Invesco (IVZ) Dips on Q1 Earnings Miss, Y/Y Revenue Decline

Invesco’s IVZ first-quarter 2024 adjusted earnings of 33 cents per share lagged the Zacks Consensus Estimate of 40 cents. The bottom line declined 13.2% from the prior-year quarter.

Shares of Invesco lost 1.2% in the pre-market trading on persistent top-line weakness. However, a full day’s trading session will depict a clearer picture.

Results were primarily hurt by a decline in adjusted revenues, along with higher adjusted expenses. However, an increase in the assets under management (AUM) balance on decent inflows was a positive.

On a GAAP basis, net income attributable to common shareholders was $141.5 million or 31 cents per share compared with $145 million or 32 cents per share a year ago. Our estimate for the metric was $137.4 million.

Adjusted Revenues Decline, Expenses Rise

Adjusted net revenues were $1.05 billion, falling 2.1% year over year. The top line lagged the Zacks Consensus Estimate of $1.08 billion.

Adjusted operating expenses were $756.7 million, up 1% on a year-over-year basis. We expected the metric to be $779.3 million.

The adjusted operating margin was 28.2%, down from 30.4% a year ago.

AUM Balance Increases

As of Mar 31, 2024, AUM was $1.66 trillion, which increased 12.1% year over year. Average AUM at the first-quarter end totaled $1.61 trillion, up 10.3%.

The company witnessed long-term net inflows of $6.3 billion in the reported quarter.

Balance Sheet Strong

As of Mar 31, 2024, cash and cash equivalents were $895.7 million compared with $1.47 billion as of Dec 31, 2023.

The long-term debt was $1.26 billion.

Dividend Hike

Concurrent to the earnings release, the company announced a quarterly cash dividend of 20.5 cents per share, representing a hike of 2.5% from the prior payout. The dividend will be paid out on Jun 4 to shareholders of record as of May 14.

Our View

Invesco is well-poised to benefit from its global footprint, product offerings and strategic buyouts. However, elevated expenses, a challenging market environment and high debt levels are major near-term concerns.

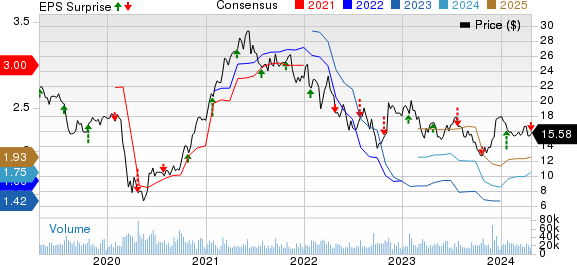

Invesco Ltd. Price, Consensus and EPS Surprise

Invesco Ltd. price-consensus-eps-surprise-chart | Invesco Ltd. Quote

Currently, IVZ carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Asset Managers

BlackRock, Inc.’s BLK first-quarter 2024 adjusted earnings of $9.81 per share handily surpassed the Zacks Consensus Estimate of $9.42. The figure reflects a jump of 24% from the year-ago quarter.

BLK’s results benefited from a rise in revenues and higher non-operating income. Further, the AUM balance witnessed an improvement, driven by net inflows. However, higher expenses acted as a dampener.

Blackstone’s BX first-quarter 2024 distributable earnings of 98 cents per share were in line with the Zacks Consensus Estimate. The figure reflects a rise of 1% from the prior-year quarter.

BX’s results benefited from a rise in segment revenues and an improvement in the AUM balance. However, higher GAAP expenses hurt the results to some extent.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Blackstone Inc. (BX) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

Invesco Ltd. (IVZ) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance