Key Factors to Impact SBA Communications (SBAC) in Q4 Earnings

SBA Communications Corporation SBAC is scheduled to report fourth-quarter and full-year 2022 results on Feb 21, after market close. The company’s quarterly results are expected to reflect year-over-year growth in revenues and funds from operations (FFO) per share.

This Boca Raton, FL-based communications tower REIT delivered a surprise of 1.97% in terms of adjusted FFO (AFFO) per share in the last reported quarter. SBAC witnessed an improvement in site-leasing and site-development businesses, which aided the top line. It continues to benefit from the addition of sites to its portfolio. It also raised its 2022 outlook.

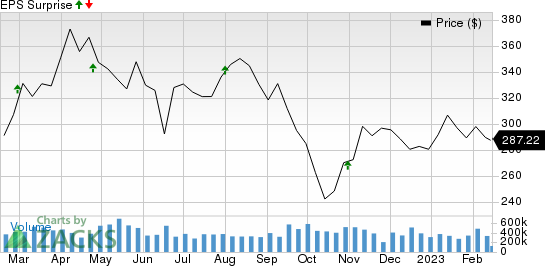

Over the preceding four quarters, SBAC’s AFFO per share surpassed the Zacks Consensus Estimate on each occasion, the average beat being 2.12%. The graph below depicts this surprise history:

SBA Communications Corporation Price and EPS Surprise

SBA Communications Corporation price-eps-surprise | SBA Communications Corporation Quote

Factors at Play

The advancement in mobile technology, such as 4G and 5G networks, and the proliferation of bandwidth-intensive applications have driven the growth in mobile data usage globally. Also, rampant usage of network-intensive applications for video conferencing and cloud services, and remote-working scenarios have fueled the rise.

As a result, during the fourth quarter, tower REITs such as SBA Communications are likely to have capitalized on the growing demand for tower leasing as wireless service providers and carriers continue to expand their networks and deploy additional equipment for existing networks to boost their network coverage and capacity.

Amid this soaring demand, SBAC long-term (typically 5-10 year) tower leases that have built-in rent escalators are anticipated to have aided its site-leasing revenues in the to-be-reported quarter.

The Zacks Consensus Estimate for fourth-quarter site-leasing revenues, which account for the lion’s share of total revenues, is pegged at $605 million, indicating an increase of 12.2% from the year-ago quarter’s $539 million. Our estimate for the same is pegged at $603.3 million.

The Zacks Consensus Estimate for fourth-quarter site-development revenues is pegged at $75 million, suggesting growth of 33.9% from $56 million reported in the year-ago period. We estimate the same to be $75.7 million.

The Zacks Consensus Estimate for fourth-quarter total revenues is pegged at $681.8 million, implying year-over-year growth of 14.5%. We expect total revenues of $678.9 million for the quarter.

To capitalize on the strong secular growth trends of the wireless industry, SBAC carried out acquisitions and development activities during the fourth quarter. In October 2022, it closed the earlier announced acquisition of 2,632 sites from Grupo TorreSur in Brazil for $725 million in cash. The recent 5G spectrum options in Brazil position SBA Communications well to benefit from the transaction.

However, increasing interest expenses amid interest rate hikes might have cast a pall on SBAC’s quarterly performance.

The Zacks Consensus Estimate for quarterly FFO per share has been revised marginally downward to $3.13 over the past month. Nonetheless, the figure implies year-over-year growth of 11.4%.

For 2022, SBAC projected AFFO per share in the range of $12.12-$12.34. In addition, site-leasing revenues are estimated to be $2,325- $2,335 million while site-development revenues are expected to lie between $291 million and $301 million. The adjusted EBITDA is estimated to be in the band of $1,763-$1,773 million.

For the full year, the Zacks Consensus Estimate for FFO per share has remained unrevised at $12.26 over the past month. The figure, however, indicates a 14.2% increase year over year on revenues of $2.63 billion.

Earning Whispers

Our proven model does not conclusively predict a surprise in terms of FFO per share for SBA Communications this season. The combination of a positive Earnings ESP and a Zacks Rank #3 (Hold) or higher — increases the odds of a beat. However, that’s not the case here.

Earnings ESP: SBAC has an Earnings ESP of -0.03 %. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: SBA Communications currently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks That Warrant a Look

Here are some stocks from the REIT sector, which according to our model, have the right combination of elements to deliver a surprise this reporting cycle:

Digital Realty Trust DLR is scheduled to report quarterly figures on Feb 16. DLR currently has an Earnings ESP of +0.99 % and a Zacks Rank of 3.

Park Hotels & Resorts PK is scheduled to report quarterly figures on Feb 22. PK currently has an Earnings ESP of +3.66% and a Zacks Rank of 3.

VICI Properties VICI is scheduled to report quarterly figures on Feb 23. VICI currently has an Earnings ESP of +0.29% and a Zacks Rank #2 (Buy).

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Note: Anything related to earnings presented in this write-up represents FFO — a widely used metric to gauge the performance of REITs.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Digital Realty Trust, Inc. (DLR) : Free Stock Analysis Report

SBA Communications Corporation (SBAC) : Free Stock Analysis Report

Park Hotels & Resorts Inc. (PK) : Free Stock Analysis Report

VICI Properties Inc. (VICI) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance