Kimberly-Clark (KMB) Looks Great on Pricing & Saving Efforts

Kimberly-Clark Corporation KMB has been benefiting from its robust pricing and saving efforts amid escalated costs. A focus on three growth pillars is also working well for the company. On its last earnings call, management stated that it continues to witness solid demand for its great-performing products. For 2023, organic sales are anticipated to increase 2-4%.

Let’s delve deeper.

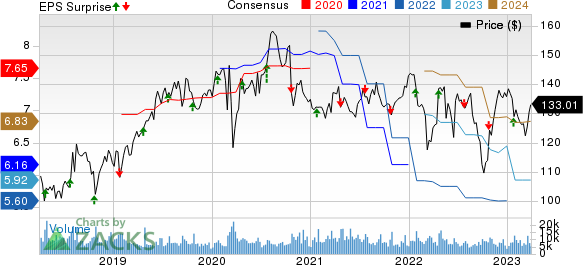

Kimberly-Clark Corporation Price, Consensus and EPS Surprise

Kimberly-Clark Corporation price-consensus-eps-surprise-chart | Kimberly-Clark Corporation Quote

Pricing & Saving Efforts Aid

Pricing has been driving the company’s sales for a while now. In the fourth quarter of 2022, Kimberly-Clark’s organic sales advanced 7%, with net selling prices rising about 10%, and the product mix increasing sales by 1%. Net selling prices increased 7%, 11% and 20%, respectively, in the Personal Care, Consumer Tissue and K-C Professional (“KCP”) segments.

In North America, organic sales of consumer products climbed 1% year over year, while the same increased 18% in the KCP segment. Outside North America, organic sales went up 3% in the developing and emerging (D&E) markets, and the same ascended 11% in developed markets. Apart from pricing, organic sales are also benefiting from the company’s constant innovation.

Additionally, Kimberly-Clark has been taking robust steps to lower costs. This is highlighted by the Focus on Reducing Costs Everywhere or FORCE Program. Kimberly-Clark aggressively cuts costs and enhances supply-chain productivity through the FORCE Program. The program has been generating solid cost savings for a while, which is driving the performance.

In the fourth quarter of 2022, the company generated savings of $115 million from the FORCE program. For 2023, management expects cost savings from the FORCE program to be in tandem with the year-ago period. While input costs are expected to flare up in 2023, management is focused on undertaking revenue management actions to counter inflation.

Focus on 3 Growth Pillars

Kimberly-Clark has been committed to its three key strategic growth pillars. These include a focus on improving its core business in developed markets, speeding up the growth of the Personal Care segment in the D&E markets and enhancing digital and e-commerce capacities.

The company expects to meet the abovementioned objectives through product development across different categories and leveraging capabilities in marketing and sales. The company has been progressing well with these objectives, which have been aiding the portfolio and expanding the global business.

We believe that the abovementioned upsides are likely to continue working well for this Zacks Rank #2 (Buy) company and keep it going amid an inflationary landscape.

Shares of the company have rallied 16.6% in the past six months compared with the industry’s growth of 2.1%.

Other Solid Consumer Staple Picks

Some other top-ranked consumer staple stocks are Post Holdings POST, General Mills GIS and Vital Farms VITL.

Post Holdings, which operates as a consumer-packaged goods company, currently sports a Zacks Rank #1 (Strong Buy). POST has a trailing four-quarter earnings surprise of 34.8%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Post Holdings’ current fiscal-year EPS suggests an increase of 111.3% from the year-ago reported number.

General Mills, a branded consumer food company, currently carries a Zacks Rank #2. GIS has a trailing four-quarter earnings surprise of 8.1%, on average.

The Zacks Consensus Estimate for General Mills’ current fiscal-year sales and earnings suggests growth of 5.7% and 6.9%, respectively, from the corresponding year-ago reported figures.

Vital Farms, which provides pasture-raised products, currently carries a Zacks Rank #2. VITL has a trailing four-quarter earnings surprise of 53.3%, on average.

The Zacks Consensus Estimate for Vital Farms’ current fiscal-year sales suggests an increase of 25.4% from the year-ago reported number.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance