Learn Forex: Price Action Setups - December 18, 2012

Article Summary: Traders utilizing Price Action are using the most relevant indicator available to analyze their charts: Price and price alone. This article covers 2 setups utilizing price action, as seen in The Forex Trader’s Guide to Price Action. The lower portion of the article provides updates on previous setups investigated in previously published Price Action Setups articles.

The past week saw massive volatility enter the markets on the heels of even more central bank news, as we move into yet another major announcement in which a Central Bank is expected to intervene in their own currency. After last week’s article, The Fed moved, as expected in outlining an additional stimulus program, thereby adding considerable weakness to US Dollars.

This week, focus shifts to the Bank of Japan as traders have massively sold the Yen in anticipation of further weakness. We had investigated a long entry in EURJPY in our Price Action Setups article 2 weeks ago, and the first profit target was obtained; illustrating how traders are attempting to sell Yen before the actual intervention announcement expected at the next Bank of Japan meeting. We’ll talk about previous weeks trade setups at the bottom of this article, but for now – we’ll investigate 2 current setups available via price action.

One of the great things about trading with Price Action is the fact that what matters most, prices, are front and center to trader’s technical analysis. This often comes up with Psychological Whole Numbers, and we saw a great example of how these levels can work in markets when trading opened on sunday.

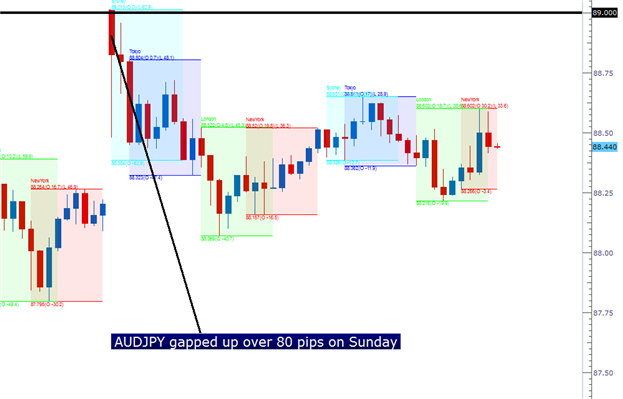

On the Sunday open, the Yen gapped down massively; on the heels of the news that the Liberal Democratic Party had won elections in Japan; and this is the party behind the stimulus/intervention hope, so there is further hope that the Bank of Japan will embark upon a more aggressive policy at the next BOJ meeting on December 20th.

As the Yen gapped down, the AUDJPY pair ran directly to the price of 89, for a gap of 81 pips on the open of trading (picture below):

AUDJPY Gapped Higher 81 Pips on the Open of Trading Sunday

(Created with Marketscope/Trading Station II)

This price of 89 has long-term implications for AUDJPY. The chart below has 4 of the more recent inflections at this price. Notice how before The Financial Collapse, this level served as rigid support, yielding to price as the throes of the global meltdown pushed price below 55 later in 2008.

The price of 89 has played an important role in AUDJPY since before the collapse

(Created with Marketscope/Trading Station II)

As the global economy begin rising out of the depths of the financial collapse, 89 has functioned as rigid resistance. Since 2009, there has been only 1 weekly close above 89, and the excitement on the open of trading pushed price right to this level.

If we break the high point of the opening candle for the week, I will look to trigger a long position on a breakout entry. Initial stop will be placed at 88.20 with an initial profit target at 90.00 (this would offer a 1:1.25 risk-to-reward ratio. The second target is in place in the event that we get significant movement upon the Bank of Japan decision, and this is at 92 (offering a 1:3.75 risk-to-reward ratio). This setup is a 1:1.25 risk-to-reward ratio.

Long AUDJPY at 89.05; stop at 88.20, Profit Target 1 at 90.00 (1:1.25 Risk-to-Reward ratio), Profit Target 2 at 92.00 (1:3.75 risk-to-reward ratio).

While most USD and JPY pairs remain stretched with weakness, it can often benefit traders to look to other non-USD or non-JPY pairings to diversify their approach. After all, if we take 3 trades, all selling the Yen, we’re really just tripling our exposure in this one theme. Why not, instead, focus on what appears to be the most opportunistic pairing with Yen and then look elsewhere for diversification?

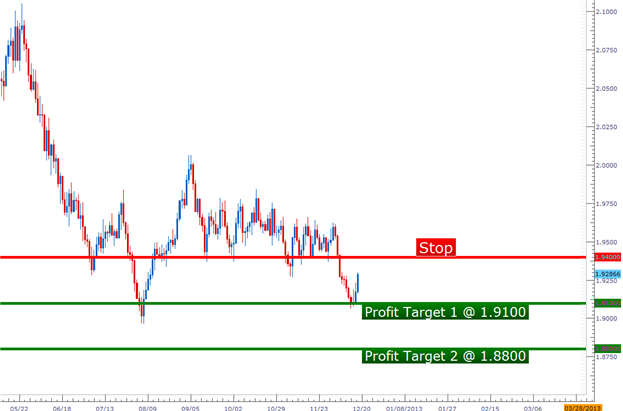

After printing new annual highs, the Kiwi has begun to sell off as traders take profits from this extremely bullish trend. Meanwhile, the UK printed better than expected inflation data this morning and GBP has rallied.

This brings up an interesting short-term setup in consideration of a longer-term trend. The trend in question is below on the GBP/NZD pair:

GBPNZD has put in one of the more impressive trends of the recent past

(Created with Marketscope/Trading Station II)

With a trend this strong, I really only want to be looking to that side of the trade: With such a strong down-trend, I only want to look to sell. Even if I decide I want to buy GBP, I would do it in another pairing (such as USD or CHF). And with the recent run-up in the currency pair, I want to look to use this to initiate a short in consideration of the longer-term trend at a better price. The chart below will illustrate this setup:

Near-term strength in the pair may offer opportunity to sell a strong down-trend

(Created with Marketscope/Trading Station II)

Short GBPNZD at Market; Stop at 1.9400, Profit Target 1 at 1.9100 (1-to-1.5 risk-to-reward ratio), Profit Target 2 at 1.8800 (1-to-4 risk-to-reward ratio).

Update on previous articles:

This week’s volatility saw numerous price action setups previously covered in this report move to their stop and/or profit target.

From the Price Action Setups published on December 4, 2012:

EURJPY triggered at 108 and the first profit target was met at 110.00, with the second profit target remaining active. I have moved stops to break-even on the position in search of the second profit target.

USDCAD remains open with an approximate +45 pip gain on the pair. Stops have been moved to break-even, or .9900 on this trade as well.

The AUDUSD position covered in the article was stopped out at break-even, and I wrote a full article about the management of that position in The Life Cycle of a Winning Trade.

From the Price Action Setups published on December 11, 2012:

The EURUSD position investigated in the article met its stop shortly before FOMC last week. The AUDUSD position outlined in the article remains open with a current profit of ~3 pips.

--- Written by James Stanley

To contact James Stanley, please email JStanley@DailyFX.com. You can follow James on Twitter @JStanleyFX.

To be added to James’ distribution list, please send an email with the subject line “Notification,” to JStanley@DailyFX.com.

Would you like a customized curriculum to walk you through Trading Education? Take our Trader IQ quiz and receive a full lesson plan with numerous free resources to expand your information arsenal.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance