JOBS ON DECK — What you need to know in markets on Friday

It is jobs day in America.

On Friday at 8:30 a.m. ET, the BLS will release the December jobs report, the final report of 2016 (and also the first report of 2017, depending on how you see it).

Economists are looking for nonfarm payrolls to grow by 175,000 in December, which would be slightly less than the 178,000 we saw in November. This would, however, be enough to push yearly job gains over 2 million for the third-straight year.

The unemployment rate is expected to tick up slightly to 4.7% from 4.6%, while average hourly earnings are expected to rise 0.3% month-on-month after a 0.1% decline in November.

Compared to the prior year, average hourly earnings are expected to rise 2.8%, which would match the post-crisis high we hit back in October.

Later on Friday morning we’ll also get the November reading on factory orders and the final reading on November’s durable goods figures.

Jobs preview

Via Goldman Sachs economist Spencer Hill:

We forecast that nonfarm payroll employment increased 180k in December, after an increase of 178k in November and 142k in October. On balance, labor market indicators were moderately strong in December, with improvement in the employment components of many service-sector and manufacturing surveys and a rise in consumer confidence to a 15-year high.

The key labor market subcomponent of consumer confidence also hovered near its post-crisis high, despite a modest pullback from November. We also expect above-trend payroll growth in the transportation and warehousing industry, driven by elevated hiring related to strong online holiday shopping.

On the negative side, initial jobless claims drifted higher and continuing claims posted the largest survey-week-to-survey-week increase in nearly a year. December’s relatively cold payroll survey week could also constrain payroll growth in weather-sensitive industries such as construction, particularly after the warmer-than-usual November. We do not expect the end of the election to be a major factor this month.

And while Hill and the team at Goldman do not see the election being a major factor in December’s report, he added that industry-specific readings — potentially in energy, financial services, or healthcare — could show signs of an impact from the election.

Trump tweets

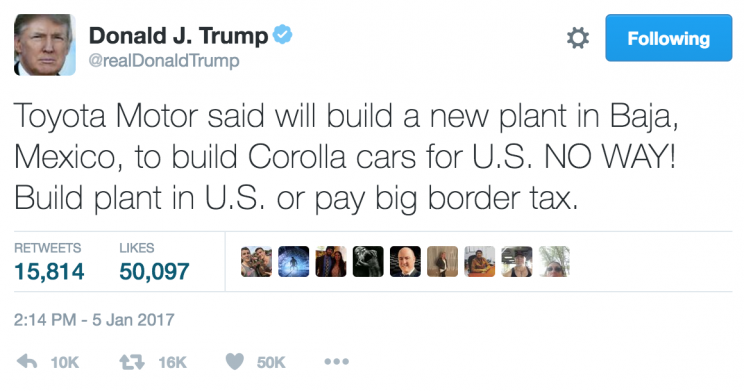

Today, it was Toyota’s (TM) turn.

In an afternoon tweet, President-elect Donald Trump said, “Toyota Motor said will build a new plant in Baja, Mexico, to build Corolla cars for U.S. NO WAY! Build plant in U.S. or pay big border tax.”

Toyota’s plans to open a factory in Guanajuato — not Baja — Mexico, however, would take jobs from a factory in Canada. In a statement, the company said that it, “looks forward to collaborating with the Trump administration to serve in the best interests of consumers and the automotive industry.”

This sentiment is mostly similar to what we heard from General Motors (GM) earlier this week after Trump attacked the company for plans to move a small portion of production to Mexico.

But consider what else happened this week in the automotive space: Ford (F) scrapped plans to build a $1.6 billion factory in Mexico and instead build cars at an existing factory in Mexico and also invest $700 million at a plant in Michigan. So, the company will still build cars in Mexico, it just won’t make a new factory to do it.

The Michigan investment will see Ford create 700 jobs, almost nothing for a company that employs nearly 200,000 people. No amount of investment of job creation or loss, however, seems too small for Trump to target or attack.

And while it remains to be seen if GM and Toyota have more to say following Trump’s tweets, it seems clear that other companies will find themselves in Trump’s crosshairs. And they’ll probably find out on Twitter.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles:

Yahoo Finance

Yahoo Finance