Japanese Yen Bounce Almost Guaranteed, but at ¥103 or ¥110?

Japanese Yen Bounce Almost Guaranteed, but at ¥103 or ¥110?

Fundamental Forecast for Japanese Yen: Bearish

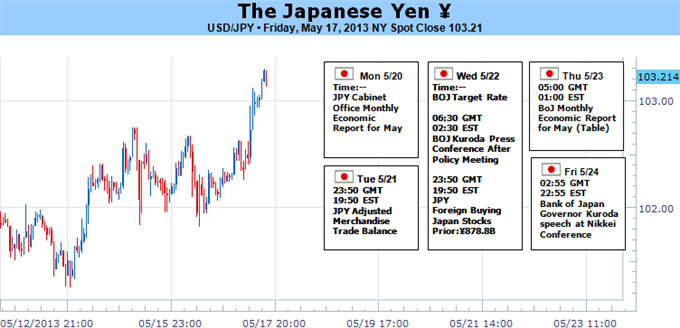

USDJPY breaks ¥103 on Surge in US Consumer Confidence

Japanese Yen weakens despite strong GDP data

It keeps falling, but JPY-short trade looking a little too obvious

The Japanese Yen tumbled for the third-straight trading week (and sixth week of the past seven) against the US Dollar, breaking the psychologically significant ¥103 mark with seemingly no end in sight. But key warning signs suggest the JPY-short trade is becoming a little too obvious for comfort.

All eyes turn to the coming week’s Bank of Japan interest rate decision to provide the next catalyst for a big Yen move. But the key question is simple: what could the Bank of Japan possibly do that it hasn’t done already?

The Japanese TOPIX equity index finds itself an incredible 70+% higher since current Prime Minister Shinzo Abe looked likely to take power in November of last year, while the Japanese Yen itself is down an almost-unbelievable 30% through the same stretch.

Indeed, the “BoJ Trade” (short JPY, long Nikkei) has paid handsome dividends to those with the foresight to jump on board. But all good things must come to an end. And though we’ve writtenrepeatedly in favor of USDJPY and EURJPY strength dating back to August, the JPY-short “boat” might be a bit overcrowded and poised to capsize.

Why now? Well, there’s this: the cover of “The Economist” features a caricature of Shinzo Abe flying with a big ¥ symbol across his chest. It’s hardly an exact science, but these signs of popular sentiment extremes have often coincided with substantive currency reversals. The US Dollar hit a critical lasting low on a comparable magazine cover in August, 2011. And if we want an apples-to-apples comparison on “The Economist” covers, this one was good for a 300-pip relief rally in the EURUSD.

It’s difficult to place buy or sell orders based on magazine covers, but at the very least it seems prudent to reduce leverage on any existing JPY-short positions (USDJPY, EURJPY, GBPJPY longs, etc…).

The past two Bank of Japan meetings have coincided with substantial Japanese Yen sell-offs (USDJPY rallies), and we could arguably expect the same ahead of Tuesday night/Wednesday morning. But context is everything, and BoJ Governor Kuroda will really need to shock markets to produce the same level of fireworks. According to one professional survey, only 3% of (large) traders are bullish the JPY (bearish USDJPY). If everyone who’s bearish is already short, it won’t take much to force a panic short-covering rally and substantive USDJPY decline.

It’s certainly worth noting that the US Dollar itself looks to move higher against major counterparts. And indeed, we’d much rather play a potential Japanese Yen reversal against recent laggards such as the Australian Dollar and Swiss Franc.

Time is the only thing that really matters in trading—I suspect we’re correct in claiming that the Japanese Yen is “due” for a substantial reversal (I certainly wouldn’t say it otherwise). But if the USDJPY rallies to 2008 peaks at ¥110 before turning lower, we won’t likely benefit from our forecasts.

I think I’ve been saying this altogether too frequently as of late, but it’s true: it’s shaping up to be a truly critical week for currency markets, and the Japanese Yen may see especially large moves on crystal-clear signs of sentiment extremes and a highly-anticipated BoJ decision. –DR

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and Trade Updates this author via e-mail, sign up for his distribution list via this link.

Contact David via Twitter at http://www.twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance