Landstar (LSTR) Continues to Grapple With Weak Freight Market

Landstar System, Inc. (LSTR) is being hurt by weak freight conditions. The top line has been suffering mainly due to the below-par performance of its key segment, namely, truck transportation. Revenues are likely to be weak going forward as well. LSTR expects second-quarter 2024 truckload to decline in the range of 5%-9% on a year-over-year basis and truck revenue per load to decline in the range of 0%-4% on a year-over-year basis. Weakness in overall volumes due to headwinds like weak freight conditions, supply-chain woes and slower network velocity is hurting the top line.

Driver shortage continues to be a major challenge facing the trucking industry. As old drivers retire, trucking companies find it difficult to hire drivers since the job does not appeal to the younger generation.

Gross profit margin was 9.7% in first-quarter 2024 compared with 10.7% in the year-ago period. Lackluster revenues due to the weak freight market scenario are putting pressure on margins.

The negative sentiment surrounding the stock is evident from the fact that the Zacks Consensus Estimate for current-year earnings has been revised downward by 6.7% over the past 90 days.

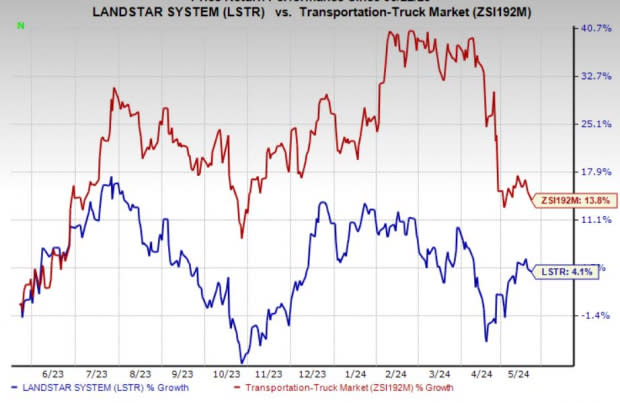

Partly due to these headwinds, shares of LSTR, despite gaining 4.1% over the past year, have underperformed its industry’s growth of 13.8%.

Image Source: Zacks Investment Research

Despite such headwinds, Landstar’s consistent initiatives to reward its shareholders through dividends and share repurchases look encouraging. During first-quarter 2024, LSTR paid dividends of $83.23 million. Such shareholder-friendly moves instill investor confidence and positively impact the company's bottom line. Further, Landstar has an encouraging earnings surprise history.

Zacks Rank and Stocks to Consider

Landstar currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 earnings per share guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance