Jabil (JBL) Teams Up With MaxLinear to Boost Data Connectivity

Jabil Inc. JBL and MaxLinear have unveiled a new era in high-speed connectivity with the release of a family of 800G silicon photonics-based optical transceiver modules. The modules, designed to fuel the AI/ML revolution, promise unparalleled performance and scalability, thanks to the collaborative efforts of industry giants.

The breakthrough technology leverages Intel Corporation's INTC cutting-edge silicon photonics platform, renowned for its manufacturing efficiency and reliability. Coupled with Jabil's world-class manufacturing capabilities and Intel’s technology prowess, the collaboration sets a new standard for speed, efficiency and reliability in data transmission.

Jabil's extensive manufacturing footprint and strong expertise position it as an ideal partner in the burgeoning AI/ML ecosystem. The company's commitment to providing unparalleled value to customers underscores its strategic importance in the optical module space.

Intel's volume-proven silicon photonics platform, with on-chip laser sources fabricated, tested and burned in at wafer scale, ensures unparalleled reliability and simplicity in module integration. With a focus on reliability, scalability and performance, the new 800G optical transceiver modules are poised to drive significant advancements in data-intensive applications.

Jabil’s top-line growth is expected to benefit from strength in the healthcare, cloud, retail and industrial sectors. The company is expected to gain from the rapid adoption of 5G wireless and cloud computing in the long haul. It is benefiting from solid demand in key end markets, together with excellent operational execution and skillful management of supply chain dynamics. In addition, Jabil has an established global presence and a worldwide connected factory network, which enables it to scale up production per the evolving market dynamics.

Jabil is likely to benefit from secular growth drivers with strong margin and cash flow dynamics. Moreover, solid end-market experience, proven technical and design capabilities, manufacturing know-how, supply chain insights and global product management expertise have put it in good stead. An extensive global footprint is further strengthened by a centralized procurement process, which, coupled with a single Enterprise Resource Planning system, aids customers with end-to-end supply chain visibility.

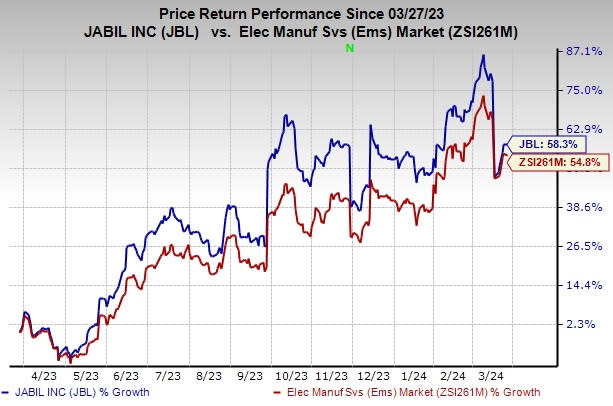

The stock has gained 58.3% in the past year compared with the industry’s growth of 54.8%.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Jabil presently has a Zacks Rank #3 (Hold).

AudioCodes Ltd. AUDC currently carries a Zacks Rank #2 (Buy). It has a long-term earnings growth expectation of 24.8% and delivered an earnings surprise of 20.1%, on average, in the trailing four quarters. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Headquartered in Lod, Israel, AudioCodes offers advanced communications software, products and productivity solutions for the digital workplace. It provides a broad range of innovative products, solutions and services that are used by large multi-national enterprises and leading tier-1 operators around the world.

Headquartered in White Plains, NY, Turtle Beach Corporation HEAR develops and markets gaming headset solutions for various platforms, including video game and entertainment consoles, handheld consoles, personal computers, tablets and mobile devices under the Turtle Beach brand.

Turtle Beach is well-positioned to benefit from quality products and enjoys a solid foothold in its served markets. Its headsets are suited for learning and working remotely via video or audio conferencing. This Zacks Rank #2 stock has a long-term earnings growth expectation of 16%. It has a VGM Score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intel Corporation (INTC) : Free Stock Analysis Report

Jabil, Inc. (JBL) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

Turtle Beach Corporation (HEAR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance