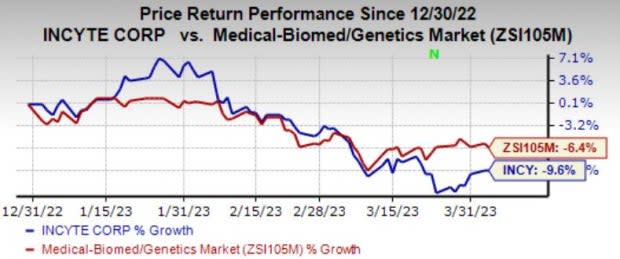

Incyte (INCY) Down 9.6% so Far in 2023 on Recent Setbacks

It has been a roller coaster ride for Incyte INCY so far this year. Shares of the company are down 9.6% in the year so far compared to the industry’s decline of 6.4%.

Incyte suffered a setback last month after the company announced that the FDA issued a complete response letter (CRL) for ruxolitinib extended-release (XR) tablets, a JAK1/JAK2 inhibitor, for once-daily (QD) use in the treatment of certain types of myelofibrosis (MF), polycythemia vera (PV) and graft-versus-host disease (GVHD).

The CRL stated that the FDA could not approve the new drug application (NDA) in its present form. The regulatory body acknowledged that the study submitted in the NDA met its objective of bioequivalence based on area under the curve (AUC) parameters but identified additional requirements for approval. Shares fell on the news.

We note that ruxolitinib is approved under the brand name Jakafi for these indications.

The NDA was based on two studies designed to show that ruxolitinib XR tablets are dosage strength proportional and bioequivalent to Jakafi tablets.

Image Source: Zacks Investment Research

Incyte also decided to discontinue the phase III LIMBER-304 trial following the results of a pre-planned interim analysis conducted by an independent data monitoring committee (IDMC). This indicated that the study is unlikely to meet the primary endpoint in the intent-to-treat patient population. The recommendation to stop the study was not due to safety.

LIMBER-304 is a randomized, double-blind study evaluating the efficacy and safety of parsaclisib plus Jakafi versus placebo plus Jakafi in adult (age ≥18 years) patients living with myelofibrosis (MF) who have an inadequate response to Jakafi monotherapy.

These setbacks were disappointing as the company is looking to strengthen its portfolio.

On a positive note, the FDA approved Zynyz (retifanlimab-dlwr), a humanized monoclonal antibody targeting programmed death receptor-1 (PD-1), for the treatment of adults with metastatic or recurrent locally advanced Merkel cell carcinoma (MCC). The biologics license application (BLA) for Zynyz for this indication has been approved under accelerated approval by the FDA based on the tumor response rate and duration of response (DOR). The continued approval of Zynyz for this indication may be contingent on the verification and description of clinical benefits in confirmatory trials.

Approval of additional drugs will add an incremental stream of revenues to the top line and reduce the company’s dependence on Jakafi. Incyte has a collaboration agreement with Swiss pharma giant Novartis NVS for Jakafi.

The uptake of the recently approved cream formulation of ruxolitinib, Opzelura, has been strong. In July 2022, the FDA approved Opzelura cream 1.5% for the topical treatment of nonsegmental vitiligo in adult and pediatric patients aged 12 years and older. Opzelura is also approved by the FDA for the topical short-term and non-continuous chronic treatment of mild to moderate atopic dermatitis (AD).

Hence, Incyte should be able to maintain momentum despite these setbacks.

Incyte currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some well-placed stocks in the overall healthcare sector are Novo Nordisk NVO and Ligand Therapeutics LGND, both carrying a Zacks Rank #1 at present.

In the past 30 days, estimates for Novo Nordisk’s 2023 earnings per share have risen from $4.20 to $4.43 and estimates for 2024 have gone up by 29 cents to $5.19.

Ligand’s earnings per share estimates for 2023 increased to $4.32 from $3.30 in the past 30 days. LGND beat earnings estimates in one of the last four reported quarters and missed the remaining three.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Incyte Corporation (INCY) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance