Huntsman Corp (HUN) Faces Challenges in Q1 2024, Misses Analyst Revenue and Earnings Estimates

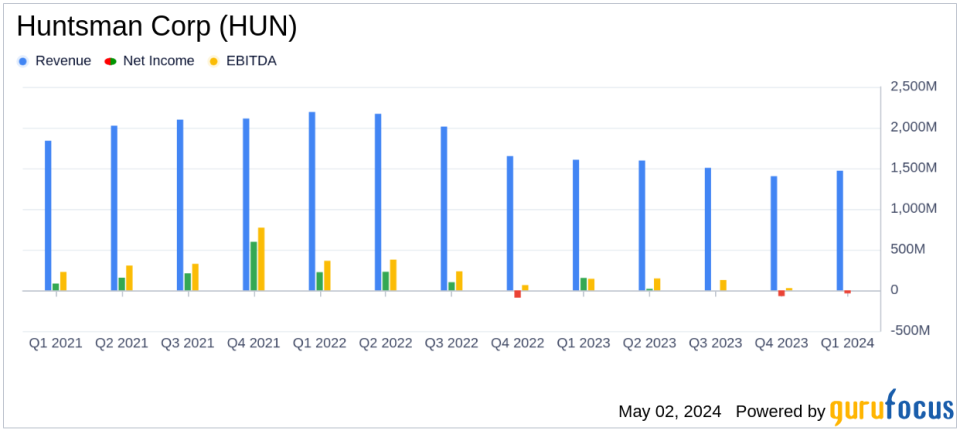

Revenue: Reported $1,470 million, a decrease from $1,606 million in the previous year, matching estimates of $1,470.58 million.

Net Loss: Reported a net loss of $37 million, significantly worse than the previous year's net income of $153 million and more than the estimated net loss of $9.91 million.

Earnings Per Share (EPS): Reported a diluted loss per share of $0.22, compared to earnings of $0.83 per share in the previous year, more than the estimated loss per share of $0.06.

Adjusted EBITDA: Reported $81 million, down 40% from $136 million in the prior year.

Free Cash Flow: Reported a negative free cash flow of $105 million, an improvement from negative $168 million in the previous year.

Capital Expenditures: Spent $42 million during the quarter, slightly lower than $46 million in the same period last year, with an expected annual spend of $200 million.

Effective Tax Rate: Reported an effective tax rate of 56%, with an adjusted rate of 57%, and anticipates an adjusted effective tax rate of 34% to 37% for 2024.

Huntsman Corp (NYSE:HUN), a global manufacturer of differentiated organic chemical products, released its 8-K filing on May 2, 2024, revealing a challenging first quarter. The company reported a revenue of $1,470 million, a decrease from $1,606 million in the same quarter the previous year, and a significant miss compared to the estimated revenue of $1470.58 million. Additionally, Huntsman reported a net loss of $37 million, contrasting sharply with a net income of $153 million in Q1 2023, and underperforming against the estimated net loss of $9.91 million.

Huntsman Corp operates primarily through its Polyurethanes, Performance Products, and Advanced Materials segments, with the majority of its revenue derived from the Polyurethanes segment. The company's products are crucial in various industries, including aerospace, automotive, and construction.

Operational and Segment Challenges

The decrease in revenue and net income can be attributed to several segment-specific issues. The Polyurethanes segment saw a decline in MDI average selling prices due to unfavorable supply and demand dynamics, although this was partially offset by higher sales volumes in the Americas and Europe. The Performance Products segment also experienced lower average selling prices due to competitive pressures, particularly in Europe. In the Advanced Materials segment, both average selling prices and sales volumes decreased, impacting the overall performance.

Strategic Focus and Future Outlook

Despite the disappointing results, Peter R. Huntsman, Chairman, President, and CEO, remains optimistic about the future. He stated,

As we expected, the first quarter of 2024 improved sequentially versus the fourth quarter due largely to higher sales volumes and improved margins. We expect these trends to continue into a seasonally stronger second quarter. While overall demand for our products, as well as our margins in Polyurethanes remain below historical averages, we remain confident that we will see both elements improve as our key markets recover over the next several quarters.

Huntsman's focus on controlling costs and driving higher returns is aimed at providing the flexibility to invest in long-term growth and return cash to shareholders. This strategic approach is critical as the company navigates through market fluctuations and aims for recovery.

Financial Health and Capital Resources

Regarding liquidity and capital resources, Huntsman reported a free cash flow use of $105 million for the quarter, an improvement from a use of $168 million in the prior year. The company ended the quarter with approximately $1.6 billion in combined cash and unused borrowing capacity. Planned capital expenditures for 2024 are estimated at around $200 million, reflecting ongoing investments in operational capabilities.

Income Taxes and Effective Tax Rate

The company's effective tax rate for the quarter was notably high at 56%, with an adjusted effective tax rate of 57%. Huntsman anticipates the adjusted effective tax rate for 2024 to be between 34% and 37%, aligning with long-term expectations of 22% to 24%.

In conclusion, Huntsman Corp's first quarter of 2024 was marked by significant challenges, reflected in its missed revenue and earnings estimates. However, management's focus on strategic initiatives and cost control, combined with expected improvements in market conditions, provide a basis for cautious optimism about the company's ability to navigate current challenges and capitalize on future opportunities.

Explore the complete 8-K earnings release (here) from Huntsman Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance