Learn Forex: Trading the Inside Bar

Article Summary: Inside bars develop when price fails to break a currency pairs previous daily high or low. As the AUDUSD consolidates, traders can use this pattern to plan for the pairs next breakout.

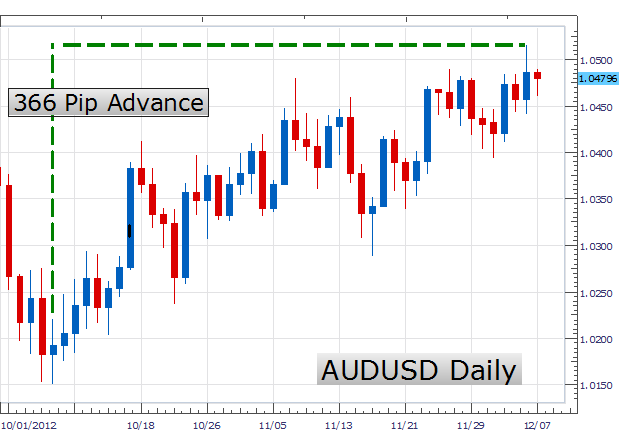

The AUDUSD has been a strong trending currency pair moving as much as 366 pips over the course of the last two trading months. Despite major news releases throughout today’s trading day, the trend is at a standstill neither creating new highs nor new lows when compared to yesterday’s price action. This form of consolidation is called an inside bar, and can be useful to help traders prepare for the AUDUSD’s next move. To prepare for the pairs next breakout, today we will focus on learning how to trade inside bars.

Learn Forex – AUDUSD Daily Trend

(Created using FXCM’s Marketscope 2.0 charts)

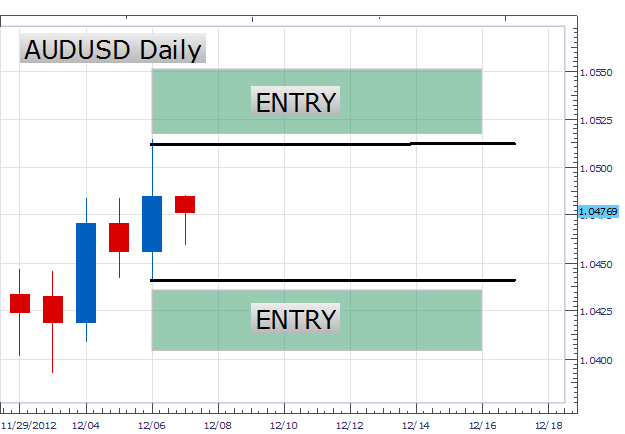

Moving in to this week’s price action, we can see the development of an inside bar on the AUDUSD daily graph. As described we can see that today’s price action does not exceed yesterday’s high at 1.0514 or its low at 1.0440. Currently at the time of this articles writing, price has yet to move beyond either boundary. If price remains at these levels traders can prepare to trade a breakout.

Traditionally inside bars lends themselves to trading breaks of either the previous high (resistance) or low (support). What is great about trading inside bars using a breakout methodology, is that a non- entry orders can be placed on either side of the market. One entry will be placed above the mentioned high at 1.0514 to buy on the creation of a new high. Conversely another entry will be set to sell the AUDUSD if prices drop below previous daily low at 1.0441. Once these entries are set risk can be managed with stops can be placed between both entry points. To aid in the simplicity of setting these orders, traders may always use the OCO feature found inside of the FXCM Trading Station.

Learn Forex – AUDUSD Inside Bar

(Created using FXCM’s Marketscope 2.0 charts)

My preference is to place an OCO entry order to trade a breakout of AUDUSD from its December 6th high or low. Stops will be placed between the OCO orders near 1.0478. Traders can use a risk/reward ratio of 1:2 or better looking for a minimum of 75 pips profit on the trade.

Alternative scenarios include continuing to trade “inside”, prior to a breakout.

---Written by Walker England, Trading Instructor

To contact Walker, email wengland@fxcm.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, CLICK HERE and enter in your email information

Looking for a strategy to trade? Take our free CCI training course and learn new ways to trade with this versatile oscillator. Register HERE to start learning your next CCI strategy!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance