Insider Sale: Executive VP and CFO John Gottfried Sells 12,500 Shares of Acadia Realty Trust (AKR)

On May 3, 2024, John Gottfried, Executive Vice President and Chief Financial Officer of Acadia Realty Trust (NYSE:AKR), sold 12,500 shares of the company. The transaction was documented in a recent SEC Filing. Following this sale, over the past year, the insider has sold a total of 25,000 shares and has not made any purchases.

Acadia Realty Trust is a real estate investment trust specializing in the acquisition, ownership, and management of retail properties, primarily in high-barrier-to-entry, densely-populated metropolitan areas in the United States.

The shares were sold at a price of $16.89, valuing the transaction at approximately $211,125. This sale occurred when the stock had a market cap of approximately $1.77 billion.

The company's price-earnings ratio stands at 214.38, significantly above both the industry median of 16.99 and the historical median for the company. This high ratio suggests a premium valuation compared to industry standards.

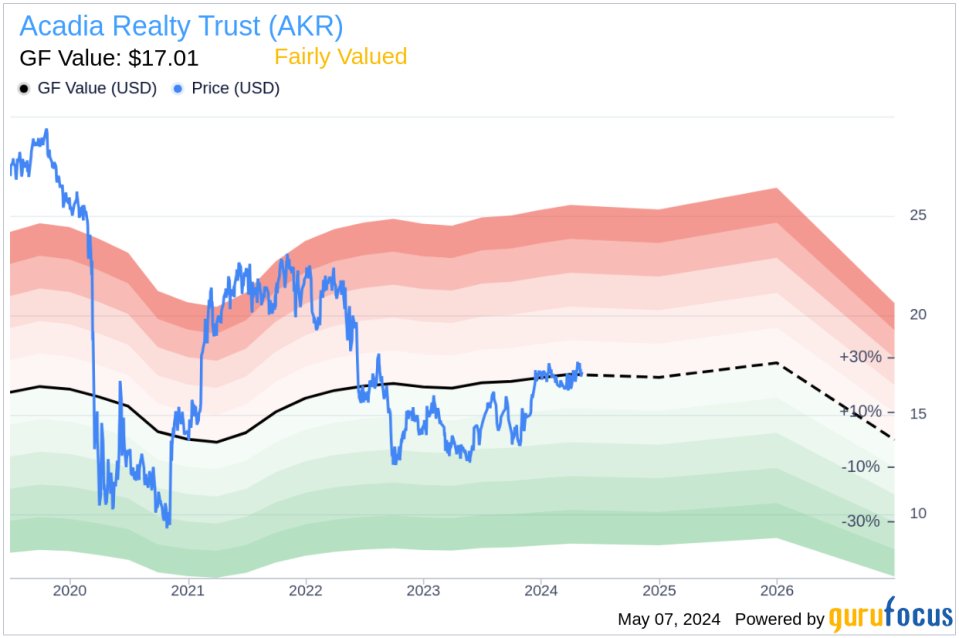

According to the GF Value, the intrinsic value of Acadia Realty Trust's stock is estimated at $17.01 per share, making the stock Fairly Valued with a price-to-GF-Value ratio of 0.99 at the time of the sale.

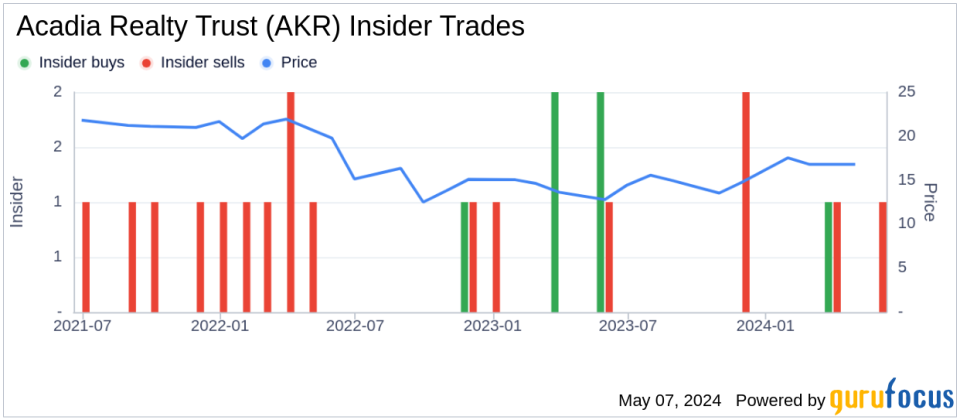

The insider transaction history for Acadia Realty Trust shows a trend of more insider sales than buys over the past year, with 6 insider sales and 3 insider buys.

This recent sale by the insider might be of interest to current and potential investors, providing insights into insider confidence and valuation perspectives at current price levels.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance