ICICI Bank (IBN) Q4 Earnings Increase Y/Y, Provisions Jump

ICICI Bank’s IBN fourth-quarter fiscal 2020 (ended Mar 31) net income was INR12.21 billion ($161 million), up 26% from INR9.69 billion ($128 million) in the prior-year period. Excluding coronavirus-related provisions, net income would have been INR32.60 billion ($431 million).

The results were driven by a rise in revenues, loans and deposits. However, provisions surged owing to coronavirus-related concerns. Further, an increase in operating expenses was a headwind.

Revenue Components Improve, Expenses Rise

Net interest income (NII) rose 17% year over year to INR89.27 billion ($1.2 billion). Excluding the interest on income tax refund, NII increased 24% from the prior-year quarter. Net interest margin was 3.87%, up 15 basis points (bps) year over year.

Non-interest income — excluding treasury income — was INR40.13 billion ($530 million), up 16% from the prior-year quarter. Fee income increased 13% from the year-ago quarter to INR31.78 billion ($420 million).

Additionally, treasury income was INR2.42 billion ($32 million), surging 55% from the year-ago quarter.

Operating expenses totaled INR57.92 billion ($765.4 million), increasing 16% year over year.

Loans & Deposits Increase

As of Mar 31, 2020, ICICI Bank’s total advances amounted to INR6,452.9 billion ($85.3 billion), up 10% year over year.

Total deposits grew 18% from the comparable year-ago period to INR7,709.69 billion ($101.9 billion) as of Mar 31, 2020. Also, as of the same date, current and savings account ratio was 45.1%.

Credit Quality: Mixed Bag

As of Mar 31, 2020, net nonperforming assets (NPA) ratio was 1.41%, decreasing 65 bps year over year. Recoveries and upgrades from non-performing loans were INR18.83 billion ($249 million) in the quarter.

Further, gross NPA additions were INR53.06 billion ($701 billion). Provisions increased substantially from the prior-year quarter to INR32.42 billion ($428 million). The company built INR27.25 billion ($360 million) provisions related to coronavirus.

Capital Ratios Strong

In compliance with the Reserve Bank of India's guidelines on Basel III norms, ICICI Bank's total capital adequacy was 16.11% and Tier-1 capital adequacy was 14.72% as of Mar 31, 2020. Both the ratios were well above the minimum requirements.

Our Take

ICICI Bank’s quarterly performance was decent. Growth in revenues was a major tailwind, which is expected to support the company's financial performance going forward. However, mounting expenses are likely to adversely impact the bank’s bottom line. Also, coronavirus-induced market mayhem is a major headwind.

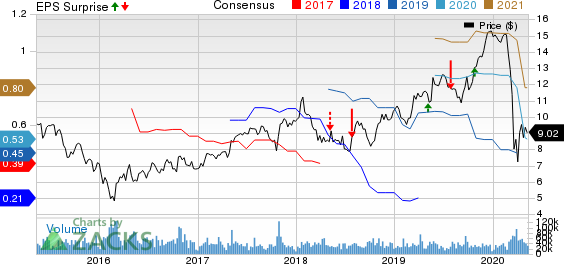

ICICI Bank Limited Price, Consensus and EPS Surprise

ICICI Bank Limited price-consensus-eps-surprise-chart | ICICI Bank Limited Quote

ICICI Bank currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Foreign Banks

UBS Group AG UBS reported first-quarter 2020 net profit attributable to shareholders of $1.6 billion compared with $1.14 billion in the prior-year period. Its performance was supported by higher net interest income, and net fee and commission income. However, higher expenses dragged down growth.

HSBC Holdings’ HSBC first-quarter 2020 pre-tax profit of $3.2 billion represents a 48% decline from the prior-year reported number. The reduction primarily reflects the impact of the coronavirus outbreak and weakening of oil prices.

Barclays’ BCS first-quarter 2020 net income attributable to ordinary equity holders of £605 million ($774.6 million) represents a 41.7% year-over-year decline. The results were primarily hurt by a significant increase in credit impairment charges. Also, the company’s top line declined in the quarter. Nonetheless, marginally lower operating expenses and a strong balance sheet position were tailwinds.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UBS Group AG (UBS) : Free Stock Analysis Report

ICICI Bank Limited (IBN) : Free Stock Analysis Report

Barclays PLC (BCS) : Free Stock Analysis Report

HSBC Holdings plc (HSBC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance