IDEXX (IDXX) Q4 Earnings Top Estimates, Revenues Grow Y/Y

IDEXX Laboratories, Inc. IDXX posted fourth-quarter 2019 earnings per share (EPS) of $1.04, reflecting a 6.1% year-over-year rise. The figure surpassed the Zacks Consensus Estimate by 14.3%. Comparable-constant-currency EPS growth was 17%, which excludes the impact of CEO transition charges of 14 cents per share.

For 2019, EPS came in at $4.89, up 14.8% (up 21% at comparable constant currency basis) from the year-ago tally. The figure surpassed the Zacks Consensus Estimate by 2.7%.

Revenues in Detail

Fourth-quarter revenues grew 10.2% year over year to $605.4 million. The metric also beat the Zacks Consensus Estimate by 0.9%. The year-over-year upside was primarily driven by strong global gains in Companion Animal Group (“CAG”) Diagnostics’ recurring revenues.

For 2019, revenues totaled $2.41 billion, up 9% on a reported basis and 10% on an organic basis. The figure surpassed the Zacks Consensus Estimate by 0.4%.

Segmental Analysis

IDEXX derives revenues from four operating segments — CAG; Water; Livestock, Poultry and Dairy (LPD); and Other. In the fourth quarter, CAG revenues rose 11% (up 11% organically) year over year to $529.8 million. The Water segment’s revenues were up 9% (up 10% organically) year over year to $32.87 million. LPD revenues rose 8% (up 10% organically) to $36.7 million. Revenues at the Other segment grew to $6.1 million.

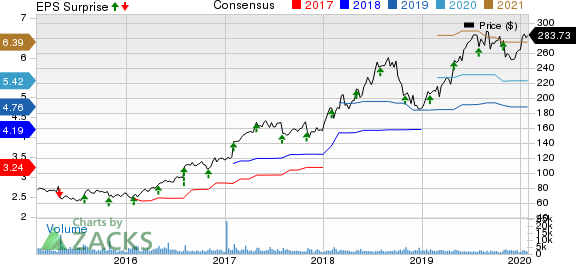

IDEXX Laboratories, Inc. Price, Consensus and EPS Surprise

IDEXX Laboratories, Inc. price-consensus-eps-surprise-chart | IDEXX Laboratories, Inc. Quote

Margins

Gross profit in the fourth quarter rose 10.3% to $331.1 million despite a 10.1% rise in cost of revenues to $274.3 million. Accordingly, gross margin expanded 2 basis points (bps) to 54.7%.

Sales and marketing expenses rose 10.2% to $105.7 million, while general and administrative expenses moved up 26.6% to $74.7 million. Additionally, research and development expenses rose 16.7% to $35.2 million. Operating margin in the quarter contracted 190 bps to 19.1%.

Financial Position

IDEXX exited fiscal 2019 with cash and cash equivalents of $90.3 million compared with $123.8 million at the end of 2018. Net cash provided by operating activities at the end of fiscal 2019 was $459.2 million compared with $400.1 million at the end of 2018.

2020 Outlook

IDEXX has raised its revenue guidance for 2020 to a band of $2.62-2.65 billion, indicating organic and reported revenue growth of 9-10.5%. The Zacks Consensus Estimate for revenues of $2.64 billion falls within the company’s guided range.

Meanwhile, the EPS projection has been raised by 12 cents to the band of $5.42 - $5.58, suggesting annualized growth of 13-16% at CER The Zacks Consensus Estimate for EPS stands at $5.42, within the company’s projected range.

Our Take

IDEXX exited the fourth quarter on a strong note, with better-than-expected numbers. Solid organic revenue growth is encouraging. The top line in the quarter was driven by strong sales at the CAG business. The company witnessed sturdy gains from CAG Diagnostics in the quarter under review. It also saw strong performances in IDEXX VetLab consumables, reference laboratory diagnostic and consulting as well as moderately robust growth in rapid assay product revenues globally. The strong performance of the company can be attributed to impressive growth in the LPD arm. The global adoption of its latest products and services, including the rapid expansion of Catalyst installed base, is another contributing factor. However, operating margin contracted during the quarter.

Zacks Rank and Key Picks

IDEXX currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader medical space are SeaSpine Holdings Corporation SPNE, STERIS plc STE and DexCom, Inc. DXCM, all three carrying a Zacks Rank of 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for SeaSpine’s fourth-quarter 2019 revenues is pegged at $43.6 million, suggesting 14.7% growth from the prior-year reported figure. The same for loss per share is anticipated at 44 cents, implying a 16.9% improvement from the year-ago reported number.

The Zacks Consensus Estimate for STERIS’ third-quarter fiscal 2020 revenues is pegged at $749.7 million, hinting at a 7.7% increase from the year-earlier reported figure. The same for adjusted earnings per share stands at $1.43, indicating a 13.5% rise from the year-ago reported figure.

The Zacks Consensus Estimate for DexCom’s fourth-quarter 2019 revenues is pegged at $457 million, suggesting 35.2% growth from the prior-year reported figure. The same for adjusted earnings per share stands at 72 cents, implying a 33.3% improvement from the year-earlier reported figure.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained and impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

IDEXX Laboratories, Inc. (IDXX) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

STERIS plc (STE) : Free Stock Analysis Report

SeaSpine Holdings Corporation (SPNE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance