Initial claims — What you need to know in markets on Thursday

After three big rallies in a row, the stock market took a breather on Wednesday.

The major averages logged a mixed close with the Dow losing 0.1% with shares of IBM (IBM) dropping 7% to weigh down the blue chip index.

The S&P 500 and the tech-heavy Nasdaq, however, both logged gains though neither index rose more than 0.2%.

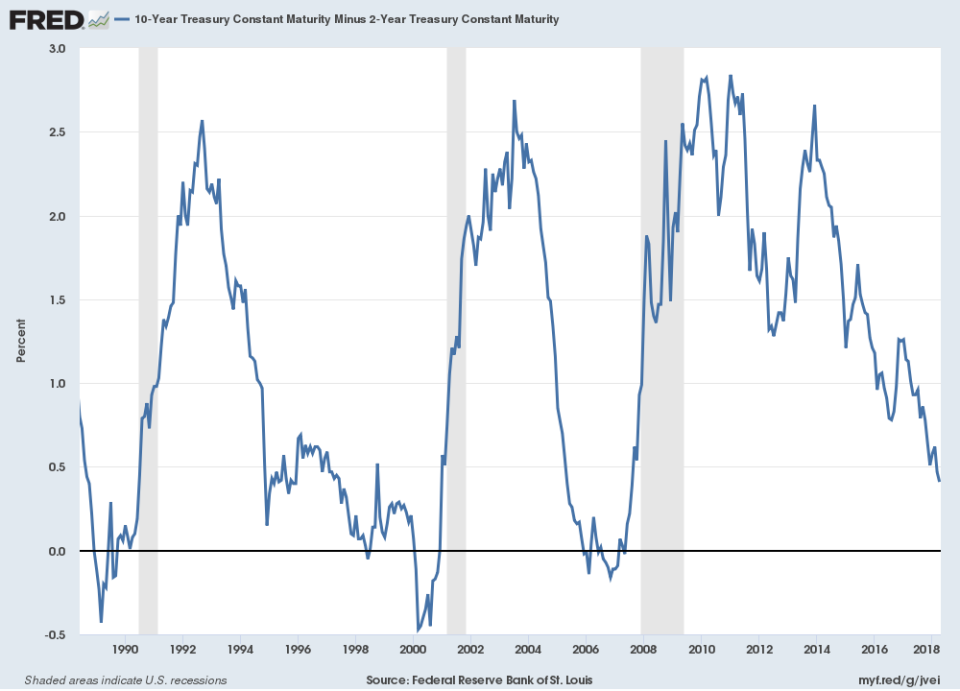

The biggest story in markets on Wednesday — and a theme likely to continue on Thursday — was the flattening Treasury yield curve, as the spread between the 2-year and 10-year Treasury note now sitting at around 44 basis points, the tightest since 2008.

Investors track this spread as an inverted yield curve, or short-term yields rising above long-term yields, typically precedes recessions.

On the calendar on Thursday, investors will have earnings to react to, though fewer major headline names will report than in recent days, with results from Blackstone (BX), Bank of New York Mellon (BK), Philip Morris (PM), Quest Diagnostics (DGX), and E-Trade (ETFC) expected to be headliners.

And on the economic data side investors will get the weekly report on initial jobless claims as well as the Philly Fed’s latest reading on manufacturing activity in its region.

On Wednesday, the Fed released its latest Beige Book, a collection of economic anecdotes from each of the Fed’s 12 districts. And the report indicated that while wage pressures continue to build in the economy and pricing pressures are percolating across the supply chain, the real worry for American business leaders right now is tariffs.

The word “tariff” or “tariffs” was mentioned 36 times in the report, which said, “Outlooks remained positive, but contacts in various sectors including manufacturing, agriculture, and transportation expressed concern about the newly imposed and/or proposed tariffs.”

In its latest monetary policy statement published on March 21, the Fed did not reference tariffs explicitly and Fed chair Jerome Powell was reluctant to discuss potential trade moves from the Trump administration.

But with trade concerns becoming a larger part of investor and business operator psychology, it seems unlikely the Fed will be as reluctant to discuss potential fallout from a trade war in its upcoming statement or future policy discussions.

100 million Prime members

Finally!

After declining for years to disclose how many Prime members Amazon (AMZN) has, CEO Jeff Bezos revealed in his annual letter to shareholders that over 100 million people globally have joined Amazon’s club.

“13 years post-launch, we have exceeded 100 million paid Prime members globally,” Bezos wrote.

“In 2017 Amazon shipped more than five billion items with Prime worldwide, and more new members joined Prime than in any previous year – both worldwide and in the U.S. Members in the U.S. now receive unlimited free two-day shipping on over 100 million different items.”

Bezos added that same-day and one-day delivery are now on offer to Prime members in 8,000 cities and towns and that Prime Now — which can deliver goods to customers in just hours — is available in 50 cities and nine countries.

In previous letters to shareholders, Bezos has often discussed Amazon’s goal to Prime such a good value that customers would be “irresponsible” not to pay for the service, which costs $99 a year in the U.S. and offers two-day free shipping among other benefits for members.

Part of Amazon’s efforts to build its Prime member base has been its investment in Prime Video, its streaming service that competes with Netflix (NFLX) and Hulu, among others.

“Prime Video continues to drive Prime member adoption and retention,” Bezos said in his letter. “In the last year we made Prime Video even better for customers by adding new, award-winning Prime Originals to the service, like The Marvelous Mrs. Maisel, winner of two Critics’ Choice Awards and two Golden Globes, and the Oscar-nominated movie The Big Sick.”

Bezos also said that Amazon’s streaming of NFL games on Thursday night accumulated more than 18 million viewers over 11 games. Amazon reportedly paid $50 million to stream NFL games, meaning it cost them about $2.78 for each viewer.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance