Insider Sale: Chief Revenue Officer Diego Panama Sells 40,000 Shares of Olo Inc (OLO)

On May 10, 2024, Diego Panama, the Chief Revenue Officer of Olo Inc (NYSE:OLO), executed a sale of 40,000 shares of the company. The transaction was filed with the SEC and can be viewed in detail through the SEC Filing.

Olo Inc (NYSE:OLO) is a software platform that provides an on-demand interface for the restaurant industry, facilitating food ordering and delivery services across various digital channels. The company's innovative solutions help restaurants to maximize their operational efficiencies and enhance customer experiences.

The shares were sold at a price of $4.7 each, totaling $188,000. This sale has adjusted the insider's holdings to a lower number of shares in Olo Inc, reflecting a significant change in the insider's investment in the company.

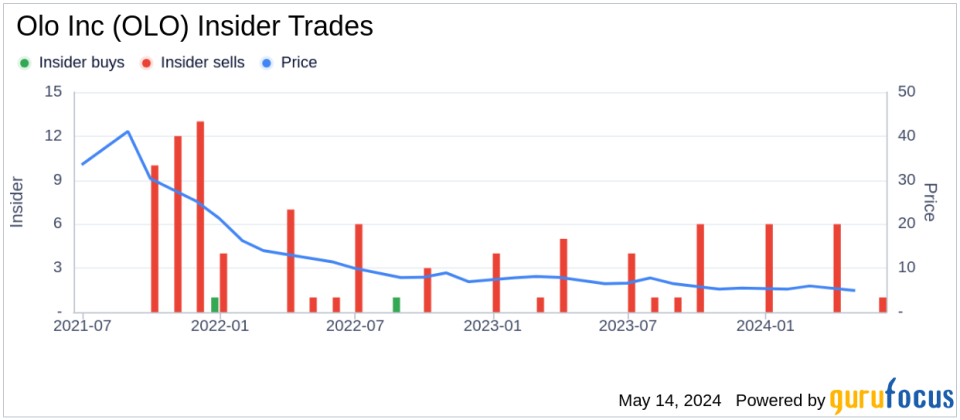

Over the past year, Diego Panama has sold a total of 149,169 shares and has not purchased any shares. This trend is consistent with the broader insider activity at Olo Inc, where there have been 25 insider sales and no insider buys over the same period.

The market cap of Olo Inc is currently $780.115 million. The stock's trading price on the day of the transaction positioned Olo Inc as significantly undervalued according to the GF Value, which is calculated at $10.82 per share. This gives the stock a price-to-GF-Value ratio of 0.43, indicating a substantial undervaluation.

The GF Value is derived from historical trading multiples such as price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow, adjusted for expected business performance.

This insider sale might be of interest to current and potential investors, as it reflects the insider's current stance on the stock, amidst its valuation metrics and market performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance