L Brands (LB) Q2 Earnings Top, Victoria's Secret Still a Drag

L Brands, Inc.’s LB second-quarter fiscal 2019 earnings surpassed the Zacks Consensus Estimate but net sales fell short of the same. Both the top and the bottom lines declined year over year. We note that the results of the company’s Victoria’s Secret business, which has been battling competition and consumers’ changing preferences for quite some time, remained dismal. However, impressive performance at Bath & Body Works brand provided some cushion.

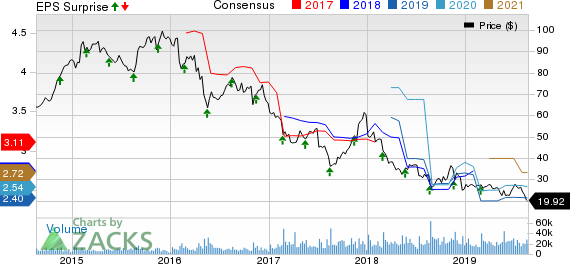

Notably, there was not much stock price movement during the after-market trading session on Aug 21. Meanwhile, shares of this Zacks Rank #3 (Hold) have slid 16.2% in the past three months compared with the industry’s decline of 25%.

Nonetheless, this specialty retailer of women's intimate and other apparel, beauty and personal care products reaffirmed its fiscal 2019 earnings view of $2.30-$2.60 per share, which indicates a considerable decline from $2.82 earned in fiscal 2018. Management now projects third-quarter bottom line to be in the range of a loss of 5 cents to earnings of 5 cents a share. This is in sharp contrast to earnings of 16 cents reported in the prior-year period. The Zacks Consensus Estimate for the third quarter and fiscal year currently stands at 9 cents and $2.40, respectively.

Detailed Quarterly Discussion

L Brands reported quarterly earnings of 24 cents a share that outpaced the Zacks Consensus Estimate of 19 cents and also came above the initial guidance of 15-20 cents. This was the seventh consecutive quarter of positive earnings surprise. However, the bottom line declined 33% from the year-ago period. We note that lower net sales hurt quarterly earnings.

Net sales came in at $2,901.5 million, down 3% from $2,983.8 million reported in the prior-year period. The top-line figure also missed the Zacks Consensus Estimate $2,960 million. Comparable sales declined 1% against 3% growth witnessed in the prior-year quarter.

Total Victoria’s Secret sales dropped 7% to $1,605.6 million. Comparable sales fell 6% while comparable store sales tumbled 9% due to lower traffic and average unit retails. Comps were down mid-single digit in the lingerie business, while the metric declined in the low-double digit range at PINK. Victoria’s Secret Beauty comps were flat. Further, total digital sales registered an increase of 4%.

On the contrary, Bath & Body Works delivered a solid show and surpassed management’s expectations. Total sales grew 10% to $1,060.9 million, with 8% rise in comparable sales and 4% improvement in comparable store sales.

Sales were fueled by robust performance in three key categories, including body care, home fragrance and soaps & sanitizers. Bath & Body Works direct channel remained sturdy, with sales up 28%. Further, merchandise margin declined on account of higher supply chain and sourcing costs.

We note that L Brands’ International sales came in at $154.5 million, up 6% year over year. Revenue and operating income grew at its partner business driven by Bath & Body Works. In China, revenues increased substantially, while operating loss also narrowed.

L Brands’ gross profit fell 7% to roughly $982.2 million during the quarter. We note that gross margin contracted 160 bps to 33.9% on account of lower merchandise margin rate and buying and occupancy expense deleverage. Operating income declined 23% from the year-ago quarter to $174.6 million while operating margin shriveled 160 bps to 6%.

SG&A expense fell 3% to $807.6 million in the quarter. As a percentage of net sales, the same remained flat at 27.8% due to the absence of La Senza and Henri Bendel businesses and decline in marketing costs at Victoria’s Secret unit.

Store Update

As of Aug 3, 2019, company-owned stores were 2,927 including 1,109 Victoria’s Secret stores, 1,735 Bath & Body Works, 21 Victoria’s Secret U.K./Ireland, 5 PINK U.K., 39 Victoria’s Secret Beauty and Accessories and 18 Victoria’s Secret China.

Total non company-owned stores were 687, including 215 Victoria’s Secret Beauty & Accessories, 54 Victoria’s Secret, nine Pink and 233 Bath & Body Works stores. Further, non company-owned stores comprised 162 and 14 Travel Retail stores of Victoria’s Secret Beauty & Accessories and Bath & Body Works, respectively.

Other Financial Details

L Brands ended the quarter with cash and cash equivalents of $852.5 million, up from the prior-year quarter’s figure of $842.7 million. Long-term debt decreased to $5,475.4 million from nearly $5,711.8 million a year ago. Shareholders’ deficit was $928.7 million. Management incurred capital expenditures of $120.4 million in the quarter under review.

For fiscal 2019, the company projects capital expenditures to be $550 million. It anticipates free cash flow of approximately $750 million during the same period.

Outlook

Management expects Bath & Body Works brand to experience another solid year. However, it hinted that supply chain and sourcing costs may continue to hurt merchandise margins during the third and fourth quarters. At Bath & Body Works segment, management hinted at continuing its investment in the White Barn concept in 2019. The company has chalked out about 200 White Barn projects for 2019. Looking ahead, the company remains committed to improve Victoria’s Secret performance by staying customer-focused, enriching assortments, and enhancing store and online experiences.

L Brands expects third-quarter comps to be to be down low-single digits to up slightly. Further, gross margin is expected to contract year over year owing to lower merchandise margin rate and buying and occupancy expense deleverage. SG&A expense rate is anticipated to escalate due to negative comps.

Management expects comps to improve in the range of 1-4% during the fourth quarter. Gross margin is likely to shrivel due to moderate decrease in the merchandise margin rate. SG&A rate is expected to be roughly flat. Earnings per share are projected to be in the band of $1.95-$2.15, the mid-point of which ($2.05) indicates a decline from $2.14 reported in the year-ago period.

For fiscal 2019, the company anticipates comps to rise in low-single digits. Total sales are expected to increase approximately 2 points lower than comps on account of loss of La Senza and Henri Bendel sales. Gross margin rate is likely to decrease year over year primarily due to lower merchandise margins. SG&A costs are expected to be flat to down marginally, while SG&A rate is expected to be roughly flat.

Stocks to Consider

Boot Barn Holdings BOOT has a long-term earnings growth rate of 17% and a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Canada Goose Holdings GOOS beat estimates in each of the trailing four quarters and carries a Zacks Rank #2 (Buy).

Fossil Group FOSL came up with positive earnings surprise in the last two reported quarters and holds a Zacks Rank #2.

It’s Illegal in 42 States, But Investors Will Make Billions Legally

In addition to the companies you read about above, today you get details on the newly-legalized industry that’s tapping into a “habit” that Americans spend an estimated $150 billion on every year.

That’s twice as much as they spend on marijuana, legally or otherwise.

Zacks special report revealing how investors can profit from this new opportunity. As more states legalize this activity, the industry could expand by as much as 15X. Zacks’ has just released a Special Report revealing 5 top stocks to watch in this space.

See these 5 “sin stocks” now>>

Click to get this free report Fossil Group, Inc. (FOSL) : Free Stock Analysis Report Canada Goose Holdings Inc. (GOOS) : Free Stock Analysis Report L Brands, Inc. (LB) : Free Stock Analysis Report Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance