Insider-Owned Growth Leaders On Euronext Paris For May 2024

Amidst a backdrop of fluctuating European markets, with France’s CAC 40 Index experiencing a slight decline, investors continue to seek stable growth opportunities. High insider ownership in growth companies on Euronext Paris is often viewed as a positive indicator of confidence in the company's future prospects, aligning well with current market conditions where discerning investment choices are paramount.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.3% | 24.4% |

Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 37.7% |

WALLIX GROUP (ENXTPA:ALLIX) | 19.9% | 101.4% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

Munic (ENXTPA:ALMUN) | 29.2% | 150% |

MedinCell (ENXTPA:MEDCL) | 16.4% | 68.8% |

Let's take a closer look at a couple of our picks from the screened companies.

MedinCell

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company based in France, specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €416.65 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling €14.13 million.

Insider Ownership: 16.4%

Revenue Growth Forecast: 40.1% p.a.

MedinCell, a French pharmaceutical company, is expected to achieve substantial growth with its revenue projected to expand by 40.1% annually. Despite recent setbacks in clinical trials, such as the Phase 3 trial for F14 not meeting its primary endpoint, there were positive trends in secondary outcomes and safety profiles. The company's stock is currently valued at 69.2% below estimated fair value, indicating potential undervaluation. However, investor caution is advised due to high share price volatility and recent shareholder dilution.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. operates globally, offering public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.23 billion.

Operations: The company generates revenue through three primary segments: Public Cloud (€140.71 million), Private Cloud (€514.59 million), and Web Cloud (€179.45 million).

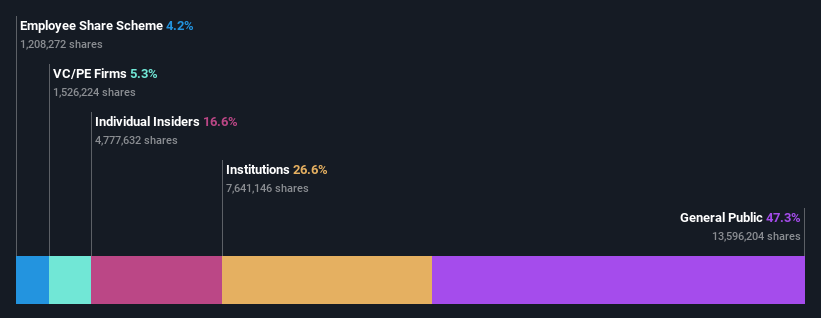

Insider Ownership: 10.5%

Revenue Growth Forecast: 11.3% p.a.

OVH Groupe, a French cloud services provider, reported improved half-year earnings with sales rising to €486.09 million and a reduced net loss of €17.24 million. The company's revenue is expected to grow by 11.3% annually, outpacing the French market's 5.8%. Despite its highly volatile share price recently, OVH shows promise with strategic hires like Benjamin Revcolevschi enhancing its focus on innovation and international expansion through significant investments such as the new Canadian data center costing CAD 145 million over eight years.

Delve into the full analysis future growth report here for a deeper understanding of OVH Groupe.

Our valuation report here indicates OVH Groupe may be overvalued.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

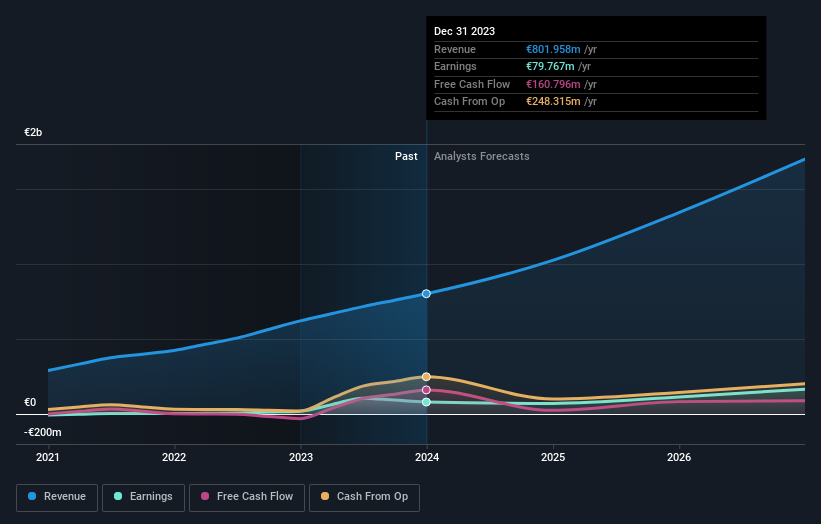

Overview: VusionGroup S.A. specializes in offering digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of approximately €2.59 billion.

Operations: The company generates its revenues by providing digitalization solutions for commercial sectors across Europe, Asia, and North America.

Insider Ownership: 13.3%

Revenue Growth Forecast: 24.4% p.a.

VusionGroup S.A. demonstrated strong financial performance, with sales increasing to €801.96 million from €620.86 million last year and net income surging to €79.77 million from €18.95 million. The company's earnings per share also saw substantial growth, rising from €1.2 to €5.02 in basic terms and from €1.18 to €4.46 in diluted terms over the same period, reflecting robust profitability improvements amid a highly volatile market environment for its shares.

Click here to discover the nuances of VusionGroup with our detailed analytical future growth report.

The valuation report we've compiled suggests that VusionGroup's current price could be inflated.

Turning Ideas Into Actions

Access the full spectrum of 21 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:MEDCL ENXTPA:OVH and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance