Landstar (LSTR) Up 3.8% Since Q1 Earnings Beat & Rosy View

Landstar System, Inc.’s LSTR first-quarter 2022 earnings of $3.34 per share surpassed the Zacks Consensus Estimate of $3.10. The bottom line surged 66.2% year over year on higher revenues.

Revenues of $1,970.6 million also outperformed the Zacks Consensus Estimate of $1,850 million. The top line soared 53% year over year owing to strong performances of the truck transportation, rail intermodal, and ocean and air-cargo carrier segments.

The top and the bottom-line beat in the first quarter as well as a strong second-quarter 2022 guidance pleased investors. Earnings per share for the June quarter are estimated in the band of $3.22-$3.32. The Zacks Consensus Estimate for the same is currently pegged at $2.79 per share. As a result, the stock has gained 3.8% since the earnings announcement on Apr 20.

Gross profit came in at $214.6 million in the reported quarter, up 46% year over year. Operating income surged 57.6% from the prior-year quarter’s figure to $162.8 million. Total costs and expenses (on a reported basis) increased 42.6% to $1.8 billion.

Total revenues in the truck transportation segment — contributing to 88.9% of the top line — amounted to $1.75 billion, up 45.8% from the year-ago quarter’s figure. Within the truck transportation segment, revenues hauled via van equipment rose 48% to $1.08 billion. Truckload transportation revenues hauled via unsided/platform equipment climbed 37% to $408.8 million.

Less-than-truckload revenues increased 31% to $33.7 million. Overall, first-quarter truck transportation revenue per load rose 22.5% year over year.

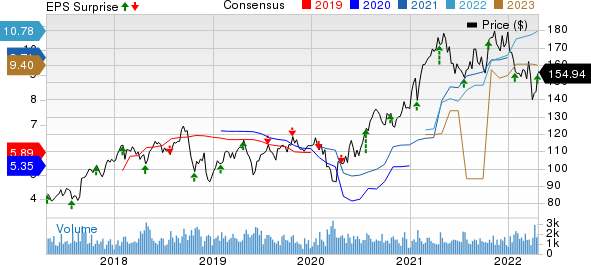

Landstar System, Inc. Price, Consensus and EPS Surprise

Landstar System, Inc. price-consensus-eps-surprise-chart | Landstar System, Inc. Quote

Rail intermodal revenues of $42.7 million increased 34.7% from the figure recorded in first-quarter 2021. Revenues in the ocean and air-cargo carrier segments skyrocketed in excess of 100% year over year to $152.1 million. Other revenues increased 67.3% to $24.6 million.

Liquidity

At the end of the first quarter of 2022, Landstar, currently carrying a Zacks Rank #3 (Hold), had cash and cash equivalents of $146 million compared with $215.5 million recorded at the end of 2021. Additionally, long-term debt (excluding current maturities) totaled $137.3 million at the end of the March quarter of 2022 compared with $75.2 million at the end of 2021. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Aspects of Q222 Outlook

Landstar anticipates second-quarter 2022 revenues in the range of $2.0-$2.05 billion. The Zacks Consensus Estimate for the metric currently stands at $1.82 billion.

Revenue per load on loads hauled via truck in the second quarter of 2022 is expected in a mid-teen percentage range above the second-quarter 2021 reported figure.

Earnings Snapshots

Within the broader Transportation sector, J.B. Hunt Transport Services JBHT, CSX Corporation CSX and United Airlines UAL recently reported first-quarter 2022 results.

J.B. Hunt reported better-than-expected first-quarter 2022 earnings numbers. Quarterly earnings of $2.29 per share surpassed the Zacks Consensus Estimate of $1.91. The bottom line surged 67.2% year over year on the back of higher revenues across all segments.

Total operating revenues of $3,488.6 million also outperformed the Zacks Consensus Estimate of $3,260.5 million. The top line jumped 33.3% year over year. JBHT currently carries a Zacks Rank #3.

CSX Corp’s first-quarter 2022 earnings of 39 cents per share beat the Zacks Consensus Estimate by a penny despite the decrease in overall volumes as supply-chain issues continue to dent results. The bottom line improved 25.81% year over year owing to higher revenues, aided by increased shipping rates.

Total revenues of $3,413 million outperformed the Zacks Consensus Estimate of $3291.2 million. The top line increased 21.33% year over year. CSX carries a Zacks Rank of 3 at present.

United Airlines incurred a loss of $4.24 per share in the first quarter of 2022, wider than the Zacks Consensus Estimate of a loss of $4.19. This is the ninth consecutive quarterly loss suffered by UAL as coronavirus woes continue to dwindle air-travel demand.

Operating revenues of $7,566 million also fell short of the Zacks Consensus Estimate of $7,657.2 million. UAL is presently Zacks #3 Ranked.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CSX Corporation (CSX) : Free Stock Analysis Report

United Airlines Holdings Inc (UAL) : Free Stock Analysis Report

J.B. Hunt Transport Services, Inc. (JBHT) : Free Stock Analysis Report

Landstar System, Inc. (LSTR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance