Increases to CEO Compensation Might Be Put On Hold For Now at Hong Leong Asia Ltd. (SGX:H22)

Key Insights

Hong Leong Asia's Annual General Meeting to take place on 25th of April

Salary of S$595.6k is part of CEO Stephen Ho's total remuneration

The total compensation is 748% higher than the average for the industry

Hong Leong Asia's EPS grew by 13% over the past three years while total shareholder loss over the past three years was 31%

The underwhelming share price performance of Hong Leong Asia Ltd. (SGX:H22) in the past three years would have disappointed many shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 25th of April could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Hong Leong Asia

How Does Total Compensation For Stephen Ho Compare With Other Companies In The Industry?

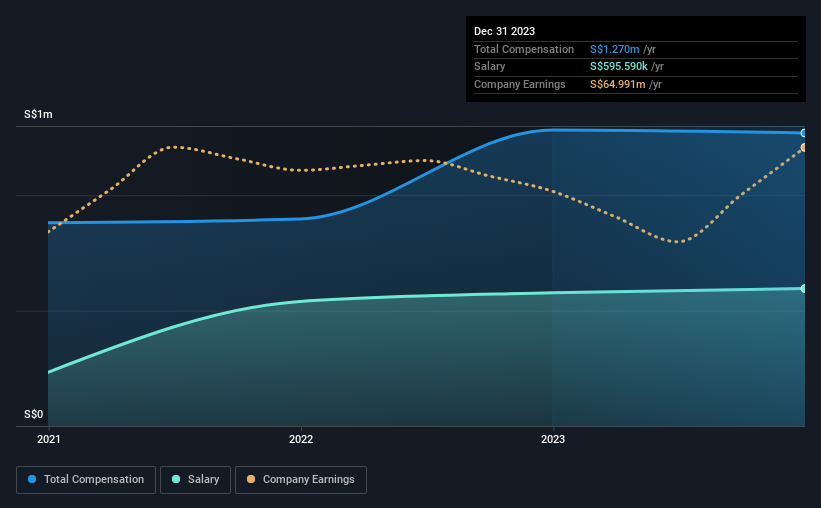

At the time of writing, our data shows that Hong Leong Asia Ltd. has a market capitalization of S$449m, and reported total annual CEO compensation of S$1.3m for the year to December 2023. This means that the compensation hasn't changed much from last year. While we always look at total compensation first, our analysis shows that the salary component is less, at S$596k.

On examining similar-sized companies in the Singaporean Machinery industry with market capitalizations between S$272m and S$1.1b, we discovered that the median CEO total compensation of that group was S$150k. Hence, we can conclude that Stephen Ho is remunerated higher than the industry median.

Component | 2023 | 2022 | Proportion (2023) |

Salary | S$596k | S$577k | 47% |

Other | S$674k | S$706k | 53% |

Total Compensation | S$1.3m | S$1.3m | 100% |

Talking in terms of the industry, salary represented approximately 85% of total compensation out of all the companies we analyzed, while other remuneration made up 15% of the pie. Hong Leong Asia sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

Hong Leong Asia Ltd.'s Growth

Hong Leong Asia Ltd.'s earnings per share (EPS) grew 13% per year over the last three years. In the last year, its revenue is up 5.2%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Hong Leong Asia Ltd. Been A Good Investment?

The return of -31% over three years would not have pleased Hong Leong Asia Ltd. shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Hong Leong Asia that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance