Insider-Heavy Growth Companies To Watch In June 2024

As global markets exhibit mixed signals with record highs in major indexes and concerns over manufacturing contraction, investors are navigating through a complex economic landscape. In this context, growth companies with high insider ownership can be particularly intriguing, as they often suggest a commitment from those who know the company best. High insider ownership might signal confidence in the firm's prospects, aligning management’s interests with that of shareholders, which is crucial during uncertain times.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Medley (TSE:4480) | 34% | 28.7% |

KebNi (OM:KEBNI B) | 37.8% | 90.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Calliditas Therapeutics (OM:CALTX) | 11.6% | 53% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.7% |

Vow (OB:VOW) | 31.8% | 97.6% |

Adocia (ENXTPA:ADOC) | 12.1% | 104.5% |

OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 79.3% |

Let's explore several standout options from the results in the screener.

Alsea. de

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alsea, S.A.B. de C.V., with a market capitalization of MX$51.56 billion, operates a chain of restaurants across Latin America and Europe.

Operations: The company generates revenue through its food and beverage segments, with MX$40.53 billion from Mexico, MX$22.83 billion from Europe, and MX$13.40 billion from other Latin American countries.

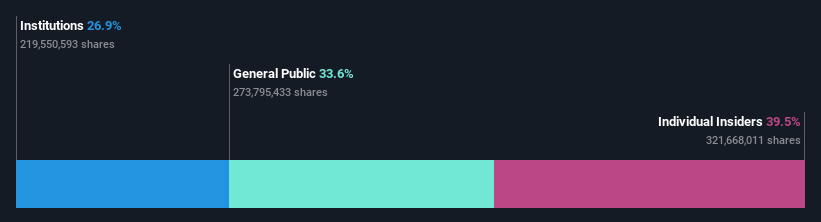

Insider Ownership: 39.5%

Return On Equity Forecast: 35% (2027 estimate)

Alsea, S.A.B. de C.V. has demonstrated robust growth with a 35% increase in earnings over the past year and is expected to continue this trend with forecasts suggesting a 26.39% annual growth rate in earnings. Despite high levels of debt, the company's revenue is projected to outpace the broader MX market with an annual increase of 9.3%, compared to the market's 7.1%. Additionally, Alsea's return on equity is anticipated to reach an impressive 34.9% in three years, aligning with analyst expectations of significant stock price appreciation by 33.2%. However, recent financial reports indicate a decrease in net income and earnings per share compared to the previous year.

Mr D.I.Y. Group (M) Berhad

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Mr D.I.Y. Group (M) Berhad operates as an investment holding company, specializing in retailing home improvement products and mass merchandise primarily in Malaysia and Brunei, with a market capitalization of approximately MYR 17.86 billion.

Operations: The company generates revenue primarily from its retail segment focused on home improvement, totaling MYR 4.46 billion.

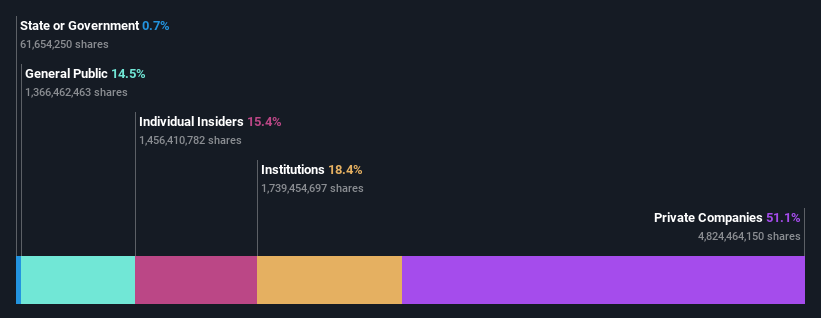

Insider Ownership: 15.4%

Return On Equity Forecast: 33% (2027 estimate)

Mr D.I.Y. Group (M) Berhad is poised for continued growth, with revenue and earnings expanding by 13.4% and 12.6% per year respectively, outpacing the Malaysian market averages. Recent financials show a robust increase in sales to MYR 1.14 billion and net income to MYR 144.88 million in Q1 2024, underscoring its operational strength. Despite this performance, its forecasted earnings growth does not reach the high-growth benchmark of over 20%. Additionally, there's no significant insider trading activity reported in the past three months, suggesting a stable but cautious insider confidence level.

Posiflex Technology

Simply Wall St Growth Rating: ★★★★☆☆

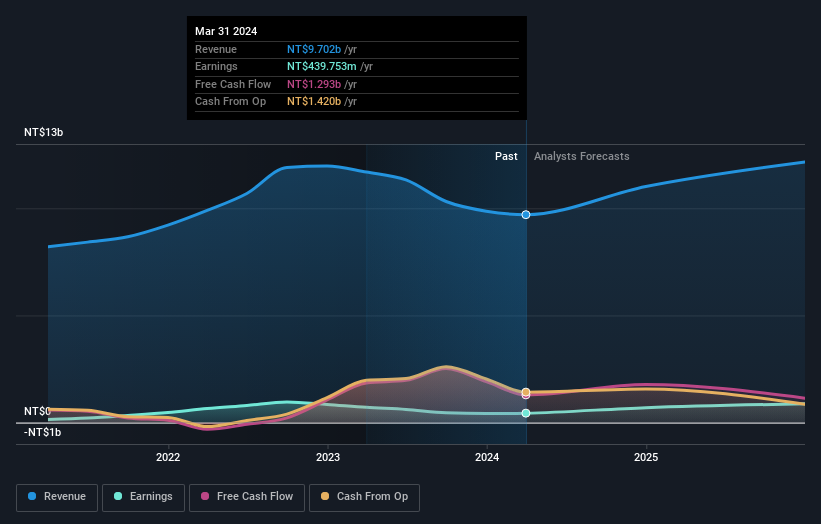

Overview: Posiflex Technology, Inc. is a global manufacturer and seller of industrial computers and peripheral equipment, with operations in Taiwan, the United States, and other international markets, boasting a market capitalization of NT$11.30 billion.

Operations: The company generates its revenue primarily from the sale of industrial computers and peripheral equipment across Taiwan, the United States, and various global markets.

Insider Ownership: 10.2%

Return On Equity Forecast: N/A (2027 estimate)

Posiflex Technology, trading 7.7% below its estimated fair value, is expected to see substantial earnings growth at 36.4% annually, outstripping the Taiwanese market's 17.5%. However, its revenue growth forecast of 12.7% per year, though above the market average of 11.2%, doesn't meet the high-growth threshold of over 20%. Recent executive changes and solid Q1 earnings with TWD 2.22 billion in sales and TWD 110.58 million in net income reflect operational adjustments and financial resilience despite no significant insider trades recently reported.

Where To Now?

Click this link to deep-dive into the 1477 companies within our Fast Growing Companies With High Insider Ownership screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BMV:ALSEA * KLSE:MRDIY and TWSE:8114.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance