Will Humana (HUM) Q1 Earnings Beat on CenterWell Strength?

Humana Inc. HUM is set to beat on earnings in the first quarter of 2024, the results for which are scheduled to be released on Apr 24, before the opening bell.

What Do the Estimates Say?

The Zacks Consensus Estimate for first-quarter earnings per share of $6.02 suggests a decrease of 35.8% from the prior-year reported number of $9.38. The estimate remained stable over the past week. However, the consensus mark for first-quarter revenues of $28.6 billion indicates a 7% increase from the year-ago reported figure.

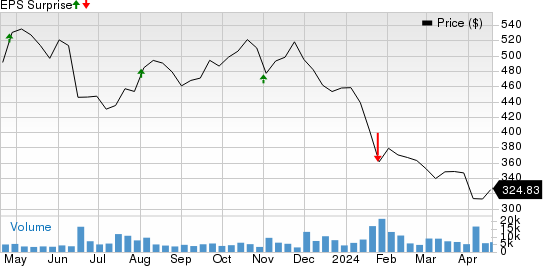

Humana beat the earnings estimate in three of the prior four quarters and missed once. This is depicted in the graph below:

Humana Inc. Price and EPS Surprise

Humana Inc. price-eps-surprise | Humana Inc. Quote

What the Quantitative Model Suggests

Our proven model predicts a likely earnings beat for Humana this time around as well. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is precisely the case here.

Earnings ESP: The company has an Earnings ESP of +0.07%. This is because the Most Accurate Estimate is currently pegged higher than the Zacks Consensus Estimate of $6.02. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Humana currently holds a Zacks Rank #3.

Before we get into what to expect for the to-be-reported quarter in detail, it’s worth taking a look at HUM’s previous-quarter performance first.

Q4 Earnings Rewind

In the last reported quarter, the company reported an adjusted loss per share of 11 cents, missing the Zacks Consensus Estimate by 57.1%, due to higher benefits expenses, operating costs and lower medical memberships. The negatives were partially offset by premium growth, increased investment income and strength witnessed in the CenterWell unit.

Now, let’s see how things have shaped up prior to the first-quarter 2024 earnings announcement.

Factors Driving Q1 Performance

In the first quarter, Humana’s revenues are expected to have benefited from improved premiums resulting from its well-devised Medicare Advantage plans and higher investment income. Several contract wins and an expanding pharmacy business are likely to have contributed to the growing top line.

The Zacks Consensus Estimate for HUM’s first-quarter premiums indicates a 5.6% increase from the prior-year quarter’s reported figure, whereas our model predicts 6.5% growth. We expect total Medicare to have witnessed 8% growth in the quarter under review. Furthermore, the consensus estimate suggests that HUM’s investment income will see a nearly 55% jump from the year-ago level.

The CenterWell segment is expected to have gained on a strong provider services business. We expect the operating cost ratio at CenterWell to have improved by 70 basis points to 90.9% in the first quarter, aiding its margins. The Zacks Consensus Estimate for the segment’s operating income indicates a 3.4% increase from the prior-year quarter’s reported figure.

The above-mentioned factors are expected to have positioned the company for an earnings beat in the first quarter. However, continued investments in marketing and distribution, and higher benefits are likely to have increased costs for the company, which, in turn, are likely to have squeezed its margins in the first quarter.

Our model estimate for HUM’s total operating expenses indicates a 9.3% year-over-year increase. With seniors resuming elective procedures that were put on hold earlier, costs have significantly risen for insurers.

The Insurance segment is likely to have been driven by a growing membership in Medicare Advantage and state-based contracts. However, decreasing memberships in Stand-Alone PDPs and total Specialty Medical is likely to have partially offset the upside.

Also, rising benefits and operating costs are expected to have affected Insurance segment profits. The Zacks Consensus Estimate for the unit’s pretax income indicates an almost 44% fall from the prior-year quarter’s reported figure. Nevertheless, the growth in its CenterWell unit is expected to play a major role in giving its bottom line some respite in the first quarter.

Other Stocks That Warrant a Look

Here are some other companies from the broader Medical space that you may also want to consider, as our model shows that these, too, have the right combination of elements to post an earnings beat this time around:

Inspire Medical Systems, Inc. INSP has an Earnings ESP of +18.04% and is a Zacks #1 Ranked player. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Inspire Medical’s bottom line for the to-be-reported quarter has improved by 3.1% over the past month. INSP beat earnings estimates in each of the past four quarters, the average surprise being 353.6%.

Edwards Lifesciences Corporation EW has an Earnings ESP of +1.68% and a Zacks Rank #3.

The Zacks Consensus Estimate for Edwards Lifesciences’ bottom line for the to-be-reported quarter indicates 3.2% year-over-year growth. EW beat earnings estimates in two of the past four quarters and met on the other occasions, with an average surprise of 0.8%.

Universal Health Services, Inc. UHS has an Earnings ESP of +8.56% and is a Zacks #2 Ranked player.

The Zacks Consensus Estimate for Universal Health’s earnings per share for the to-be-reported quarter indicates a 34.2% year-over-year jump. UHS beat earnings estimates in each of the past four quarters, the average surprise being 5.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Edwards Lifesciences Corporation (EW) : Free Stock Analysis Report

Humana Inc. (HUM) : Free Stock Analysis Report

Inspire Medical Systems, Inc. (INSP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance