Illinois Tool (ITW) Q1 Earnings Beat Estimates, Revenues Miss

Illinois Tool Works Inc. ITW reported first-quarter 2024 adjusted earnings of $2.44 per share, which surpassed the Zacks Consensus Estimate of $2.35. Earnings increased 5% year over year.

Illinois Tool’s revenues of $3.97 billion missed the consensus estimate of $4.02 billion. The top line inched down 1.1% year over year due to an unfavorable foreign currency translation of 0.4%. Also, organic sales decreased 0.5% and divestitures reduced revenues by 0.6%.

Segmental Performance

Test & Measurement and Electronics’ revenues were down 0.9% year over year to $696 million. Our estimate for segmental revenues was $705.8 million. Revenues from Automotive Original Equipment Manufacturer increased 2.5% year over year to $816 million. Our estimate for segmental revenues was $813.3 million.

Food Equipment generated revenues of $631 million, decreasing 0.7% year over year. Our estimate for segmental revenues was $650.7 million. Welding revenues were $476 million, down 3.4% year over year. Our estimate for segmental revenues was $497.7 million.

Construction Products’ revenues were down 7.3% year over year to $488 million. Our estimate for segmental revenues was $505.4 million. Revenues of $440 million from Specialty Products reflected an increase of 3.4% year over year. Our estimate for segmental revenues was $401.7 million. Polymers & Fluids’ revenues of $432 million declined 3.3% year over year. Our estimate for segmental revenues was $447.3 million.

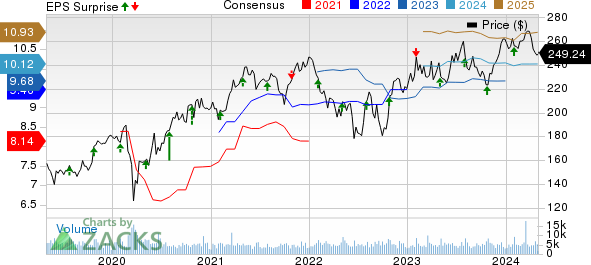

Illinois Tool Works Inc. Price, Consensus and EPS Surprise

Illinois Tool Works Inc. price-consensus-eps-surprise-chart | Illinois Tool Works Inc. Quote

Margin Profile

Illinois Tool’s cost of sales decreased 8.4% year over year to $2.1 billion. Selling, administrative, and research and development expenses decreased 0.2% year over yer to $676 million. The operating margin was 28.4%, up 420 basis points (bps) from the year-ago quarter. Enterprise initiatives contributed 140 bps to the operating margin.

Balance Sheet and Cash Flow

At the end of the first quarter, Illinois Tool had cash and equivalents of $959 million compared with $1.1 billion at the end of December 2023. Long-term debt was $6.25 billion compared with $6.33 billion at the end of December 2023.

In the first three months of 2024, Illinois Tool, carrying a current Zacks Rank #3 (Hold), generated net cash of $589 million from operating activities, reflecting a decline of 19.1% from the year-ago reported number. Capital spending on the purchase of plant and equipment was $95 million, down 15.9% year over year. Free cash flow of $494 million decreased 19.7% year over year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

2024 Guidance

Illinois Tool expects earnings of $10.30-$10.70 per share for 2024. Organic revenues are expected to increase 1-3%. The company anticipates total revenues to increase 1-3% from the year-ago reported figure. Operating margin is expected to be 26-27%. Enterprise initiatives are expected to contribute more than 100 bps to the operating margin.

Illinois Tool projects free cash flow to be more than 100% of net income in 2024. The company expects to repurchase about $1.5 billion worth of shares. The tax rate is expected to be 24-24.5%.

Performance of Other Industrial Companies

IDEX Corporation’s IEX first-quarter 2024 adjusted earnings of $1.88 per share surpassed the Zacks Consensus Estimate of $1.75. On a year-over-year basis, the bottom line decreased approximately 10.1%.

In the quarter under review, IDEX’s net sales of $800.5 million underperformed the consensus estimate of $805 million. The top line also decreased 5.3% year over year.

A. O. Smith Corporation’s AOS first-quarter 2024 adjusted earnings of $1.00 per share surpassed the Zacks Consensus Estimate of 99 cents. The bottom line increased 6% on a year-over-year basis.

Net sales of $978.8 million missed the consensus estimate of $995 million. However, the top line inched up 1% year over year, driven by strong demand for commercial water heaters in North America.

W.W. Grainger, Inc. GWW has reported earnings per share of $9.62 in first-quarter 2024, beating the Zacks Consensus Estimate of $9.58. The bottom line improved 0.1% year over year.

Grainger’s quarterly revenues rose 3.5% year over year to $4.24 billion. The top line missed the consensus estimate of $4.27 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Illinois Tool Works Inc. (ITW) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

W.W. Grainger, Inc. (GWW) : Free Stock Analysis Report

IDEX Corporation (IEX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance