Kimberly-Clark (KMB) Beats on Q2 Earnings, Raises Outlook

Kimberly-Clark Corporation KMB continued with its upbeat performance in 2019 reporting second straight quarter of positive earnings surprise. The company’s second-quarter adjusted earnings of $1.67 per share surpassed the Zacks Consensus Estimate of $1.64 and increased 5% from the year-ago period.

The quarterly performance marked robust organic sales growth, improved gross margin, cost savings efforts and increase investments in brands. These factors along with improving commodity environment prompted management to lift top- and bottom-line outlook for the full year. Management now envisions 2019 earnings in the band of $6.65-$6.80 per share, up from prior forecast of $6.50-$6.70. The Zacks Consensus Estimate for 2019 is pegged at $6.76.

The better-than-expected bottom-line performance and impressive earnings outlook seems to have bolstered investors’ sentiments. Evidently, shares of the company are up roughly 2% during the pre-market trading session. Notably, the company’s K-C Strategy 2022 positioned it to continue growth momentum and enhance shareholder value. In fact, this Zacks Rank #2 (Buy) stock has rallied 20.5% in the past six months outperforming the industry’s growth of 1%.

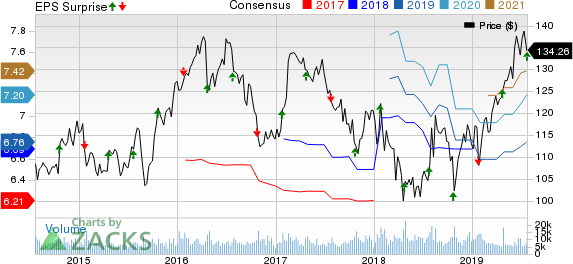

Kimberly-Clark Corporation Price, Consensus and EPS Surprise

Kimberly-Clark Corporation price-consensus-eps-surprise-chart | Kimberly-Clark Corporation Quote

Quarter in Detail

Kimberly-Clark’s sales came in at $4,594 million, which fell short of the Zacks Consensus Estimate of $4,604 million. However, the top line remained almost flat year over year. Unfavorable currency movements weighed on sales by 5%. Management now forecasts full year net sales to be even to down 1% year over year. The company had earlier expected net sales to decline in the range of 1-2%.

Organic sales rose 5% year over year, owing to improved net selling prices (up 5%) and product mix (up 1%), somewhat offset by a marginal drop in volumes. Kimberly-Clark now projects organic sales of growth 3%, up from prior estimate 2%.

Within North America, organic sales in consumer products and K-C Professional rose 5% and 2%, respectively. Internationally, organic sales increased 9% across developing and emerging markets, while it grew 1% in developed markets.

Adjusted operating profit came in at $789 million, up from $774 million in the year-ago quarter. Results gained from increased net selling prices and cost savings of $70 million and $20 million from FORCE (Focused On Reducing Costs Everywhere) program and 2018 Global Restructuring Program, respectively.

However, adjusted operating profit was hurt by higher input costs to the tune of about $80 million, stemming from increased prices of pulp and other raw materials. Also, unfavorable currency translations, higher manufacturing costs, increased advertising expenses and rise in general and administrative costs negatively impacted adjusted operating profit.

Management now anticipates adjusted operating profit growth of 3-5% for the full year. Earlier, the company had estimated 1-4% growth.

Segment Details

Personal Care Products: Segment sales of $2,286 million rose roughly 1% owing to improved net selling prices (up 5%), volumes (up 1%) and product mix (up 1%). This was to an extent offset by unfavorable currency rates that hurt sales by 6%. Further, sales increased 5% in North America, while it declined 1% and 6% across developing and emerging markets as well as developed markets outside North America, respectively.

Consumer Tissue: Segment sales of $1,472 million remained flat year over year. Results gained from improved net selling prices (up 5%) and marginal improvement in product mix, partially offset by lower volumes (down 2%). Adverse currency movements hurt sales by 4%. Sales increased 5% in North America, while it declined 4% and 7% across developing and emerging markets as well as developed markets outside North America, respectively.

K-C Professional (KCP): Segment sales dipped 5% to $821 million due to adverse currency rates and several businesses exits as part of the 2018 Global Restructuring Plan that hurt sales by 4% and 2%, respectively. Volumes were down 3%. This was somewhat cushioned by improved product mix (up 1%) and higher net selling prices (up 3%). Sales remained flat in North America, while the same declined 6% and 8% in developing and emerging markets as well as developed markets outside North America, respectively.

Other Financial Updates

The company ended the quarter with cash and cash equivalents of $534 million, long-term debt of $6,701 million and stockholders' deficit of $178 million, excluding non-controlling interest of $228 million.

Further, Kimberly-Clark generated cash flow of $609 million from operating activities during the quarter under review. Management incurred capital expenditures of $253 million. During the quarter, Kimberly-Clark bought back 1.3 million shares for approximately $167 million.

Other Developments

Management is on track with the 2018 Global Restructuring Program, which is its biggest restructuring plan in a long time. During the quarter, pre-tax restructuring charges under the initiative amounted to $119 million, which took the cumulative pre-tax charges to $1,307 million.

Further, cumulative savings from the program came in at $20 million during the quarter, taking the cumulative savings to $215 million. Additionally, Kimberly-Clark is strongly focused on its K-C Strategy 2022.

Check Out These Stocks

The Estee Lauder Companies EL, with long-term earnings growth rate of 13%, carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Campbell Soup Company CPB with long-term earnings growth rate of 5%, carries a Zacks Rank #2.

General Mills GIS, with a Zacks Rank #2, has long-term earnings growth rate of 7%.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Kimberly-Clark Corporation (KMB) : Free Stock Analysis Report

The Estee Lauder Companies Inc. (EL) : Free Stock Analysis Report

General Mills, Inc. (GIS) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance