Larry Summers says $100 billion in health investments key to rapid recovery

The lack of “fundamental health investments” in the U.S. is threatening to slow the nation’s economic recovery as it emerges from a global pandemic, according to Larry Summers, former U.S. Treasury Secretary in the Clinton administration.

Speaking to Yahoo Finance, Summers said the country is in danger of overemphasizing the impact social distance restrictions are having on the economy — and underestimating the health measures necessary to safely reopen the economy.

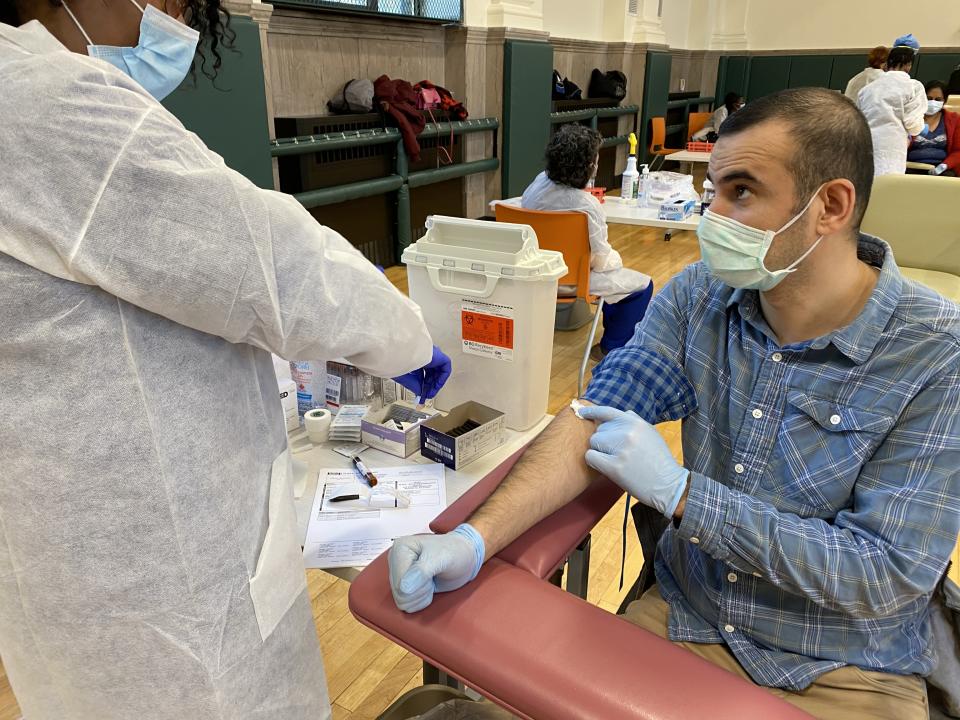

“I'm sure that we can very profitably invest in more testing, I'm sure that we can very profitably invest in more contact tracing, I'm sure that we can invest better in strategic targeting to protect nursing homes. These are [the] higher priorities for me,” said Summers, who also served as the Director of the National Economic Council under President Obama. “I’d like to see at least $100 billion in fundamental health investments to drive and make possible a more rapid recovery.”

Business shutdowns prompted by the coronavirus outbreak have led to an unprecedented downturn in U.S. economic activity. Retail sales plummeted a record 16% in April, while GDP contracted 4.8% in the first quarter. More than 36 million Americans have filed unemployment insurance claims.

As states begin easing lockdown restrictions, officials have warned about the health risks that come with resuming economic activity too quickly. Speaking to the U.S. Senate last week, Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, said a new wave of infections is “inevitable.”

Summers said health investments will not only spur economic activity, but also lead to more sustainable growth.

“If employers can test their employees when they come to work, they can provide other employees with the confidence that they're safe. They can provide the people who walk into the store with the confidence that the person behind the cash register is safe. If schools can test their students, people can go to the school with much greater confidence that they will be safe,” Summers said. “Testing transparency leads to confidence. Confidence leads to better economic performance.”

President Trump has repeatedly underplayed the importance of nationwide testing, while also touting the number of tests the U.S. has conducted. Last week, he questioned whether testing is “overrated,” adding that “if we didn’t do any testing, we would have very few cases.” That has put him at odds with governors who say access to testing is key to safely reopening their states.

‘We need to borrow money to carry us through’

As lawmakers debate when and how to restart the economy safely, there is growing concern about the impact the government’s efforts to fight the pandemic will have on future spending. Congress has approved nearly $3 trillion in emergency relief to combat the downturn, while delaying tax deadlines for businesses and individuals. Spending in April climbed to a record $979.71 billion, leading to a $737.85 billion deficit for the month.

Summers said the severity of the crisis and the need to support the economy outweighs the need for an “adequate investment agenda.” Without the current investments, Summers said the U.S. would risk suffering reduced capacity from “lost generations of potential workers” and “greater social insurance burdens for those who become estranged from the workforce.”

“The most basic truth about borrowing money is that you can't judge the borrowing of money unless you know what it's going to be used for. That's true for a household. If you borrow money to buy a house, that's one thing. If you borrow money to go eat out a lot, that's a different thing. The same thing is true for us as a nation, and we need to borrow money to carry us through this emergency and to maintain investment in the future of our economy,” he said.

Akiko Fujita is an anchor and reporter for Yahoo Finance. Follow her on Twitter @AkikoFujita

Yahoo Finance

Yahoo Finance