Lantheus (LNTH) Q1 Earnings Surpass Estimates, Gross Margin Up

Lantheus Holdings, Inc. LNTH delivered adjusted earnings per share (EPS) of $1.69 in the first quarter of 2024, up from the year-ago period’s $1.47. The figure topped the Zacks Consensus Estimate by 9%.

The adjustments include expenses related to amortization of acquired intangible assets, among others.

GAAP EPS for the quarter was $1.87 against the year-earlier loss of 4 cents per share.

Revenues in Detail

Lantheus registered revenues of $369.9 million in the first quarter, up 23% year over year. The figure topped the Zacks Consensus Estimate by 5.9%.

Segment Details

Lantheus’ operations consist of three categories — Precision Diagnostics, Radiopharmaceutical Oncology, and Strategic Partnerships and Other Revenue.

For the quarter under review, Precision Diagnostics reported revenues of $104.2 million, up 8.9% from the year-ago quarter. This upside can be primarily attributed to strength in DEFINITY products, which fetched revenues of $76.6 million (up 11.2% year over year).

Revenues in the Radiopharmaceutical Oncology segment totaled $259.3 million, up 32.1% year over year. The segment’s performance reflected solid PYLARIFY sales, which generated revenues of $258.9 million, up 32.4% year over year. The growth in PYLARIFY sales was driven by increasing utilization of PSMA PET with PYLARIFY at existing customers and expansion of the prostate-specific membrane antigen (PSMA) positron emission tomography (PET) imaging market.

Strategic partnerships and other revenues were $6.5 million, down 27.5% from the year-ago quarter. This was primarily due to the prior year’s comparable having $6.2 million of RELISTOR-related royalties, not repeated this year.

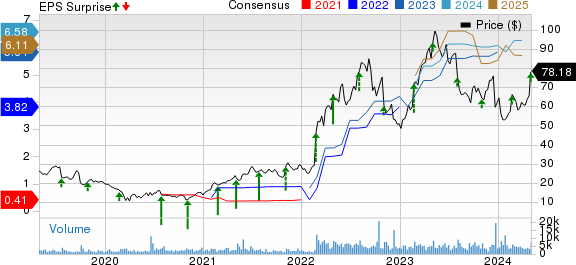

Lantheus Holdings, Inc. Price, Consensus and EPS Surprise

Lantheus Holdings, Inc. price-consensus-eps-surprise-chart | Lantheus Holdings, Inc. Quote

Margin Analysis

In the quarter under review, Lantheus’ gross profit increased 213.8% to $241.8 million. The gross margin expanded a huge 3974 basis points (bps) to 65.4%.

Sales and marketing expenses increased 39.6% to $45.5 million. Research and development expenses increased 57.3% year over year to $48 million, while general and administrative expenses climbed 105.8% year over year to $47.9 million. Total operating expenses of $141.5 million increased 63.7% year over year.

Total operating profit totaled $100.4 million against the year-ago quarter’s operating loss of $9.3 million.

Financial Position

Lantheus exited first-quarter 2024 with cash and cash equivalents of $718.3 million compared with $713.7 million at 2023-end. Total debt (including current debt obligations) at the end of first-quarter 2024 was $563.2 million compared with $562.5 million at 2023-end.

Net cash provided by operating activities at the end of first-quarter 2024 was $127.2 million compared with $108.5 million a year ago.

Guidance

Lantheus has provided its financial outlook for second-quarter 2024, and upped the same for the full year.

The company projects its second-quarter revenues in the range of $380 million-$390 million. The Zacks Consensus Estimate is pegged at $356.3 million.

The second-quarter adjusted EPS is anticipated to be in the range of $1.81-$1.86. The Zacks Consensus Estimate is pegged at $1.66.

Lantheus now expects its full-year revenues in the range of $1.50 billion-$1.52 billion, up from the previous outlook of $1.41 billion-$1.445 billion. The Zacks Consensus Estimate is pegged at $1.43 billion.

For the full year, adjusted EPS is now anticipated to be in the range of $7.00-$7.20, up from the previous guidance of $6.50-$6.70. The Zacks Consensus Estimate is pegged at $6.58.

Our Take

Lantheus ended the first quarter of 2024 with better-than-expected results. Its robust top-line and bottom-line results and strong performances in the majority of its segments were impressive. The continued strength in PYLARIFY and DEFINITY was also promising. The gross margin expansion bodes well.

An expanding PSMA PET imaging market and increasing utilization of PSMA PET with PYLARIFY at existing customer sites also look promising. On the earnings call, management confirmed that it continues to support investigator-sponsored research with the potential to expand the clinical utility of PYLARIFY. Per management, Lantheus continued to make progress with MK-6240. Management also confirmed its strategic partnership with Perspective Therapeutics, which provides Lantheus with options to add radioligand therapy assets to its pipeline and expand into alpha therapeutics. These raise our optimism.

Yet, a decline in Strategic partnerships and other revenues and the Radiopharmaceutical Oncology segment’s Other radiopharmaceutical oncology revenues was disappointing.

Zacks Rank and Stocks to Consider

Lantheus currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, ResMed Inc. RMD and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2024 adjusted EPS of $2.14, beating the Zacks Consensus Estimate by 8.1%. Revenues of $997.4 million outpaced the consensus mark by 2.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Align Technology has a long-term estimated growth rate of 6.9%. ALGN’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 5.9%.

ResMed reported third-quarter fiscal 2024 adjusted EPS of $2.13, beating the Zacks Consensus Estimate by 10.9%. Revenues of $1.19 billion surpassed the Zacks Consensus Estimate by 1.9%. It currently sports a Zacks Rank #1.

ResMed has a long-term estimated growth rate of 10.7%. RMD’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, beating the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 12.5%. BSX’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Lantheus Holdings, Inc. (LNTH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance