You Know You’ve Become a Singaporean Adult When These 5 Things Happen to You

Remember when you were a kid and you thought turning 21 was the only thing you needed to do to become an adult? Ah, those were good times. “Adulting” is much, much more than just what kind of movie classifications we can watch and goes beyond the ability to drive and buy alcohol.

And yes, while it may be still too early to start thinking about buying a house or raising children, some of us may be fearful of the responsibilities of being an adult in Singapore. Here’s a little food for thought with regards to that:

Here’s the thing – you may not have realised it, but if you’ve started earning money for any kind of work, you’re pretty much starting to adult. Here are 5 ways to tell that you’re already “adulting”:

1. You are giving your parents an allowance

Now that you’re earning your own paycheck, it’s payback time. Remember how your parents used to give you a regular allowance while you were in school? I’m betting those days are over the second you get your salary. Now the tables have turned and you may be expected to provide them with a regular allowance.

Even if your parents are still working, you should still give them an allowance. This will help you take ownership of the household expenses. Your contribution may help to defray the utilities bill or pay for that month’s groceries, for example. Ultimately, it’s the principle of responsibility that matters – so if your parents don’t really need your money, why not set up a Regular Savings Plan for them instead?

It’s a simple investment tool which they can cash out and utilise during their retirement years. Don’t know what to invest in? As an alternative, you can help boost your parents’ retirement income by topping up their Special Accounts (if they are below the age of 55) or Retirement Accounts (if they are aged 55 and above) through the CPF Retirement Sum Topping-Up Scheme (RSTU) – you even get tax relief by doing that. Click here to find out how much you can top up and the tax relief you can enjoy under RSTU.

2. You now pay attention to how much mobile data you use

Now that you’re earning a salary, you will most probably be expected to start paying for your own stuff. Especially your mobile phone bill!

Gone are the days when you didn’t need to care about Wi-Fi because you had no idea how much 4G data you were using. Now that you’ll be settling your own monthly telco bill, you’ll pay special attention to just how much data you have and how much you can use. No more video streaming while on the way to work, since you run the risk of paying for excess data charges! Paying $10.70 per Gb of excess data usage is no joke.

And unless you make the effort to budget your expenditure, you can probably forget about getting the latest phone model as soon as it comes out. But the good news is, once you start working, you should check if you’re eligible for corporate mobile plans or some other telco deal that your employer might have.

3. Your holidays are no longer paid for

Welcome to the working world, and welcome to finding your own ways to fulfil your travel needs. Which means you’ll have to start saving for these trips. Alternatively, you can find ways to be smart about travelling.

For example, your friends or your colleagues might want to do a quick weekend trip up north to Malaysia or Thailand. Go with them! Travelling in a group often saves money, especially when it comes to accommodations or renting a car. Unless your travel buddies are only planning to eat at restaurants with at least two Michelin Stars.

But whether you’re travelling in a group or by yourself, consider signing up for a credit card that earns you air miles every time you spend. These miles often go a long way in helping to subsidise your flights.

4. You’re now eligible for your own credit card

I know some of you may have carried a supplementary credit card, or even one of those student credit cards with a $500 credit limit. Forget those. A fresh grad in Singapore could be earning about $2,500 a month, or $30,000 a year. That’s all you need to be eligible for your own credit card, complete with a credit limit that’s just high enough to encourage all kinds of bad spending habits.

Being an adult means being aware of just how much credit card debt can get you in trouble – not only can the fees and charges on unpaid bills go into the thousands, but a poor credit rating will make it harder for you to secure a loan when you want to buy your own house or car later.

But being an adult also means being aware of how credit cards can benefit you as well. If you spend within your means and pay all your bills in full and on time, you could be swimming in cashback rebates, rewards points and air miles instead! Just make sure you get the right credit card for your spending needs.

If you tend to overlook payments, consider setting up automated payments using GIRO or a standing instruction via Internet Banking.

5. Your take home pay is less than you expected

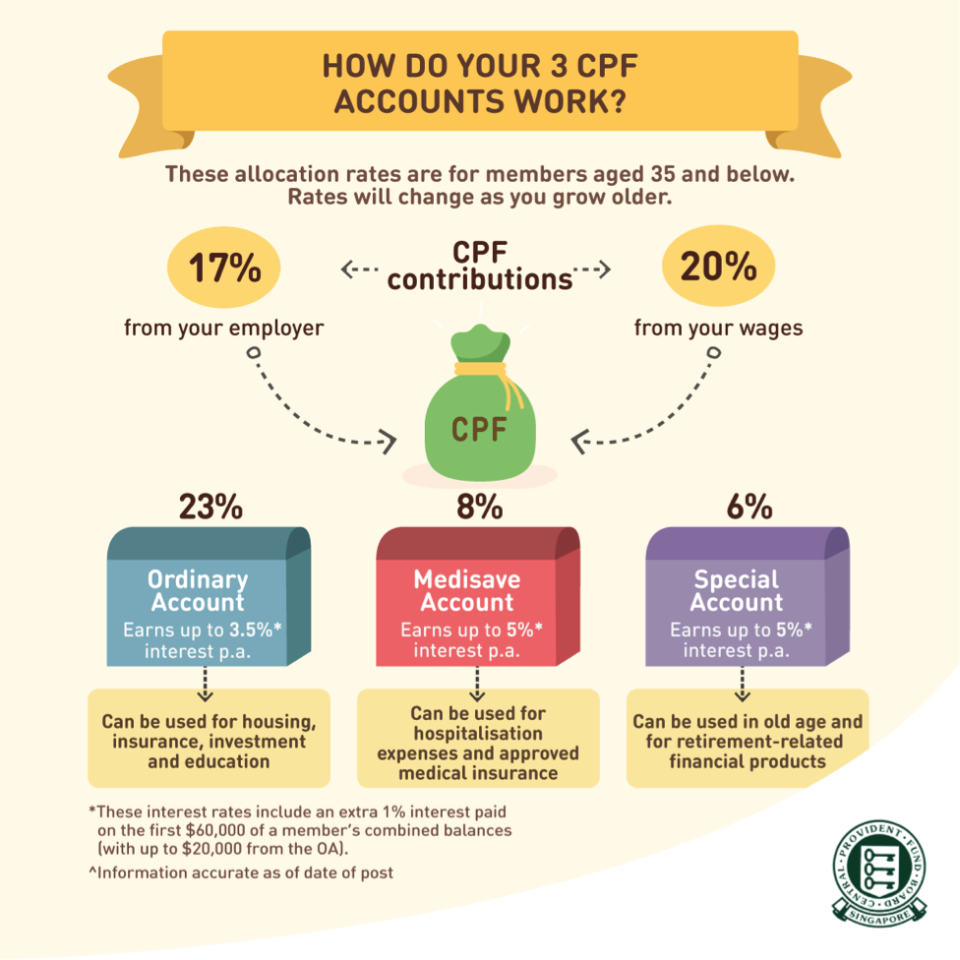

As long as you’re a Singapore Citizen or PR below 55 years old, 20% of your monthly salary will go into your CPF account. That means if your official salary is $2,500, you’re only taking home about $2,000. That’s going to seem like quite a big deal when you’re just starting out and didn’t budget with CPF in mind.

But here’s the thing – you’re not the only party contributing to your CPF account, your employer is contributing as well. In addition to paying your salary, your employer also contributes an extra 17% of your salary into your CPF account. This total of 37% goes into a mix of your Ordinary Account (OA), Special Account (SA) and Medisave Account (MA), whose interest rates are higher than that of a lot of banks’ savings accounts.

Here’s how this 37% of your salary is allocated:

Employee’s age | Allocation Rates from 1 Jan 2016 (for monthly wages ≥ $750) | ||

Ordinary Account (% of wage) | Special Account (% of wage) | Medisave Account (% of wage) | |

35 and below | 23 | 6 | 8 |

Above 35 to 45 | 21 | 7 | 9 |

Above 45 to 50 | 19 | 8 | 10 |

Above 50 to 55 | 15 | 11.5 | 10.5 |

And your CPF funds aren’t just for show! There are several ways you can use your CPF, so let’s look at a couple of them.

A. Using your Ordinary Account to pay for housing

Whether you’re planning to buy a HDB flat or a private property, your CPF Ordinary Account can help you significantly with the purchase. Thanks to CPF, you sometimes don’t even have to pay a single cent out of pocket.

B. Using your Medisave Account to pay for healthcare

Your Medisave can be used to help you pay for selected medical care and hospitalisation expenses. This reduces the amount of money you need to pay out-of-pocket, so that your medical bills don’t affect your cashflow. For example, you can withdraw up to $300 a day for approved day surgeries and $450 a day for inpatient hospitalisation.

Medisave can also be used to pay for your MediShield Life or integrated shield plan insurance premiums, so that you don’t have to feel like your healthcare coverage is limited by your take-home pay.

So yes, you’re already “adulting”!

Hopefully you’re already doing some, if not all, of the 5 things mentioned above. Being an adult in Singapore is not as hard as it might seem and all you need is to start with these small steps.

What else do you need to do “to adult” in Singapore? Share your thoughts with us.

The post You Know You've Become a Singaporean Adult When These 5 Things Happen to You appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

More From MoneySmart

Yahoo Finance

Yahoo Finance