Learn Forex: Trend Trading Basics

Article Summary: Trend traders enjoy the luxury of first identifying market direction prior to executing a trading strategy. Today we will review the basics of trend identification.

Traders enjoy trading trends to take advantage of extended directional market moves. This is especially true in the Forex market where trends can last for days, weeks, months, or even longer. If a trader can find the direction of the trend, it can exponentially increase the likelihood of having a successful trade.

To begin our discussion on trend trading basics, we first need to be able to identify two types of trends. Today we will begin with finding both an uptrend and a downtrend using a daily chart.

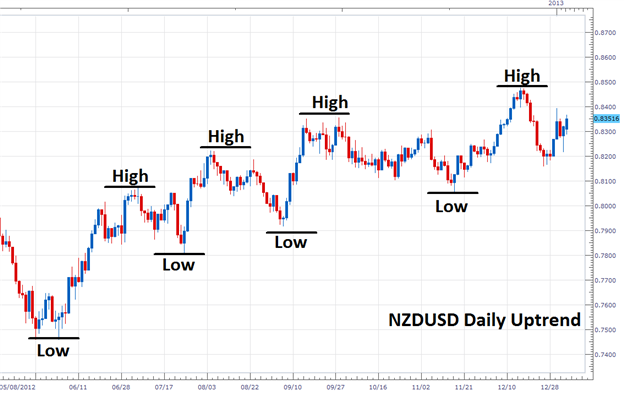

Learn Forex – NZDUSD Daily Uptrend

(Created using FXCM’s Marketscope 2.0 charts)

Identifying an Uptrend

Identifying an uptrend is the first skill we need to tackle before trading directional markets. An uptrend can be defined as a market that makes a series of higher highs and higher lows. Pictured above is an excellent example of the NZDUSD pair, which is currently residing in an uptrend. Since the first low pictured at .7454 the pair has advanced as much as 1021 pips! Notice how the pair has now made a series of four higher highs as this uptrend has progressed. This is indicative of a strong trending move and our trend is expected to continue as long as our lows and highs continue to increase in value.

Uptrends are the perfect environment for finding buying opportunities. As seen in the daily graph above each time the NZDUSD has moved temporarily lower, it has found support prior to moving on to higher highs. Regardless of the strategy used, trend traders will continue to buy this uptrend until it concludes with the creation of a lower low.

Learn Forex – EURAUD Daily Downtrend

(Created using FXCM’s Marketscope 2.0 charts)

Identifying a Downtrend

The second trend we should learn to identify is the downtrend. This process is similar to finding an uptrend but the methodology is reversed. This time we are looking for prices to continually decline. Both highs and lows should be moving lower, much like we can see in the EURAUD chart above. From the first labeled high at 1.4334, price has made a total of three lower lows while declining a total of 2730 pips.

The decline in the EURAUD depicted above, has taken place over the last two years. This chart has offered many selling opportunities while showing exactly how long daily trends may run. As long as prices continue to head lower, traders will continue to apply their trend trading strategies on the EURAUD.

---Written by Walker England, Trading Instructor

To contact Walker, email WEngland@FXCM.com . Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to WEngland@FXCM.com .

Been trading FX but wanting to learn more? Been trading other markets, but not sure where to start you forex analysis? Register and take this Trader Quiz where upon completion you will be provided with a curriculum of resources geared towards your learning experience.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance