Insiders Have Bought These 3 Stocks in 2022

Insider purchases are frequently closely followed by investors. After all, it's easy to see why these transactions are so significant; it's always reassuring when a well-known name invests more.

Section 16 of the Securities Exchange Act defines an insider as an officer, director, 10% stockholder, or anyone who has information because of their relationship with the company.

Insiders are subject to a slew of rules, as one would expect.

Insiders can’t trade based on material nonpublic information, they must pre-clear all trades, and all transactions of the company’s stock must occur during the Window Period; the Window Period opens on the second trading day following the company’s quarterly or annual earnings release and closes 20 days later.

Further, insiders are prohibited from selling short and trading, writing, or purchasing “put” or “call” options on the company’s stock whether or not such options are traded on an exchange.

Finally, insiders must disclose purchases, sales, and holdings of their company's securities by filing SEC Forms 3, 4, and 5.

Insiders have purchased Adobe ADBE, Fastenal FAST, and Rocket Companies RKT shares in 2022.

Below is a chart illustrating the share performance of all three companies in 2022, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a deeper dive into each one.

Fastenal

Fastenal is a national wholesale distributor of industrial and construction supplies. The company distributes its products through more than 3,200 company-owned stores.

Daniel Florness, CEO and President of Fastenal, purchased 5000 FAST shares in September for an overall cost of approximately $240,000.

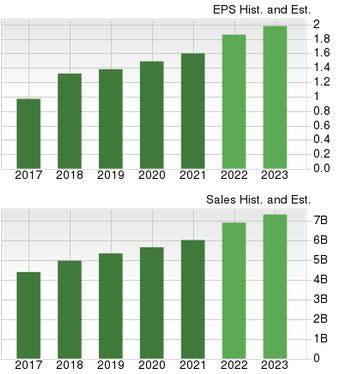

The company carries a solid growth profile; earnings are forecasted to climb 16.3% in FY22 and a further 3% in FY23. FAST’s top line is also in exceptional health, with revenue estimates calling for 15% and 3.8% growth in FY22 and FY23, respectively.

Image Source: Zacks Investment Research

Owning FAST shares comes with several perks, and dividends are one of those; FAST’s 2.7% annual dividend yield is notably higher than its Zacks Retail and Wholesale sector average of 1.1%.

Image Source: Zacks Investment Research

Adobe

Adobe is one of the biggest software companies in the world, generating the bulk of its revenue via licensing fees from its customers.

David Ricks, an Adobe Director, purchased 1200 ADBE shares in September for approximately $336,000.

Daniel Durn, EVP, and CFO, also joined in on the fun, buying 3250 ADBE shares for an overall cost of roughly $936,000.

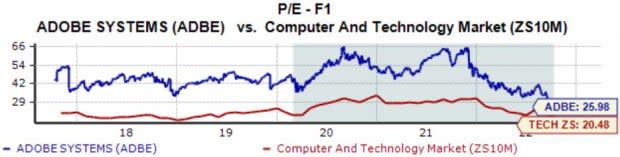

ADBE shares are still rather expensive, trading at a 25.9X forward earnings multiple. However, the current value is nearly half its five-year median of 45.3X.

Image Source: Zacks Investment Research

Rocket Companies

Rocket Companies is a holding company consisting of personal finance and consumer service brands, including Rocket Mortgage, Rocket Homes, and Rocket Loans, to name a few.

Jay Farner, CEO, has bought aggressively throughout 2022, now owning a massive total of roughly 4.6 million RKT shares.

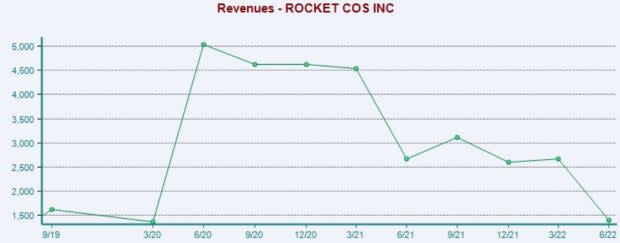

RKT has struggled to exceed quarterly estimates, falling short of the Zacks Consensus EPS Estimate in three consecutive quarters.

Top line results have been notably stronger, with the company penciling in five revenue beats over its last eight quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Insider buys are widely followed by investors and for valid reasons. If an insider buys, it could only mean one thing – they expect shares to move upwards.

While price action in 2022 has been primarily disheartening, insiders of all three companies – Fastenal FAST, Adobe ADBE, and Rocket Companies RKT – have been on the offensive, buying shares at a discount.

Still, investors need to know that insiders have a much longer holding horizon than most.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fastenal Company (FAST) : Free Stock Analysis Report

Adobe Inc. (ADBE) : Free Stock Analysis Report

Rocket Companies, Inc. (RKT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance