Incyte's (INCY) Q1 Earnings & Revenues Fall Shy of Estimates

Incyte Corporation INCY reported first-quarter 2024 adjusted earnings of 64 cents per share, which missed the Zacks Consensus Estimate of 88 cents. The company had recorded earnings of 37 cents per share in the year-ago quarter.

Total revenues in the reported quarter were $881 million, which grew 9% year over year, driven by the sustained performance of its lead drug, Jakafi (ruxolitinib), and increased sales of Opzelura (ruxolitinib) cream on strong launch and demand. The top line, however, missed the Zacks Consensus Estimate of $935.8 million.

Quarter in Detail

Jakafi’s (a first-in-class JAK1/JAK2 inhibitor approved for polycythemia vera, myelofibrosis and refractory acute graft-versus-host disease) revenues came in at $571.8 million, down 1% from the year-ago quarter, owing to inventory drawdown. Jakafi's sales missed the Zacks Consensus Estimate of $634 million.

Opzelura (ruxolitinib) cream generated $85.7 million in sales, increasing 52% year over year but missing the Zacks Consensus Estimate of $100 million. The year-over-year rise in sales was driven by patient demand and expansion in payer coverage as launch in atopic dermatitis and vitiligo continues.

Opzelura cream 1.5% is approved for the topical treatment of non-segmental vitiligo in adult and pediatric patients aged 12 years and older. Opzelura is also approved by the FDA for the topical short-term and non-continuous chronic treatment of mild-to-moderate atopic dermatitis.

The newly approved medicine, Zynyz (retifanlimab-dlwr), generated sales of $0.46 million. The company obtained accelerated approval for Zynyz to treat metastatic or recurrent locally advanced Merkel cell carcinoma.

Net product revenues of Iclusig were almost $30.3 million, up 10% year over year. The figure beat the Zacks Consensus Estimate of $27.7 million.

Pemazyre generated $17.6 million in sales, reflecting a year-over-year decrease of 21%. The figure missed the Zacks Consensus Estimate of $22.1 million.

Minjuvi's revenues totaled $23.8 million, surging 264% from the prior year quarter’s number. The figure beat the Zacks Consensus Estimate of $21.9 million.

Incyte gained worldwide exclusive global rights for tafasitamab from MorphoSys AG, which is marketed as Monjuvi in the United States and as Minjuvi in the ex-U.S markets in February.

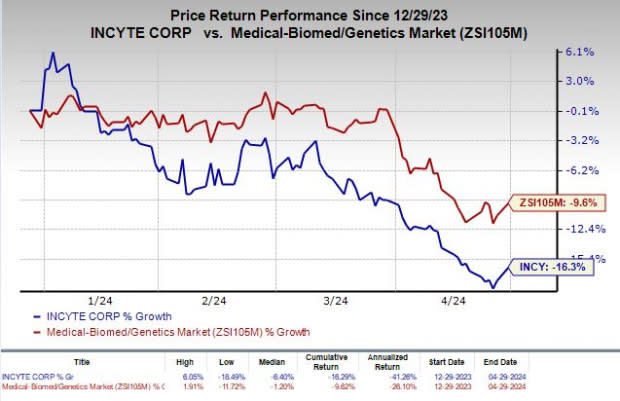

Shares of Incyte have plunged 16.3% year to date compared with the industry’s decline of 9.6%.

Image Source: Zacks Investment Research

We remind investors that Jakafi is marketed by Incyte in the United States and by Novartis NVS as Jakavi in ex-U.S. markets.

Jakavi royalty revenues from Novartis for commercialization in ex-U.S. markets rose 17% to $89.6 million. Jakavi royalties beat the Zacks Consensus Estimate of $86 million.

Incyte also receives royalties from the sales of Tabrecta (capmatinib) for the treatment of adult patients with metastatic non-small-cell lung cancer. Its partner, Novartis, has exclusive worldwide development and commercialization rights for Tabrecta. The royalty revenues from the drug’s sales amounted to $5.2 million, up 25% year over year.

Olumiant’s (baricitinib) product royalty revenues from Eli Lilly LLY totaled $30.6 million, down 10% year over year. The figure missed the Zacks Consensus Estimate of $39.4 million.

Incyte has a collaboration agreement with Eli Lilly for Olumiant.

The drug is a once-daily oral JAK inhibitor discovered by Incyte and licensed to LLY. It is approved for several types of autoimmune diseases.

Adjusted research and development expenses totaled $388.4 million, up 3% year over year. This was due to continued higher investment in late-stage development pipeline and assets.

Adjusted selling, general and administrative expenses amounted to $277.3 million, down 6% from the prior-year quarter’s number. This was due to the timing of consumer marketing activities and of certain other expenses.

Incyte’s cash and cash equivalents totaled $3.9 billion as of Mar 31, 2024, compared with $3.7 billion as of Dec 31, 2023.

2024 Guidance

Incyte reiterated the guidance it provided earlier this year. The company continues to expect Jakafi revenues in the range of $2.69-$2.75 billion in 2024.

Adjusted research and development expenses are expected in the band of $1.58-$1.61 billion, while adjusted selling, general and administrative expenses are expected in the range of $1.11-$1.14 billion.

Pipeline Updates

Incyte has a collaboration and license agreement with Syndax Pharmaceuticals SNDX to develop and commercialize axatilimab, the latter’s anti-CSF-1R monoclonal antibody, in chronic graft-versus-host disease (GVHD) and other fibrotic diseases.

In February 2024, the FDA accepted INCY and SNDX’s biologics license application (BLA) for axatilimab for Priority Review. The candidate was evaluated for the treatment of chronic GVHD after failure of at least two prior lines of systemic therapy. A decision from the regulatory body is due on Aug 28, 2024.

Incyte and Syndax submitted the BLA for axatilimab in chronic GVHD in December 2023.

Incyte Corporation Price, Consensus and EPS Surprise

Incyte Corporation price-consensus-eps-surprise-chart | Incyte Corporation Quote

Zacks Rank

Incyte currently carries a Zacks Rank #3 (Hold).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

Syndax Pharmaceuticals, Inc. (SNDX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance