Illumina (ILMN) Advances in NGS With DRAGEN v4.3 Launch

Illumina, Inc. ILMN has progressed in genomic research with the recent launch of DRAGEN v4.3. This is the latest version of the company’s DRAGEN software line.

This new release marks a significant advancement in the field of next-generation sequencing (NGS), featuring an advanced multigenome mapping technology. This innovation allows for the inclusion of 128 samples from 26 different ancestries, thus capturing a broader spectrum of genetic diversity and reducing ancestry bias.

The ability to create custom DRAGEN multigenome references on the Illumina cloud further empowers researchers to tailor their studies with improved accuracy and precision.

DRAGEN v4.3 in Detail

One of the standout features of DRAGEN v4.3 is its machine-learning mosaic model, which enhances the detection of low allele frequency variants. This capability is particularly valuable in translational and research settings, where precision is crucial.

Additionally, the introduction of a new family of specialized callers enables comprehensive genotyping of challenging genes in segmental duplication regions. This innovation is pivotal for applications such as hereditary cancer screening and newborn screening, where accurate genetic analysis can significantly impact patient outcomes.

AI-Powered Annotations and Expanded Data Compression

DRAGEN v4.3 also incorporates AI-powered annotations through its updated engine, Connected Annotations. Leveraging advanced algorithms like SpliceAI and PrimateAI-3D, the software can now reduce variants of unknown significance, thus providing clearer and more actionable insights from genetic data. Furthermore, the extension of lossless ORA compression functionality to support human methylation and nonhuman data enhances data management capabilities, offering high compression ratios without sacrificing data integrity.

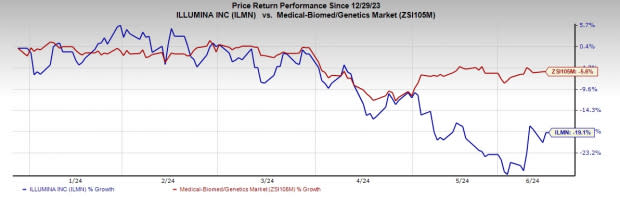

Image Source: Zacks Investment Research

Impact on Clinical Research

Broad Clinical Labs' systematic research into the accuracy of variant calls made by DRAGEN v4.3 highlights the software's reliability and speed. The lab's findings underscore the potential of DRAGEN v4.3 to revolutionize clinical whole-genome research, offering a powerful tool for accurate and efficient genomic analysis.

Market Prospects

Going by a report by Nova One Advisor published on BioSpace, the global NGS market size was valued at $9.19 billion in 2023 and is projected to hit $66.04 billion by 2033, at a CAGR of 21.8%.

Share Price Performance

Year to date, shares of Illumina have plunged 19.1% compared with the industry’s 5.6% decline.

Zacks Rank and Key Picks

Illumina carries a Zacks Rank #3 (Hold) currently.

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and ResMed RMD. While Hims & Hers Health and Medpace sport a Zacks Rank #1 (Strong Buy), ResMed carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks Rank #1 stocks here.

Hims & Hers Heath stock has surged 143.8% in the past year. Estimates for the company’s earnings have remained constant at 18 cents for 2024 and increased 3.1% to 33 cents for 2025 in the past 30 days.

HIMS’ earnings beat estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. In the last reported quarter, it posted an earnings surprise of a staggering 150%.

Estimates for Medpace’s 2024 earnings per share have moved up to $11.29 from $11.23 in the past 30 days. Shares of the company have surged 81.4% in the past year compared with the industry’s 4.2% growth.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

Estimates for ResMed’s fiscal 2024 earnings per share have remained constant at $7.70 in the past 30 days. Shares of the company have declined 2.1% in the past year against the industry’s rise of 3.9%.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, the average surprise being 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illumina, Inc. (ILMN) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance