Insider-Owned Indian Growth Companies To Watch In May 2024

The Indian market has shown robust performance, with a 3.7% rise over the past week and an impressive 44% climb over the last year. With earnings expected to grow by 17% annually, companies with high insider ownership might offer valuable stability and growth potential in this flourishing environment.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 35.4% |

Pitti Engineering (BSE:513519) | 33.6% | 28.4% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 23.5% |

Titagarh Rail Systems (NSEI:TITAGARH) | 24.3% | 28.8% |

Dixon Technologies (India) (NSEI:DIXON) | 25% | 27.8% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 27.8% |

MTAR Technologies (NSEI:MTARTECH) | 38.4% | 41.7% |

Steel Strips Wheels (BSE:513262) | 35.9% | 26.5% |

Kirloskar Pneumatic (BSE:505283) | 30.7% | 27.7% |

Let's take a closer look at a couple of our picks from the screened companies.

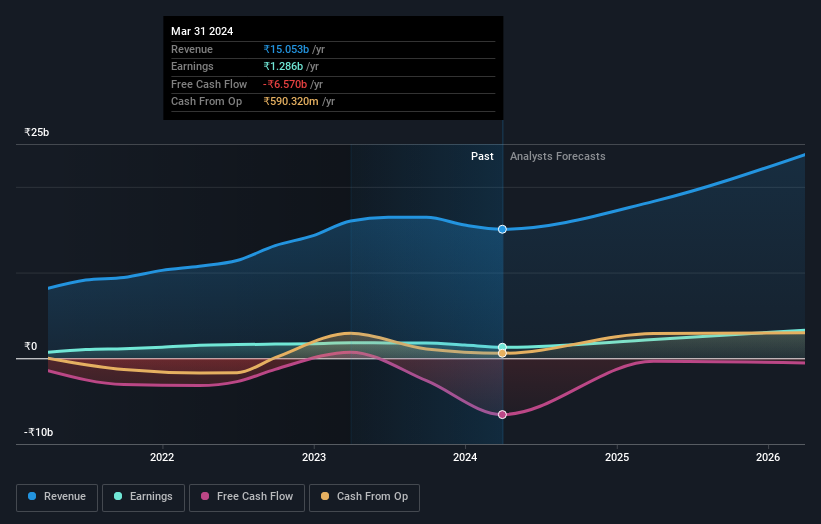

Anupam Rasayan India

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anupam Rasayan India Ltd specializes in custom synthesis and manufacturing of specialty chemicals, serving markets in India, Europe, Japan, Singapore, China, North America, and beyond with a market capitalization of approximately ₹86.11 billion.

Operations: The company specializes in custom synthesis and manufacturing of specialty chemicals, catering to diverse international markets including India, Europe, Japan, Singapore, China, and North America.

Insider Ownership: 39.6%

Revenue Growth Forecast: 22.9% p.a.

Anupam Rasayan India is poised for robust growth with its revenue and earnings expected to outpace the Indian market significantly, growing at 22.9% and 44.37% per year respectively. However, its Return on Equity is projected to be modest at 9.4%. Recent strategic moves include a $90 million deal with a leading Japanese company and expansion into the U.S., establishing Anupam USA, LLC. Despite these positives, shareholder dilution has occurred over the past year.

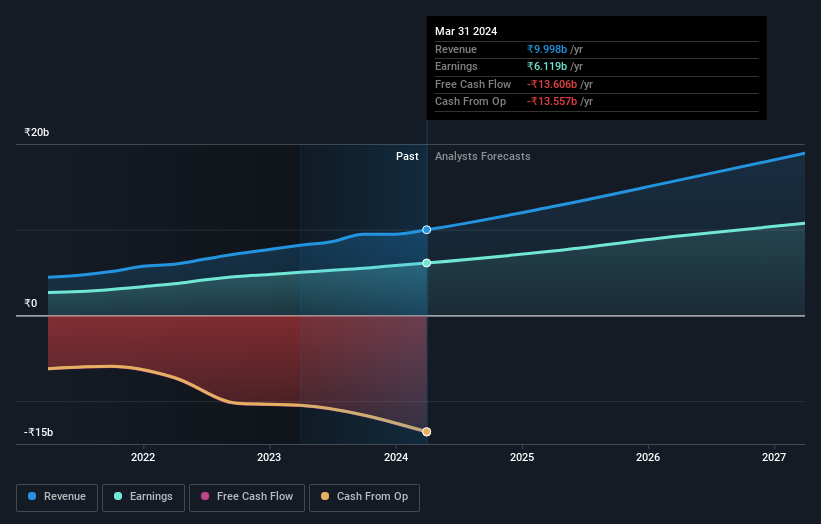

Aptus Value Housing Finance India

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aptus Value Housing Finance India Limited, along with its subsidiary, functions as a housing finance company in India, boasting a market capitalization of approximately ₹157.68 billion.

Operations: The company primarily engages in housing finance operations across India.

Insider Ownership: 24.3%

Revenue Growth Forecast: 18.8% p.a.

Aptus Value Housing Finance India has shown solid financial performance with a notable increase in annual revenue to INR 14.17 billion and net income to INR 6.12 billion, reflecting year-on-year growth. The company maintains a competitive Price-To-Earnings ratio below the Indian market average, suggesting good value. Despite this, its dividend coverage is weak, indicating potential challenges in sustainable payouts. Recent insider activities lack significant buying or selling, highlighting stable ownership amidst operational growth.

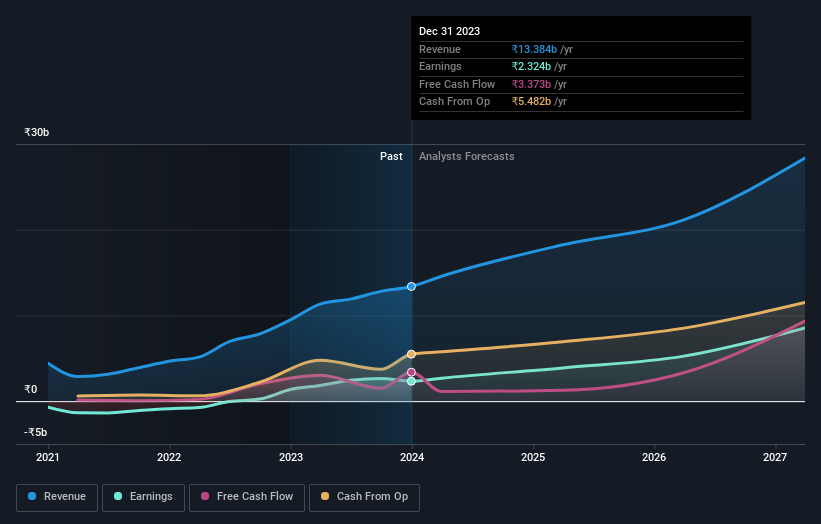

Chalet Hotels

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chalet Hotels Limited focuses on owning, developing, managing, and operating hotels across India, with a market capitalization of approximately ₹17.41 billion.

Operations: The company generates revenue primarily through its hospitality segment, which brought in ₹12.20 billion, and its rental/annuity business, contributing ₹1.17 billion.

Insider Ownership: 13.1%

Revenue Growth Forecast: 20.2% p.a.

Chalet Hotels Limited, a growth-oriented company with high insider ownership, has shown robust financial performance with a substantial increase in quarterly sales and net income as of Q4 2024. Despite facing regulatory challenges with recent GST demands, the company is actively contesting these while maintaining normal business operations. Leadership changes include new appointments in key marketing and CFO roles, promising fresh strategic directions. Additionally, the acquisition of Courtyard by Marriott Aravali Resort indicates expansion and diversification into new markets.

Unlock comprehensive insights into our analysis of Chalet Hotels stock in this growth report.

Our valuation report here indicates Chalet Hotels may be overvalued.

Summing It All Up

Delve into our full catalog of 82 Fast Growing Indian Companies With High Insider Ownership here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:ANURAS NSEI:APTUS and NSEI:CHALET.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance