LEARN FOREX: Trading Descending Triangles

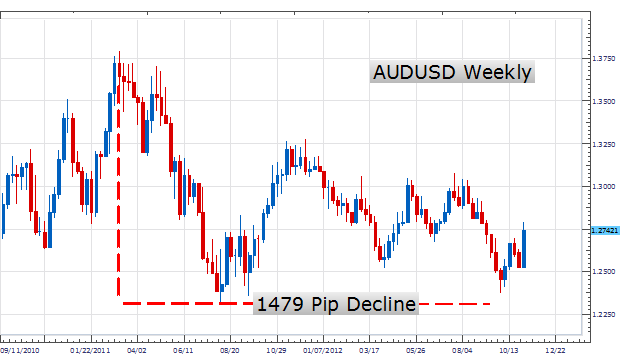

The AUDNZD is generally known as a slow moving currency pair with long periods of consolidation. So far throughout the 2012 trading year this pair has not disappointed. The pair has currently been trading between 2011 high and low found at 1.3794 and 1.2315. Since this 1479 pip decline the pair has been trading virtually sideways, neither breaking new highs nor lows. One way we can take advantage of consolidating market is to look for pricing patterns using support and resistance levels. Today we will learn about trading thedescending triangle pattern.

(Created using FXCM’s Marketscope 2.0 charts)

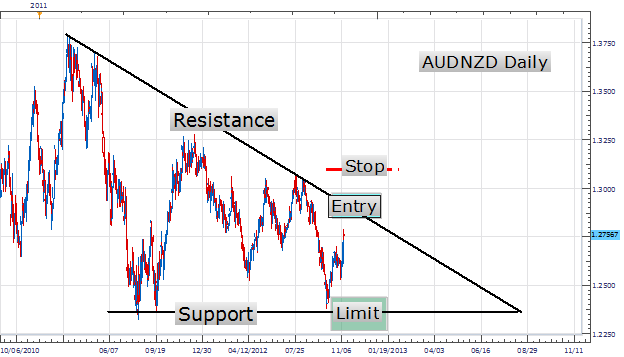

The primary method of trading a triangle can been seen depicted below. Traders intend to use the descending triangles bearish bias to their benefit, and look to sell the AUDNZD at its current resistance levels. Our entry point can be found by identifying resistance by drawing a declining trendline by connecting the March and April 2011 highs with July 2012 high. Currently resistance is found near 1.2900 making it the first possible position to consider an entry order to sell the AUDNZD.

Stop orders should be placed above the current resistance line in case price breaks up to higher highs against our entry. In the example below, our stop resides above the July 2012 high at 1.3075. With a 175 pip stop in place traders can then extrapolate a positive risk reward ratio of their choosing. Descending triangles can also allow a trader to target support, near the previous low, as a potential take profit level. Currently support resides near 1.2400 which would allow for a potential 500 pip profit target.

(Created using FXCM’s Marketscope 2.0 charts)

It is important to remember that descending triangles occur prior to a market breakout. These triangles have a bearish bias and their presence on a chart is generally seen as a continuation in a downward trending market. When a descending triangle is found at the top of an uptrend a descending triangle can signal a pending reversal. Regardless of the direction taken, breakout traders may opt to enter the market when the AUDNZD moves through either the support or resistance levels mentioned above.

---Written by Walker England, Trading Instructor

To contact Walker, email wengland@fxcm.com. Follow me on Twitter at @WEnglandFX.

To be added to Walker’s e-mail distribution list, send an email with the subject line “Distribution List” to wengland@fxcm.com.

New to the FX market? Save hours in figuring out what FOREX trading is all about.

Take this free 20 minute “New to FX” course presented by DailyFX Education. In the course, you will learn about the basics of a FOREX transaction, what leverage is, and how to determine an appropriate amount of leverage for your trading.

Register HEREto start your FOREX learning now!

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance