Lazard's (LAZ) February AUM Improves 1.7% on Upbeat Market

Lazard, Inc. LAZ reported its preliminary asset under management (AUM) balance of approximately $248 billion for February 2024. This indicates a 1.7% increase from $243.8 billion as of Jan 31, 2024.

The improvement in AUM balance for the month of February was driven by a market appreciation of $7 billion. However, it was partially offset by net outflows of $2 billion and foreign exchange depreciation of $0.8 billion.

In February, Lazard’s equity assets increased 2.3% from the prior month’s level to $192.7 billion.

Nevertheless, both fixed income and other income declined marginally to $47.3 billion and $8.08 billion, respectively, from the previous month.

Lazard’s strong AUM balance, coupled with innovative investment strategies and solutions, is expected to support its top line. We project average AUM and revenues to rise 21.2% and 14.5%, respectively, in 2024. A well-laddered debt maturity profile and impressive cost-control efforts are other positives. However, the current challenging macroeconomic environment and high reliance on financial advisory fees for most of its revenues are major concerns.

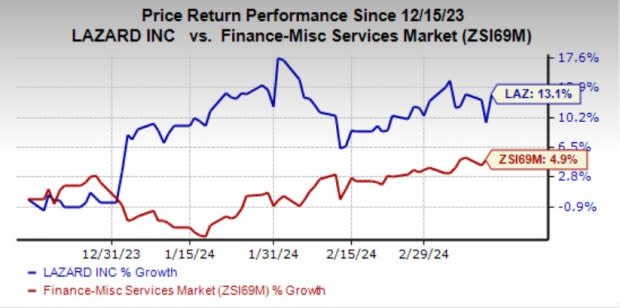

Over the past three months, shares of Lazard have gained 13.1% compared with the industry’s growth of 4.9%.

Image Source: Zacks Investment Research

LAZ currently carries a Zacks Rank #3 (hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

Virtus Investment Partners, Inc. VRTS recently recorded a preliminary AUM of $176.1 billion for February 2024, down 3% as of Jan 31, 2024. The company offered services to $2.6 billion of other fee-earning assets. This was excluded from the above-mentioned AUM balance.

Victory Capital Holdings, Inc. VCTR recently reported AUM of $164.9 billion for February 2024. This reflected a 2.9% rise from $160.2 billion reported in the prior month.

By asset class, VCTR’s U.S. Mid Cap Equity AUM was up 4.4% from the January level to $31.3 billion. The U.S. Small Cap Equity AUM of $15.7 billion increased 3%. The Global/Non-U.S. Equity AUM rose 3.4% to $17.1 billion. The U.S. Large Cap Equity AUM increased 5.5% to $13.5 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lazard, Inc. (LAZ) : Free Stock Analysis Report

Virtus Investment Partners, Inc. (VRTS) : Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance