International Flavors (IFF) Hits 52-Week High: What's Aiding It?

International Flavors & Fragrances Inc. IFF shares scaled a new 52-week high of $99.91 on May 20 before closing the session lower at $98.82.

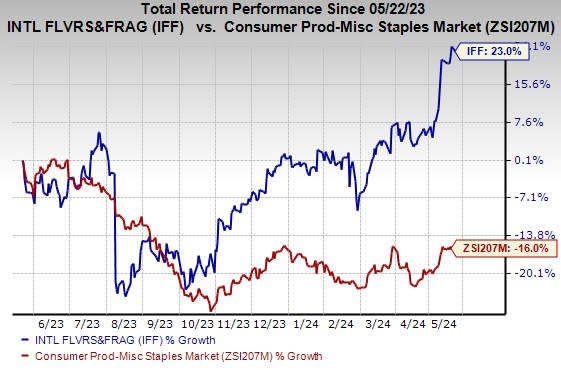

IFF has a market capitalization of $25.5 billion. The company’s shares have gained 23% over the past year against the industry’s decline of 16%.

Image Source: Zacks Investment Research

What’s Driving International Flavors?

Demand for Flavors & Fragrances to Drive Growth: International Flavors is well-poised to benefit from demand for a variety of consumer products containing flavors and fragrances. Anticipated growth in emerging markets will likely be a key catalyst.

Consequently, International Flavors is focused on gaining share in emerging markets. Backed by the company’s global presence, diversified business platform, broad product portfolio, and global and regional customer base, it will be able to capitalize on the expansion in the flavors and fragrances markets and deliver long-term growth.

Growth Strategies Aid Margins: In December 2022, the company announced a strategic and financial vision, which, among other things, consisted of a renewed growth-focus strategy, enhanced cost and productivity initiatives, and a redesigned operating model. It intends to transform its operating model into a more customer-centric and market-backed one. To this end, the company will conduct business in three core end markets — Food and Beverage, Home and Personal Care, and Health.

To drive growth, IFF plans to step up its investment in high-return businesses, such as Flavors, Fragrances, Health, Cultures and Food Enzymes. It continues to optimize its portfolio and has completed the sale of Microbial Control, a portion of the Savory Solutions business and the Flavor Specialty Ingredients businesses .

The company closed the sale of the Cosmetic Ingredients business to Clariant for $810 million at the end of 2023.

Recently International Flavors announced that it entered an agreement to sell its Pharma Solutions business. These endeavors will help International Flavors focus on its core business operations, strengthen its balance sheet and maximize shareholder return.

Upbeat Q1 Performance Bodes Well: In the first quarter of 2024, the company reported adjusted earnings of $1.13 per share, beating the Zacks Consensus Estimate of 84 cents. The bottom line improved 30% from the year-ago quarter. Currency-neutral organic sales growth in the quarter was 1.8% year over year.

Revenues generated in the Health & Bioscience segment increased both year over year and sequentially. Revenues in the Nourish segment improved sequentially in the first quarter.

Improved Performance Enhances 2024 Outlook: IFF's Functional Ingredients business is a leading global specialty food ingredients provider, with a market leadership position in a broad portfolio of ingredients businesses, including Protein Solutions, Emulsifiers & Sweeteners, Core Texturant, and Cellulosic & Food Protection.

The company is taking additional actions to rapidly improve the performance of the business, which is expected to lead to low-single-digit comparable currency-neutral sales growth, in line with the market.

International Flavors expects sales for 2024 to be at the higher end of $10.8-$11.1 billion. Volume is anticipated to be near the higher end of its earlier stated expectation of flat to up 3%.

The company expects pricing to increase 1% year over year, up from the previously stated decline of 2.5%. The company estimates an adjusted operating EBITDA margin in the mid-teens over the next three years, with a strong improvement in 2024.

Focus on Capital Allocation Bodes Well: International Flavors & Fragrances continues to maintain a disciplined approach to capital allocation even as it focuses on accelerating growth through organic investments and strategic acquisitions, while returning significant capital to shareholders.

It continues to effectively manage its balance sheet by taking necessary actions to generate strong cash flow and maintain ample liquidity by reducing operational and capital expenses.

The company ended the first quarter of 2024 with a net debt-to-credit adjusted EBITDA ratio of 4.4. Supported by the portfolio optimization initiative, it expects to take the ratio down to 3.0. The company returned $207 million to its shareholders as dividends in the first quarter.

Zacks Rank & Stocks to Consider

International Flavors currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Consumer Staples sector are Vital Farms, Inc. VITL, Tyson Foods, Inc. TSN and Ingredion Incorporated INGR. VITL flaunts a Zacks Rank #1 (Strong Buy) at present, and TSN and INGR have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Vital Farms has an average trailing four-quarter earnings surprise of 102.1%. The Zacks Consensus Estimate for VITL’s fiscal 2024 earnings is pegged at 94 cents per share. The consensus estimate for 2024 earnings has moved 24% north in the past 60 days. Its shares gained 157.8% in the last year.

Tyson Foods has an average trailing four-quarter earnings surprise of 24.2%. The Zacks Consensus Estimate for TSN’s 2024 earnings is pegged at $2.48 per share. This indicates an 85.1% increase from the prior-year reported figure. The consensus estimate for fiscal 2024 earnings has moved 6% north in the past 60 days. ELF shares have gained 25.6% in the past year.

The Zacks Consensus Estimate for Ingredion’s 2024 earnings per share is pegged at $9.67, indicating growth of 2.6% from the prior-year actual. Earnings estimates have moved 1% north in the past 60 days. INGR shares have gained 9.1% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Flavors & Fragrances Inc. (IFF) : Free Stock Analysis Report

Tyson Foods, Inc. (TSN) : Free Stock Analysis Report

Ingredion Incorporated (INGR) : Free Stock Analysis Report

Vital Farms, Inc. (VITL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance