P 500 Index. In the past six months, the stock has lost 2.9% against the industry’s 1.1% rise. The sector and S&P 500 Index have declined 27.3% and 17.6%, respectively, in the same time frame.

Zacks Rank

LEG currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some Better-Ranked Stocks in the Consumer Discretionary Sector

Some better-ranked stocks in the sector are Marriott Vacations Worldwide Corporation VAC, Hyatt Hotels Corporation H and InterContinental Hotels Group PLC IHG.

Marriott Vacations currently sports a Zacks Rank #1. VAC has a trailing four-quarter earnings surprise of 13.9%, on average. The stock has declined 18% in the past year.

The Zacks Consensus Estimate for VAC’s current financial year sales and earnings per share (EPS) indicates an increase of 19.7% and 131.4%, respectively, from the year-ago period’s reported levels.

Hyatt carries a Zacks Rank #2 (Buy). H has a trailing four-quarter earnings surprise of 798.9%, on average. The stock has declined 2% in the past year.

The Zacks Consensus Estimate for H’s current financial year EPS indicates growth of 113% from the year-ago period’s reported levels.

InterContinental Hotels carries a Zacks Rank #1. IHG has a long-term earnings growth of 32.7%. The stock has declined 26.6% in the past year.

The Zacks Consensus Estimate for IHG’s current financial year sales and EPS indicates growth of 21.7% and 88.4%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intercontinental Hotels Group (IHG) : Free Stock Analysis Report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Leggett & Platt, Incorporated (LEG) : Free Stock Analysis Report

Marriot Vacations Worldwide Corporation (VAC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance