Insperity Inc (NSP) Q1 Earnings: Aligns Closely with Analyst Projections Amid Economic Challenges

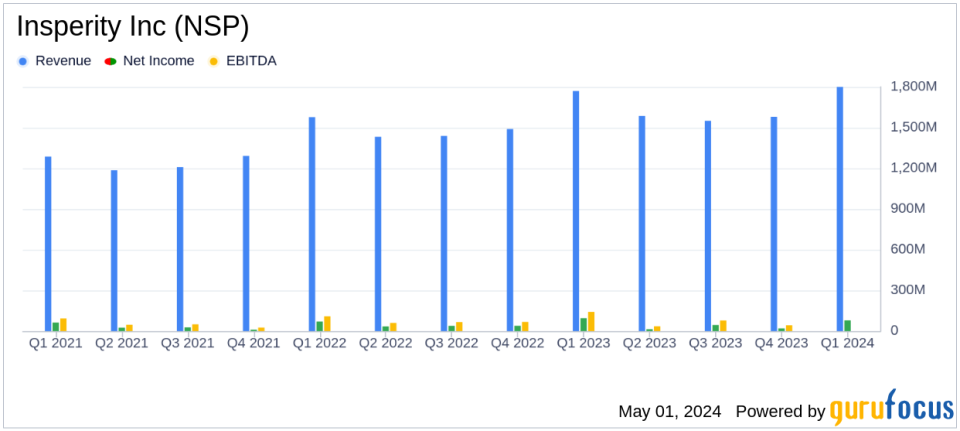

Revenue: Reported $1.8 billion, a 2% increase year-over-year, closely aligning with estimates of $1808.34 million.

Net Income: Achieved $79 million, falling short of the estimated $81.18 million.

Earnings Per Share (EPS): Recorded at $2.08 per diluted share, below the estimated $2.13.

Gross Profit: Rose by 4% to $345 million, driven by robust pricing and favorable benefits costs.

Operating Expenses: Increased by 12% compared to the previous year, reflecting ongoing investments in growth and technology.

Adjusted EBITDA: Reached $142 million, indicating strong operational performance.

Shareholder Returns: Distributed $44 million through share repurchases and dividends in Q1 2024.

On May 1, 2024, Insperity Inc (NYSE:NSP) disclosed its first quarter results for the period ending March 31, 2024, through an 8-K filing. The company, a prominent provider of human resources and business performance solutions, reported a net income of $79 million and diluted earnings per share (EPS) of $2.08, closely aligning with analyst expectations of $2.13 EPS and $81.18 million in net income. Revenue for the quarter stood at $1.8 billion, slightly under the forecast of $1808.34 million.

About Insperity Inc

Insperity Inc specializes in a comprehensive suite of human resources solutions aimed at enhancing business performance primarily for small and midsize enterprises. The company's offerings, delivered through its Workforce Optimization and Workforce Synchronization solutions, include payroll and employment administration, employee benefits, compliance management, and other essential HR functions. Insperity operates entirely within the United States, with a revenue stream rooted deeply in its expansive client base across the nation.

Quarterly Performance Insights

The first quarter saw a slight decline in the average number of worksite employees (WSEEs), with a 1% decrease compared to the previous year, primarily due to layoffs and loss of large accounts. Despite these challenges, the company achieved a 2% increase in revenue, attributed to a 3% rise in revenue per WSEE, which helped offset the decline in employee numbers. Gross profit rose by 4% to $345 million, driven by strong pricing strategies and favorable outcomes from benefits cost management.

Operating expenses, however, climbed by 12% due to ongoing investments in growth initiatives and the integration of new service and technology enhancements, including the initial phases of a strategic partnership with Workday. The effective tax rate for the quarter was 29%, a rise from the previous year's 23%, influenced by stock price variations affecting tax benefits related to employee stock awards.

Strategic Moves and Future Outlook

Insperity's management remains optimistic about its strategic direction despite the economic slowdown. The company's robust balance sheet, coupled with expected strong cash flows, positions it well to continue investments in strategic initiatives like the Workday partnership while still returning value to shareholders. For 2024, Insperity has updated its guidance, reflecting a cautious yet steady approach towards growth amid prevailing economic uncertainties.

Investor and Analyst Engagements

Following the earnings release, Insperity is set to host a conference call to discuss these results in detail and provide further insights into its 2024 outlook. Additionally, the company has scheduled an Investor Day on May 16, 2024, promising deeper dives into its business model, market strategies, and upcoming initiatives.

Conclusion

Insperity's first quarter results reflect a resilient business model capable of navigating economic headwinds, underscored by strategic foresight in its operational and financial maneuvers. As the company continues to adapt and innovate, it remains a significant player in the HR solutions sector, poised for sustained growth.

For detailed financial figures and further information, refer to the full earnings release and join the upcoming investor discussions as Insperity continues to unfold its strategy for 2024 and beyond.

Explore the complete 8-K earnings release (here) from Insperity Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance