Investing in Hong Kong properties for Singapore investors

Hong Kong’s property market is among the world’s most expensive and prices continue to climb steadily. In November 2016, flats in South Horizons in Aberdeen, sold for HK$16,497 (S$3,160) per square foot, a 12.8% increase over the previous peak in September 2015.

Real estate in Hong Kong is a favourite with local investors. Most of the city’s wealthy families have large investments in real estate.

Although property prices can fluctuate, Hong Kong is high on the list of those international investors who can afford its inflated valuations.

High stamp duty costs

Source: Pixabay

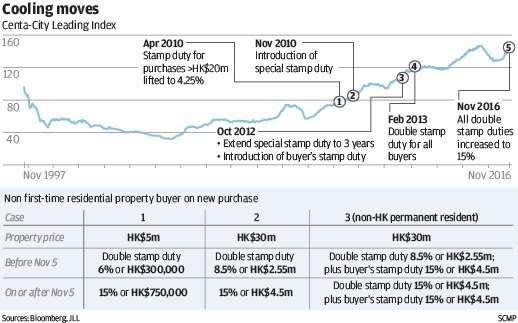

All foreigners are liable to pay an additional amount as stamp duty in a property purchase transaction. This can add greatly to the cost of acquisition.

Foreigners would have to pay twice the standard stamp duty rate. The stamp duty rises with the price of the property being purchased.

Additionally, foreigners are required to pay buyer’s stamp duty (BSD). This is calculated at a flat 15% of the sale value and does not depend on the price of the property.

Stamp duty can be a major deterrent for foreigners as it can add up to 23.5% for an expensive flat or condo.

Is it possible for a foreigner to avoid paying Buyer’s Stamp Duty?

Source: Pixabay

If you don’t have a permanent Hong Kong identity card, you are required to pay BSD. But if a foreigner happens to be married to a permanent resident, there will not be any liability for this additional financial burden.

Another way to escape paying BSD is to purchase the holding company which owns the property. In this case, you would buy the shares of the company, a transaction that would attract stamp duty which could be as low as 0.2%.

But there are certain disadvantages to following this route. You cannot mortgage the shares in the company to raise funds, a facility that is available if you buy property directly. Additionally, as the holder of the shares in the company, you would be liable for all its debts. It is essential to carry out a comprehensive due diligence exercise to protect your interests.

Steps in a property transaction in Hong Kong

Source: Pixabay

After you identify a suitable property through your real estate agent, it is important to negotiate prices with the seller or with the developer, in case you are buying a new unit.

Once a price has been agreed upon, a provisional agreement for sale and purchase is prepared by the seller’s solicitor. It is important to get this document reviewed by the solicitor appointed by you.

Source: Pixabay

When this document is signed, you will be required to pay between 2% and 5% of the purchase price as an initial deposit. The formal sale and purchase agreement will be signed within a period of 14 days of this date.

At this point in time, the buyer will be required to pay a further sum so that a total payment of 10% of the purchase price is paid. So, if you initially paid 2%, you would be required to pay an additional 8%.

You would then need to pay the entire purchase value. The total time for the deal to be completed, from the signing of the provisional agreement for sale and purchase to making the full payment, would be about six weeks.

As the buyer, you are responsible for payment of stamp duty and for the registration of the purchase document with the land registry.

An overheated property market?

Real estate prices rose sharply for most of 2016. A report by Knight Frank, an international property consultant, reveals the astronomical prices of residential real estate in Hong Kong.

Source: Knight Frank Research

In an effort to bring prices under control, the authorities have raised stamp duty rates. The latest increase was made in November 2016, when an extra stamp duty burden was imposed on buyers who were purchasing their second homes.

Source: South China Morning Post/Bloomberg

But these measures do not seem to be having much effect on the enthusiasm of buyers to acquire additional properties. Analysts predict that as the recently imposed stamp duty hike applies only to residential real estate, investors will now switch over to the non-residential property market.

Can prices fall?

Source: Pixabay

Chen Hongtian, the billionaire chairman of Shenzhen-headquartered Cheung Kei Group, bought properties in Hong Kong valued at almost US$1 billion between September 2015 and July of the next year.

But he now says that he “may consider investing in other places such as Singapore.” The reason for his disillusionment with Hong Kong? According to Mr Hongtian, the local demand for autonomy from China is sure to have a negative effect on the property market.

He also says that an uncertain political environment has led to his “becoming more careful” about his investment plans for Hong Kong.

(By Ravinder Kapur)

Related Articles

- The Perfect Year-Round Holiday Home: Divine Living with Kamui-Niseko, Annupuri

- Is buying property in China really worth it for Singapore investors?

- Investing in UK properties for Singapore investors

Yahoo Finance

Yahoo Finance