What you need to know about POSB’s monthly cashback “BANK AND EARN” programme

POSB has just introduced their new “Bank and Earn” cashback rewards programme, targeting the early- and mid-career individuals based on their banking needs.

A programme that rewards you based on transactions you're probably already doing

Earlier this year, they conducted a survey among some 800 customers on their reward preferences based on their banking relationships. Results showed that customers wanted the following:

Rewards structure that is straightforward and simple to understand.

Cashback rewards which are credited to their accounts regularly.

Rewarded based on their multiple relationships and transactions done with the bank.

No requirement to make additional deposits to earn rewards.

To meet these needs, POSB launched the “bank and earn” programme. The programme aims to reward customers with a cashback incentive every month. All customers have to do is carry on with their regular banking transactions.

The straightforward programme is the first of its kind in Singapore that offers direct cashback rewards without the need for customers to make additional fund deposits into their accounts.

Start earning cashbacks immediately

Customers need only fulfill three types of regular banking transactions within a month to qualify for these rewards. Most people already meet these requirements.

According to POSB, customers will only need to conduct at least three of the following transactions every month to earn up to SGD 130 per month in cashback rewards:

Source: POSB

Credit their monthly salary (Minimum amount of SGD 2,500; cashback of 0.3%; monthly cashback cap of SGD 20)

Spend on their POSB/DBS credit cards (No minimum amount required; cashback of 0.3%; monthly cashback cap of SGD 20)

Pay their monthly home loan instalments (No minimum amount required; cashback of 3%; monthly cashback cap of SGD 30)

Pay their POSB/DBS insurance premiums (No minimum amount required; cashback of 3%; monthly cashback cap of SGD 30; insurance products should be purchased after signing up for the programme)

Invest through POSB/DBS (No minimum amount required; cashback of 3%; monthly cashback cap of SGD 30; investment products should be purchased after signing up for the programme)

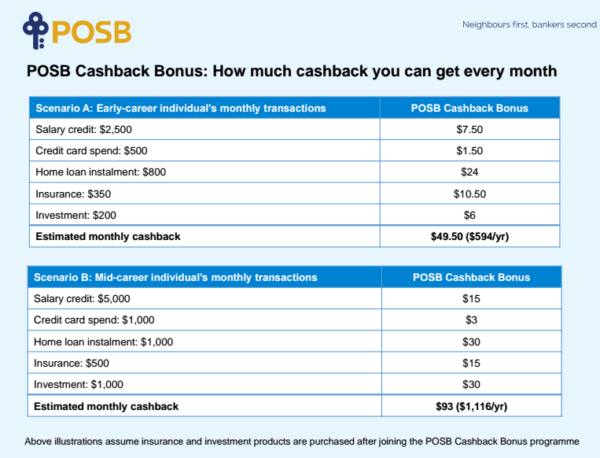

They even illustrate how customers can do that with two simple tables:

Source: POSB

To enroll in the “POSB Cashback Bonus” programme, customers simply have to log on to POSB/DBS iBanking to register, and nominate a deposit or credit card account to receive their monthly cashback. Visit www.posb.com.sg/cashbackbonus for more information on the programme.

(By Sarah Voon)

Related Articles

- “30% of German banks’ profits may be lost to the fintech sector” says McKinsey

- Balance held on Starbucks Cards higher than deposits at some banks

- S$100,000 in a bank account? You are losing money!

Yahoo Finance

Yahoo Finance