IBM's Q1 Earnings Beat, Revenues Miss Despite Solid Demand

International Business Machines Corporation IBM started 2024 on a positive note with relatively modest first-quarter results. The bottom line beat the Zacks Consensus Estimate, but the top line missed the same despite solid demand. The company witnessed healthy demand trends for hybrid cloud and AI solutions with a client-focused portfolio and broad-based growth and remains firmly on track to reach its targets for 2024.

Net Income

On a GAAP basis, net income from continuing operations was $1,575 million or $1.69 per share compared with $934 million or $1.02 per share in the year-ago quarter. The improvement in GAAP earnings was primarily attributable to top-line growth and income tax benefits.

Excluding non-recurring items, non-GAAP net income from continuing operations was $1.68 per share compared with $1.36 in the prior-year quarter. The bottom line beat the Zacks Consensus Estimate by 9 cents.

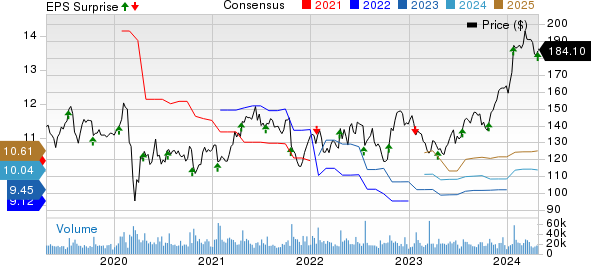

International Business Machines Corporation Price, Consensus and EPS Surprise

International Business Machines Corporation price-consensus-eps-surprise-chart | International Business Machines Corporation Quote

Quarter Details

Quarterly total revenues increased to $14,462 million from $14,252 million on strong demand for hybrid cloud and AI, driving growth in the Software and Consulting segments. On a constant currency basis, revenues were up 3% year over year. The top line missed the consensus estimate of $14,572 million.

Gross profit improved to $7,742 million from $7,509 million in the prior-year quarter, resulting in respective gross margins of 53.5% and 52.7% owing to a strong portfolio mix. Total expenses increased to $6,669 million from $6,451 million, driven by higher interest expense and R&D costs.

Segmental Performance

Software: Revenues improved to $5,899 million from $5,591 million, driven by growth in Hybrid Platform & Solutions, Red Hat, Automation, Data & AI and Transaction Processing. The reported segment revenues missed our estimate of $5,998 million despite solid hybrid cloud traction. Segment pre-tax income from continuing operations was $1,500 million compared with $1,379 million in the year-ago quarter for margins of 25.4% and 24.7%, respectively. The company is witnessing healthy hybrid cloud adoption by clients and solid demand trends across RedHat, automation and Data & AI.

Consulting: Revenues were $5,186 million compared with $5,197 million a year ago, led by pervasive growth driven by demand for digital transformation, increasing revenues across most business lines and regions. The segment’s revenues missed our estimate of $5,340 million. Segment pre-tax income was relatively flat at $424 million for a margin of 8.2%.

Infrastructure: Revenues were $3,076 million compared with $3,098 million, as lower demand for support services was partially offset by higher demand for hybrid and distributed infrastructure. Segment pre-tax income was $311 million compared with $307 million in the year-ago quarter for respective margins of 10.1% and 9.9%.

Financing: Revenues remained almost flat at $193 million. Segment pre-tax income was $92 million compared with $100 million in the year-ago quarter for respective margins of 47.7% and 51.2%.

Cash Flow & Liquidity

During the first quarter, IBM generated $4,168 million in cash from operations compared with $3,774 million in the year-ago quarter. Free cash flow was $1,910 million in the quarter, up from $1,340 million in the prior-year period, driven by higher profit and working capital efficiencies. As of Mar 31, 2024, the company had $14,603 million in cash and cash equivalents with $54,033 million of long-term debt.

Outlook

For full-year 2024, the company reiterated its revenue growth expectations in the mid-single digit on a constant currency basis. Free cash flow is expected to be in the vicinity of $12 billion.

Zacks Rank & Stocks to Consider

IBM currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Here are some better-ranked stocks from the broader industry.

Airgain, Inc. AIRG currently carries a Zacks Rank #2 (Buy). It has a long-term earnings growth expectation of 35%.

Headquartered in San Diego, CA, Airgain offers integrated wireless solutions in the form of antenna products. These products are equipped to solve critical connectivity needs in both the design process and the operating environment across the enterprise, automotive and consumer markets. Ideal for original equipment and design manufacturers, vertical markets, chipset vendors, service providers, value-added resellers and software developers worldwide, the customizable antennas from Airgain serve both indoor and outdoor connectivity issues.

Pinterest Inc. PINS, sporting a Zacks Rank #1, delivered a trailing four-quarter average earnings surprise of 37.4%. It has a long-term earnings growth expectation of 20%.

Pinterest is increasingly establishing a unique value proposition to advertisers that could provide a competitive advantage in the long haul. Through various innovations, PINS continues to dramatically improve the advertising platform, which appears to be one of the best ad platforms for consumer discretionary brands looking for ways to reach customers and stretch smaller ad budgets.

Headquartered in White Plains, NY, Turtle Beach Corporation HEAR develops and markets gaming headset solutions for various platforms, including video game and entertainment consoles, handheld consoles, personal computers, tablets and mobile devices under the Turtle Beach brand.

Turtle Beach is well-positioned to benefit from quality products and enjoys a solid foothold in its served markets. Its headsets are suited for learning and working remotely via video or audio conferencing. This Zacks Rank #2 stock has a long-term earnings growth expectation of 16%. It has a VGM Score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

Turtle Beach Corporation (HEAR) : Free Stock Analysis Report

Airgain, Inc. (AIRG) : Free Stock Analysis Report

Pinterest, Inc. (PINS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance