When Investing For Dividends Could Be A Trap

The old adage of “one man’s meat could be another man’s poison” cannot be more apt especially when it comes to investing. In politics, we have seen how the West have consistently tried to impose the western style of democracy on African and Asian countries but there is a proliferation of a new trend that calls for the West to not interfere in the affairs of countries that do not adopt the western style of politics.

This begs the question of whether one particular set of practice – be it politics or investing – can work in different cultures and regions.

Warren Buffett is one of the most successful investors we have ever known, so much so that investors are willing to plunge into stocks that he owns without critically assessing whether it suits their investment needs and profile.

The US economy is huge, and there are plenty of companies that can continuously grow into world beaters. In such an economy and stock market, investors can find multi-baggers that will grow their portfolios by many folds. Warren Buffett is one such investor that is in the right place.

Together with his stunning ability to pick the right stocks, it is no doubt that he is one of the richest men in the world in addition to becoming the most successful investor in recent history.

Warren Buffett In Singapore

But will Warren Buffett be as successful if he was to invest in Singapore’s stock market? We will never know the answer. But we do know that he is not into Singapore stocks simply because our economy is too small for his appetite and we have no growth companies that suit his investment profile.

Try picking one stock based on “Buffettology” and we will all falter at doing so. Why is he not investing in DBS, Singtel and even our REITs? We have to ask ourselves.

If we were to apply his methods in a stock market that does not fit into his investment profile, then are we all barking up the wrong tree? Worse still, some investors use Buffet’s investment matrix to invest in some super high-growth SGX-listed company that is now under investigation, then that is surely a sign that these investors are just blindly copying Buffett.

Investing For Dividends

Just admit it! How many of us are really in the stock market for the long haul? How long is long?

If you are truly a long-term investor, then remember what Buffett said about “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes”. And if you are indeed a long-term investor, how many of the stocks in your portfolio have grown your wealth exponentially?

Investing for dividends became very popular when risk-free returns sank to almost negligible returns a decade ago after the Global Financial Crisis. Everyone started chasing for yields resulting in the ever-growing popularity of REITs. Investing in REITs has benefited plenty of investors who gained from rising prices and steady dividend income.

We cite three examples of picking the correct dividend/capital gains play:

1. Ascendas Real Estate Investment Trust

When the Global Financial Crisis struck, the price sank as low as $1.02 in 2009. The yield back then was 4.62 cents, which was decently good. If an investor had bought into Ascendas REIT at anything between $1.02-$1.10, he would have received 15.8 cents of dividend in FY2018. This would translate into a yield of 14.3 percent return assuming the investor had bought at $1.10 and are holding onto Ascendas REIT in 2018.

At current price of $3.17, the capital gains would have been $2.07 or a return of 207 percent! This is a figure that Warren Buffett would be proud of.

2. CapitaMall Trust

In 2009, the REIT price dived to as low as $0.935. The yield back then was 3.85 percent. A gutsy investor who bought at $1.00 would have made $1.69 worth of capital gains based on the latest closing at $2.69. Wow, right?!

In 2018, it declared total dividends of 12.8 cents, meaning that the same investor who bought at $1.00 back in 2009 would have received a yield equal to 12.8 percent. Wow, right?!

3. CapitaCom Trust

$0.43 in 2009! Yes, you read correctly – $0.43! That was when everyone thought that the world would end. It is now $2.15, meaning that you could have made a very remarkable return of more than 400 percent on your initial return! Call Buffett and tell him your greatness!

In terms of yield, it paid out 9.1 cents in 2009 and 8.4 cents in 2018. Wait! Why did the payout not increase after so many years? The yield in 2009 would have been an astronomical 21.1 percent but only a decent 3.9 percent in 2018.

Surely there must be a reason. But this is not to be discussed here.

Dividend Play Failures

We can possibly cite more examples of successful REIT plays, but there are more non-REIT plays that have failed. Just remember about “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes”

Seasoned investors will know that once a stock goes ex-dividend, the share price will drop by a similar amount on the same day. This means that if DBS goes ex-dividend for 30 cents, then the share price will also shed from $25.00 to $24.70.

In a bullish market, the share price may claw back the 30 cents within a short period of time but the share price may fall more than the 30 cents if sentiment is bad.

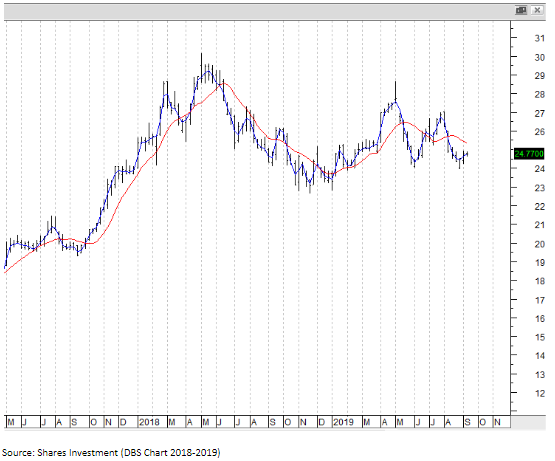

Source: Shares Investment (DBS Chart 2018-2019)

We look at the DBS chart from 2018 to 2019. During this period, DBS Group paid out a total of $2.90 in dividends. The current share price of $24.77, even if combined with the dividends of $2.90, will add to $27.67. If an investor had bought the shares at any price higher than $27.67, he or she would not have made money.

What if an investor had bought close to the $30-peak back in 2018? What if the trade war took a turn for the worse and the share price of DBS gets hit year after year?

While we can comfort ourselves by saying that the yearly dividends will cushion the impact of capital losses, most of us do not want to be stuck in the stock market even if the shares we bought are blue chips.

And this is DBS that we are talking about. What if we had bought into Singtel in 2007? What would be the impact on us?

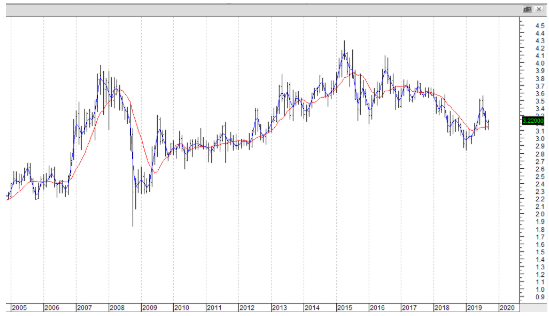

Source: Shares Investment (Singtel 2005-2019)

What if we had, unfortunately, bought into Singtel in 2007 or 2008? While we would have collected plenty of dividends, but it would have been a lost decade from 2007 to 2017. We would have even made a loss and the opportunity costs would have been greater. Let us assume that we managed to breakeven for Singtel after collecting dividends. But what if we had bought into something else?

Let’s say, Venture Corp?

Source: Shares Investment (Venture Corp 1999-2019)

If you had bought into Venture Corp in 1999, you would have lost 20 years of your time and money. No amounts of dividends can make up for 20 years. If not for the huge pop that started in 2017, investors of 20 years would have been wondering if they had bought into the wrong shares especially if dividend was a factor.

Buy Stocks Not Just For Dividend, Please!

Of course, Venture Corp is by no means a dividend-play stock, but investors have the tendency to comfort themselves by using dividend as an excuse to justify wrong calls.

While we have cited examples using fundamentally strong examples, what if we had bought into some dividend-paying stocks that have been on the downtrend? There are too many examples of such stock.

There are many reasons why investors who invest in a certain stock but dividends should not be the sole reason for investing in a stock. There are many other financial matrices that we can rely on but the timing of making an investment is very important i.e. the three REITs we cited.

If you are a long-term investor, the best bet would be to wait for a crisis. This is the best time to buy when everyone else is panicking and selling. But such a scenario, such as in 2008-2009, would mean that only those with B***S dared to buy. Do you have the marbles?

Related Article:

Yahoo Finance

Yahoo Finance